How to Choose the Right Equipment Rate Methodology

Key Highlights

In this article, you will learn:

- How to differentiate between single-rate and dual-rate systems.

- How dual-rate systems can promote better utilization management.

- How to implement dual-rate systems to shift utilization risk to operations.

When calculating equipment rates, managers must understand utilization and its impact on fixed and variable cost recovery. Let’s explore how single- and dual-rate methodologies handle this challenge.

At the heart of any equipment rate are two types of costs: ownership costs and operating costs. Ownership costs are fixed costs incurred whether the machine operates or not. Think depreciation, insurance, licensing fees, and return on capital. They’re predictable and unavoidable. Operating costs are only realized when the machine is used, covering expenses like fuel, maintenance, and wear parts.

Converting fixed ownership costs into a usage-based rate requires estimating how much the machine is expected to work—referred to as utilization. Understanding the distinction between fixed and variable costs is necessary to identify over- or under-recoveries in the equipment account.

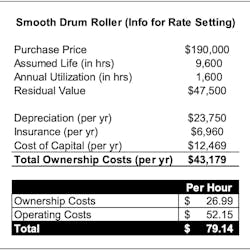

To illustrate, the table below provides the relevant data for a smooth drum roller that will be used throughout the examples that follow.

How to set the equipment rate

In a traditional single-rate system, ownership and operating costs are combined into a single hourly charge.

Ownership costs are calculated by adding all fixed costs expected over the year—such as depreciation, insurance, and cost of capital—and dividing by the estimated annual usage. For example, with depreciation at $23,750, insurance at $6,960, and cost of capital at $12,469, the total ownership cost is $43,179. Dividing this by the expected utilization of 1,600 hours results in an ownership cost of $26.99 per hour.

Next, this fixed ownership cost is combined with the variable operating cost of $52.15 per hour to yield a single rate of $79.14 per hour. Most companies use this single rate to charge themselves for equipment use, effectively blending ownership and operating costs. However, maintaining this separation is essential to analyze the equipment account, as explained in greater detail below.

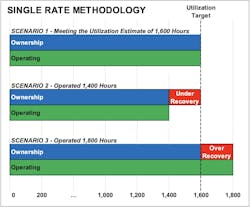

Single-rate equipment management

In a single-rate system, cost recovery depends on how much the machine is used. For example, when a machine operates 1,600 hours per year as shown in Scenario 1 of the nearby illustration, it recovers $43,179 of ownership costs ($26.99 × 1,600). This matches the total fixed ownership costs, representing the ideal break-even point for the equipment account.

In Scenario 2, where the machine operates only 1,400 hours, it recovers $37,786 ($26.99 × 1,400), falling short of the $43,179 total ownership costs by $5,393 ($43,179 - $37,786). This shortfall translates to an under-recovery of $3.85 per hour ($5,393 / 1,400 hours), leaving the equipment account under-recovered.

In Scenario 3, the machine operates 1,800 hours, recovering $48,582 ($26.99 × 1,800). This exceeds the total ownership costs by $5,403 ($48,582 - $43,179), resulting in an over-recovery of $3.00 per hour ($5,403 / 1,800 hours), which is viewed as a profit to the equipment account.

With the single-rate methodology, the hourly ownership cost of $26.99 is only accurate when the machine's utilization reaches exactly 1,600 hours. If the machine operates fewer hours than expected, the fixed ownership costs will be under-recovered. Conversely, if the machine operates more hours than expected, these same fixed costs will be over-recovered.

Any over- or under-recovery does not occur because the costs changed: It happens because of how much the machine was used.

Manage the risk in utilization

More on asset management

- Understand the strengths and weaknesses of cost-tracking systems

- Inflation strains equipment budgets

- Sargent uses data for regional fleet maintenance

- 2025 construction equipment fleet outlook

- Increasing utilization across equipment types

- How to proactively identify and address causes of equipment cost

To address these issues, some companies implement a minimum use policy, charging projects for a predetermined amount of usage (i.e., hours or days) whether or not the equipment was used. Although this approach reduces the risk of under-recovery, it introduces new challenges.

A more balanced solution is the dual-rate system, which separates ownership and operating costs into two distinct charges. Both approaches aim to manage utilization risks.

