How to Align Equipment, Operations, and Accounting

Key Highlights

In this article, you will learn:

- How to focus on maintenance, uptime, and equipment longevity.

- How to prioritize equipment utilization to meet project goals.

- How to understand the priorities of availability, utilization, and ROI.

- How to avoid high downtime, under- or over-recovery of costs, and low equipment utilization.

In every equipment-intensive company, three core groups shape how the business operates: the Equipment Team, the Operations Team, and the Accounting Team. Whether through shared roles, dedicated individuals, or entire departments, their collective impact is undeniable. Although each team has distinctly separate responsibilities, their roles pertaining to equipment management overlap in critical ways that are essential to the organization’s success.

Understanding how these groups interact with the equipment—and each other—is vital. When aligned, they drive positive results on the equipment side of the business. But when misaligned, they can negatively impact the organization’s bottom line and even disrupt its culture. Proper alignment, therefore, is not just strategic—it’s a necessity for long-term success.

What are the roles within the equipment triangle?

The Equipment Group: Guardians of the Fleet

This group is easily recognized by their oil-stained coveralls and their belief that the company’s success hinges on its equipment. To them, the business revolves around the equipment: its repair, upkeep, and optimal performance. They see the company as an “equipment business,” where revenue is earned as a byproduct of a well-maintained and efficiently running fleet. Equipment is viewed as an “asset” that must be protected, and because machines can’t speak up for themselves, this group takes on the role of their defenders. Their focus is on uptime, reliability, and equipment longevity, which they achieve by following strict maintenance schedules and protocols.

The Operations Group: Revenue Rockstars

This group is responsible for bidding, estimating, deploying, and otherwise using the equipment in the field. To this group, equipment is a critical tool for accomplishing the job to generate revenue. Whereas the equipment team sees equipment as an asset to be preserved, operations views it as a resource to be utilized. Simply put: Operations sees the equipment as a means to an end and not the end itself. Their focus is on doing the work in the field to produce revenue, which requires them to “use” the equipment.

The Accounting Group: Financial Gatekeepers

Lastly, this team is responsible for generating the financial reports that cover both equipment and operations, as well as for the overall company. Often caught in the crossfire of “us vs. them” between Equipment and Operations, accounting’s primary job is to report the numbers. They view equipment as an “investment” that must deliver a return, ensuring that every machine contributes positively to the company’s financials, otherwise why tie up the capital to own it? Like the name suggests: Management relies on this group to be the “gatekeeper” to the bank account ensuring that any spending is well timed and responsibly done.

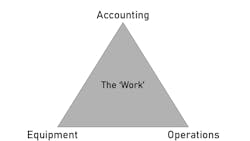

Together these three groups—Equipment, Operations, and Accounting—form a conceptual framework that I call the Internal Equipment Triangle. The nearby graphic illustrates the dynamics of this triangle, helping to show how each group’s contributions influence the “work” that is central to the organization’s success. Here the “work” lies at the heart of the triangle, emphasizing that all efforts by these three groups must align to support and optimize it.

How does the equipment triangle evolve?

In a company’s early days, the roles of Equipment, Operations, and Accounting naturally evolve around the core business activity or the work—moving dirt, breaking rock, or laying pipe—that generates revenue. At this stage, the work is central to the Internal Equipment Triangle, emphasizing that all efforts by these groups must align to support and optimize it. Early on, roles often overlap, with a small group of individuals managing multiple tasks. For example, the business owner might handle every major financial decision including equipment purchase and disposal, while others juggle responsibilities like field supervision, safety, and bidding.

As the company grows, these roles become more defined, leading to the creation of specialized departments. The Equipment team brings in tradespeople, Operations hires professional engineers, and Accounting recruits certified financial experts. Although specialization improves each department’s ability to focus on its own core responsibilities in support of the work, it also introduces new challenges—most notably, a communication barrier between the groups.

