Key Highlights

What you’ll learn from this article:

-

Understand the four aspects of the Acquire & Dispose process.

-

Learn how to set fleet standards for equipment acquisition.

-

Learn how procurement ensures fleet readiness.

-

Understand how lifecycle analysis affects fleet age.

-

Learn when to dispose of equipment.

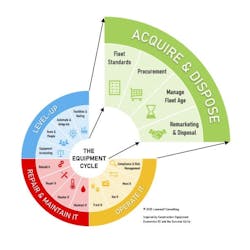

The Equipment Cycle describes the four core activities of an equipment-intensive business: acquire and dispose; operate it; repair and maintain it; and continuous improvement.

Here we investigate the first stage, Acquire & Dispose, and see how mastering it can improve performance, lower costs, and keep machines ready to work.

Buying and selling equipment is more than a financial transaction: It directly affects costs, productivity, and return on investment (ROI), which is only fully known when the equipment is sold. Like in the stock market, the goal is simple: Buy low, sell high. Still, many businesses overlook how much value is gained—or lost—when equipment changes hands. Even fewer plan ahead with strategies like setting target lives or scheduling replacements. A smart approach brings in the right equipment at the right time and replaces it before it becomes a financial drain.

Fleet Standards: Identify the right equipment

Fleet standards are about knowing what equipment is needed and what it must do. This depends on three things: specifications, standardization, and organization.

Specifications describe the equipment’s size, power, features, and performance and come in two types. Functional specs explain what the equipment must do (lift 10,000 pounds at 10-foot reach). Performance specs cover more technical details (3/4-inch hydraulic lines with 20 gpm at 3,000 psi).

Standardization goes one step further. It means setting a consistent list of features and add-ons for each equipment type, making them safer, more reliable, easier to use, and maintain. Excavators, for example, all have quick-attach with two buckets, auto-lube, and extendable handrails. Pickup trucks all have regular cabs with removable beacons for project managers, crew-cabs with toolboxes, transfer tanks, beacons, and back-up alarms for field teams.

Organization involves grouping equipment by function and size, such as 30-ton and 40-ton articulated dump trucks (see table below). This helps with estimating, billing, and dispatching.

Learn how to create an asset structure.

Clear fleet standards lead to smoother operations and a fleet that’s easier to order, manage, and maintain.

Procurement: Acquiring what’s needed at the right price

Procurement is about how equipment and supplies are bought. A strong approach focuses on three key areas: purchase orders, inventory systems, and vendor management.

A purchase order (PO) system tracks spending, avoids duplicate orders, and shows who ordered what and when. A “three bids and a buy” approach—collecting three quotes before large purchases—helps obtain the best price. Over time, PO data highlights high-use items like fluids, filters, and fuel that can be bundled into long-term contracts with volume discounts.

Inventory systems help avoid shortages and overstock by setting min/max levels based on usage. For fast-moving parts, vendor-managed inventory (VMI) or vending machines can track usage, consume to work orders, and reorder automatically.

Vendor management goes beyond price. It’s about building relationships with reliable, cost-effective suppliers who deliver on time and meet safety and service standards. Tracking vendor performance—pricing, delivery times, and service—helps identify top performers. Pre-qualifying vendors makes sure they meet safety and service standards before doing business. Over time, strong relationships lead to better pricing, faster service, and improved warranty recovery by making sure covered parts and repairs aren’t paid for twice.

Done right, procurement keeps equipment ready, projects on schedule, and budgets in check.

Managing Fleet Age: Knowing when to repair, rebuild, or replace

Managing fleet age is about deciding how long to keep the equipment before it’s repaired, rebuilt, or replaced. The goal is to balance service life with cost, performance, and reliability by setting target lives, creating a capital expenditure (capex) plan, and using lifecycle analysis tools to support decisions.

Target lives set clear limits for when a machine should be rebuilt or replaced—often based on time (years) or usage (hours). These thresholds help avoid costly repairs near end-of-life. For example, if an excavator needs an undercarriage and is close to replacement, selling early may be the better choice. For pickups, a five-year or 100,000-mile target keeps resale value strong and supports a predictable, cost-effective replacement cycle—ideal for factory orders, which offer lower prices but have longer lead times.

Capex planning builds on target lives by helping schedule replacements, plan rebuilds, and prepare for fleet growth or modernization. It ensures equipment is replaced on time, avoiding costly last-minute repairs. Using target lives, along with fleet age and condition, companies can plan ahead and focus on critical assets. Strong CapEx plans also include growth, diversification, and rebuild programs. Supporting this are clear capitalization and depreciation policies that define when assets are added to the books (capitalized), how long they are kept (useful life), and what they will be worth at the end (salvage value).

More on fleet replacement

- Create a fleet asset structure for proper management.

- Defer machine replacement, but don't deny it.

- How to use cost history to determine remaining life.

- Three steps to a machine replacement decision.

Lifecycle analysis uses tools like churn charts and sweet-spot analysis to time equipment replacement. Churn charts show when each unit is due for replacement, while sweet-spot analysis pinpoints when the cost to own and operate a machine is at its lowest point, helping maximize ROI.

In short, managing fleet age leads to smarter decisions and delivers some of the highest ROI.

Remarketing & Disposal: Recovering value from retired equipment

The final step focuses on knowing what to sell, where to sell it, and for how much.

Start by identifying units near the end of their target life, with rising repair costs, or that no longer suit the work. Tracking usage and repair history helps flag machines no longer worth keeping. Pulling these machines from service at the right time avoids costly repairs and frees up money for newer, more efficient gear.

Where to sell depends on the asset. Local wholesalers are a good option for licensed vehicles, while auction platforms work well for heavy equipment, reaching a wider audience and often bringing better prices. Clean, well-maintained machines can also be sold through direct or online listings, which are useful when targeting specific industries or regions.

Pricing should be based on market data and not book value, which is often too low due to conservative accounting and rarely reflects actual resale potential. Updating residuals improves accuracy and supports more competitive equipment rates. Tracking the difference between sale price and book value (ie: gain and loss) provides insight to fine-tune depreciation policies.

This final step closes the loop: recovering value from retired machines and providing insights to improve future decisions.

Mastering the Acquire & Dispose process is about more than just buying and selling equipment. It sets the foundation for how the fleet is selected, managed, and replaced. From defining what’s needed and how it should perform, to getting the best deals, planning replacements, and knowing when to sell—this stage connects daily operations with long-term financial results.

It’s the structure that turns equipment from a one-time purchase into a strategic asset.

About the Author

Craig Gramlich

Craig has extensive experience in equipment management across transportation, heavy lifting, civil projects, mining, and construction sectors. Driven by a passion for cost and data analysis, he excels in enhancing equipment accounting, rate modeling, and developing programs for rate escalation and transfer pricing.

Through Lonewolf Consulting, Craig effectively unites Equipment, Operations, and Accounting departments, leveraging his extensive field experience to help companies streamline operations and find cost savings, significantly boosting ROI.

He holds a Bachelor of Commerce from the University of Alberta and a Certified Equipment Manager (CEM) certification, along with a variety of professional development courses, showcasing his commitment to ongoing professional growth.