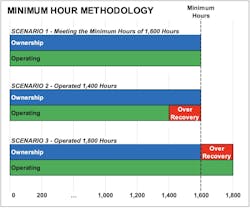

Minimum use and the equipment rate

In Scenario 1, the machine operates exactly 1,600 hours, meeting the minimum use requirement. Ownership costs are fully recovered at $43,184 ($26.99 × 1,600), and operating costs of $83,440 are charged ($52.15 × 1,600). Since utilization matches the minimum use target, there is no over- or under-recovery, resulting in a balanced equipment account as shown in the nearby illustration.

In Scenario 2, the machine works 1,400 hours but the project is charged for the 1,600-hour minimum. Ownership costs of $43,184 ($26.99 × 1,600) are fully recovered, while operating costs for 1,600 hours are also charged, totaling $83,440 ($52.15 × 1,600), even though only $73,010 ($52.15 × 1,400) were incurred. This creates an over-recovery of $10,430 or $7.45 extra per hour, inflating project costs and recoveries to the equipment account.

In Scenario 3, the machine operates 1,800 hours, exceeding the minimum use threshold. Ownership costs are charged at $48,582 ($26.99 × 1,800), even though the actual ownership costs remain fixed at $43,184. This results in an over-recovery of $5,398 or $3.00 per hour, leaving the equipment account in a profit position.

Although minimum-use policies ensure fixed costs are recovered, they frequently overcharge operating costs at low utilization and ownership costs at high utilization. This inflates project costs and causes tension between Equipment and Operations teams. Ultimately, minimum-use policies are single-rate systems in disguise.

Dual-rate equipment rates

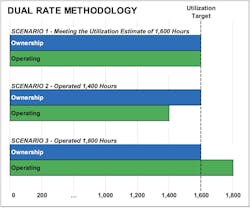

In a dual-rate system, projects are charged the actual fixed ownership costs rather than a rate based on assumed utilization. Ownership costs are charged at a fixed rate of $43,179 annually ($3,598 per month), while operating costs are charged separately at $52.15 per hour of machine use.

By separating ownership and operating costs into two distinct charges, the dual-rate system shifts the utilization risk to operations. This incentivizes the field to maximize machine usage since increasing machine hours reduces the ownership cost per unit produced.

Using the same examples, in Scenario 1, as shown in the nearby illustration, the machine operates exactly 1,600 hours. Operations are charged $43,179 in ownership costs plus $83,440 ($52.15 × 1,600) in operating costs. This results in no over- or under-recovery, keeping the equipment account balanced.

Next, in Scenario 2, with the machine working 1,400 hours, Operations was charged $43,179 in ownership costs and $73,010 in operating costs ($52.15 × 1,400). Even with lower utilization, the dual-rate system maintains accurate cost recovery.

Lastly, in Scenario 3, where the machine operates 1,800 hours, Operations is charged $43,179 in ownership costs and $93,870 in operating costs ($52.15 × 1,800). Despite higher utilization, there is no over- or under-recovery, leaving the equipment account balanced.

The key advantage of the dual-rate system is its ability to charge ownership and operating costs separately, ensuring the equipment account stays balanced regardless of how much the equipment is used.

The rate structure you choose plays a critical role in profitability and cost management, with utilization serving as the single most influential factor.

Single-rate systems are straightforward but link cost recovery directly to utilization, exposing the equipment account to over- or under-recovery. This places unfair responsibility on fleet managers for factors beyond their control, potentially hiding inefficiencies and eroding profitability. Minimum-use policies, though an attempt to address under-recovery, often lead to inflated project costs and tension between departments.

In contrast, dual-rate systems, though more complex, clearly separate ownership and operating charges, shifting utilization risk to Operations: the team best positioned to manage it. This approach promotes higher utilization while ensuring fixed ownership costs are consistently recovered, even during periods of lower use. Adopting a dual-rate structure fosters transparency, builds accountability, and empowers teams to focus on improving equipment performance to achieve better financial outcomes.

About the Author

Craig Gramlich

Craig has extensive experience in equipment management across transportation, heavy lifting, civil projects, mining, and construction sectors. Driven by a passion for cost and data analysis, he excels in enhancing equipment accounting, rate modeling, and developing programs for rate escalation and transfer pricing.

Through Lonewolf Consulting, Craig effectively unites Equipment, Operations, and Accounting departments, leveraging his extensive field experience to help companies streamline operations and find cost savings, significantly boosting ROI.

He holds a Bachelor of Commerce from the University of Alberta and a Certified Equipment Manager (CEM) certification, along with a variety of professional development courses, showcasing his commitment to ongoing professional growth.