This breakdown occurs because each group speaks a different language rooted in their professional training and daily experiences. The Equipment team talks about preventive maintenance, fluid compatibility, and lifecycle management; Operations talks about project timelines and contract or change management. Meanwhile, Accounting operates in terms of balance sheets, profit and loss statements, and financial metrics.

Without a deliberate effort to bridge these language barriers, collaboration becomes challenging, and silos begin to form. This splits the Internal Equipment Triangle into three separate, smaller triangles, leaving a gap in the center where the work once resided, as shown in the nearby illustration.

This gap at the center of the triangle signals that the Internal Equipment Triangle is misaligned—or more directly, that a giant hole has emerged in the core business of the organization. When these issues arise, it indicates that the organization has lost its focus on the work, undermining performance and profitability of the organization as a whole.

Warning Signs of Misalignment

When the Internal Equipment Triangle is out of sync, the following symptoms are common:

Equipment

- Missed maintenance

- Unexpected breakdowns (reliability issues)

- High downtime (number of events resulting in downtime and/or durations of downtime)

- Availability impacts to projects, masked by buying more equipment or use of rentals

Operations

- Utilization below target

- High standby or idle time (meter hour to billable hour ratio)

- Damage (number of # of events and costs)

- Increased reliance on rentals

Accounting

- Under-recovering equipment costs (rates too low or unreported usage)

- Large over-recoveries on equipment costs (rates too high or not repairing equipment)

- High undeployed time (fleet size or type issues)

- Low to no return on investment

How to align perspectives

To realign the Internal Equipment Triangle, it is essential to recognize that each group—Equipment, Operations and Accounting—has its own perspectives and priorities when it comes to equipment. Understanding and balancing these priorities helps to break down silos, improve communication, and ensure equipment is effectively used to perform the work.

Next is to get back to basics. At the core of the Internal Equipment Triangle is the business itself, where “the work” generates revenue. Supporting this core requires each group to fulfill one primary responsibility:

- Equipment is responsible for availability, ensuring that machines are maintained and ready to work.

- Operations is responsible for utilization, using equipment effectively to meet project demands.

- Accounting is responsible for monitoring the return on investment (ROI), tracking costs and profitability to ensure equipment investments are delivering returns.

This alignment reinforces the central focus on the work and keeps the Internal Equipment Triangle functioning effectively.

It is important to note that equipment management is built on an interdependent or symbiotic relationship between the three groups:

- Equipment must be available for Operations to use.

- Operations must utilize the equipment for Accounting to measure ROI.

- Accounting must approve equipment investments for Equipment to be readied and made available.

Each function depends on the others. Without availability, there’s no utilization; without utilization, there’s no ROI; and without ROI, there is no investment in equipment. Without investment in equipment there is no equipment available to do the work. This interdependence keeps the Internal Equipment Triangle balanced and the Equipment Cycle functioning while reinforcing the core work as the singular thing of importance for the entire organization.

The Internal Equipment Triangle is the key to effective equipment management. Each group—Equipment, Operations, and Accounting—must recognize they play a vital but interdependent role. When aligned, they drive availability, utilization, and return on investment, boosting both performance and profitability. When misaligned they create inefficiencies, increase downtime, balloon fleet size, and miss financial targets.

For equipment-intensive companies, mastering this alignment isn’t just beneficial—it’s paramount for long-term success.

About the Author

Craig Gramlich

Craig has extensive experience in equipment management across transportation, heavy lifting, civil projects, mining, and construction sectors. Driven by a passion for cost and data analysis, he excels in enhancing equipment accounting, rate modeling, and developing programs for rate escalation and transfer pricing.

Through Lonewolf Consulting, Craig effectively unites Equipment, Operations, and Accounting departments, leveraging his extensive field experience to help companies streamline operations and find cost savings, significantly boosting ROI.

He holds a Bachelor of Commerce from the University of Alberta and a Certified Equipment Manager (CEM) certification, along with a variety of professional development courses, showcasing his commitment to ongoing professional growth.