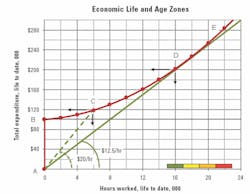

In order to help understanding, we’re going to develop a different graphic (above) that will communicate what we mean. We will use it to define the sweet spot and show that it can be used to define economic life and set age zones.

Refer to the diagram above as we go step by step through the process.

The first thing to notice is that the horizontal X axis measures hours worked, life to date, in thousands. The next thing to notice is that that the vertical Y axis measures total dollar expenditure, life to date, also in thousands. This is a little unusual and sets this graphic apart from the more usual cost-per-hour graphs that show budget versus actual cost per hour and track economic life.

The red line that shows how total expenditure life to date grows through the life of the machine starts with a vertical jump from A to B due to the fixed commitments made on Day 1 of the machine’s life. These commitments can be the purchase price, the sum of the depreciation charges levied through the depreciation period, or the sum of the lease or loan payments required to fulfill agreements. It does not matter how you define the commitments; you will have to “buy back the new” at some stage, and so the right thing to do is to recognize them at the start. The example machine cost $100,000, so point B stands at zero hours worked and $100,000 of total expenditure representing either the purchase price or the total of the commitments made.

Once the machine is brought into the fleet, it starts to work and build up hours on the horizontal axis. It also starts accumulating operating cost up the vertical axis. Typically, only age-dependent cost categories such as repair and maintenance parts and labor are included in the cost calculation in order to simplify things and make the impact of increasing cost with increasing age all the more apparent.

Repair and maintenance parts and labor costs come in spurts of increasing frequency and increasing magnitude as the machine ages. These spurts can, on the average, be reasonably represented by a concave upward sloping curve as is shown by the red line from B through E. Historical data and other information on the machine’s performance can and should be used to produce the red line, which represents the best estimate of how expenditure required to “buy back the new” (A to B) and pay for the exponentially growing cost of repair and maintenance parts and labor increases over the life of the machine (B to E).

Want more asset management? Go to the Construction Equipment Executive Insititute.

The question now arises: What is the average cost-per-hour rate required to recover this expenditure over any given number of hours worked, life to date? Point C shows us that the unit has worked 6,000 hours life to date and that the expenditure up to that point comes to $120,000. ($100,000 in commitments made when the machine was acquired and $20,000 in repair and maintenance parts and labor over the first 6,000 hours.) The average cost-recovery rate, therefore, works out to $20 per hour for the first 6,000 hours as shown by the slope of the dotted green line that goes from A—the beginning of time and cost for the machine—to C—the point under study. In graph-speak, the X value of a point gives the hours worked, life to date; the Y value of a point gives the total expenditure, life to date; and the slope of the line out of the origin to the point (the green line) gives the rate required to recover the total expenditure over the given period.

Now consider point D. In the vast majority of cases, the cumulative expenditure curve slopes upward in a concave fashion as it progresses from B through E. This means that there will be a point where the cost recovery (green) line drawn from A to the cumulative cost (red) line just touches the cumulative cost line. This point identifies the age and the total expenditure at which the slope of the green line is a minimum. Our example shows that the tangent point occurs at 16,000 hours when the total expenditure is $200,000 ($100,000 in commitments made when the machine was acquired and another $100,000 in repair and maintenance parts and labor over the 16,000 hour period). The cost-recovery rate for this optimum life is therefore $12.50 per hour ($200,000 divided by 16,000). The 16,000-hour life is the economic or sweet-spot life, and the $12.50 rate is the minimum average or sweet-spot rate.

Look also at the slope of the red line before and after the sweet-spot life at D and note that the slope of the red line after D is steeper than the slope of the green line. This illustrates the important fact that the hourly cost of every period of production (the slope of the red line) after the sweet spot is more than the average cost of all the periods of production before the sweet spot (the slope of the green line).

The sweet-spot rate of $12.50 per hour at 16,000 hours is the minimum rate required to “buy back the new” and cover the exponentially rising cost of repair and maintenance parts and labor over the optimum 16,000-hour life. All green lines from A to the red line before 16,000 hours and all green lines from A to the red line after 16,000 hours will slope more steeply than $12.50 per hour. $12.50 per hour and 16,000 hours are therefore the foundation for a rate calculation based on a calculated economic life rather than an assumed estimated life. It is certainly not the full and final rate. From an owning cost point of view, you will need to add in the hourly cost of licenses, insurances, and taxes likely to be paid over the life of the machine. Also, you will need to deduct the estimated residual market value divided by 16,000 hours to sweeten the rate and allow for the fact that the calculation made no provision for the sale of the asset. From an operating cost point of view, you will need to add the hourly cost of non-age-dependent items such as fuel, wear parts, and scheduled maintenance.

The science, algebra, and graphics behind the analysis we have done on our example machine are rock solid. The fact that repair and maintenance parts and labor costs come in spurts of increasing frequency and increasing magnitude during the life of the machine and that actual data is sometimes above and sometimes below the red line means we must take a broader more practical point of view. Regardless, there is a sweet spot in the life of every machine, and there is a time when the cost of the next period of production is likely to be more expensive than the average cost of all preceding periods.

This leads to the concept of age zones: the green, yellow, orange, and red blocks shown at the bottom right of the graph. The green zone—in our case, 1,000 hours each side of the sweet spot at 16,000 hours—shows where, with reasonable certainty, we believe the sweet spot will lie. The yellow, orange, and red zones are also each 2,000 hours long and show with increasing urgency and confidence when it is likely that the next period of production will be more expensive than the average of all the preceding periods. There seems little reason to own and operate a machine in these zones.

The total-cost model is a convenient way to illustrate many of the concepts associated with average cost life to date, economic life, and the sweet spot calculation. It clearly shows that there will come a time in the life of a machine when the cost of the next period of production is likely to be more expensive than the average cost of all preceding periods. Next, we will show that it is also a simple and convenient way of tracking actual cost relative to budget and supporting the replacement decision.