It is rate-setting season again. We know about last year, this year is well under way, and we are thinking about the rates we need to change to be successful next year. Do we set conservative rates that will ensure we recover the full cost of owning and operating our fleet; or do we set challenging rates that will put us in the best position at the bid table, even if it means under-recovering some of our true costs?

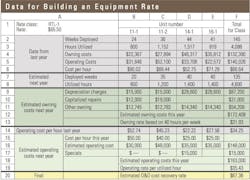

In Accomplish the Most Important Task, we described the rate-setting process as “probably the most difficult, contentious and important task that an equipment manager needs to perform.” We published a flow chart that detailed the process, but now let’s illustrate the important concepts using the above spreadsheet as an example.

Notice that the example includes only owning and operating costs. In an effort to keep things simple, it does not include fuel and other principle cost types. The principles remain the same, and the learning points are unchanged.

Row 1, Column A shows that we are looking at the RTL-1 rate class and that all the units in the class share a current rate of $65.50 per hour. Columns B to E show that there are four units in the rate class. These are the units that we bring together to calculate the rate. Some will have costs above the average and some will be below, but all units in the class share the same rate. High-cost units such as 11-1 will be candidates for replacement, especially if replacement lowers the class average rate and results in a more competitive rate. Column F shows totals and averages.

Rows 2 to 6 summarize the actual results obtained last year. “Deployment” is actual weeks deployed and working on site during the year; “utilization” is actual hours worked during the year. The average actual cost for the group came to $66.64 per hour (cell F6 represents the sum of $132,390 and $140,026 divided by 4,088 hours). It is useful to have the key facts used in your rate calculation summarized and close at hand in your spreadsheet, and I strongly recommend you include information like that given in rows 2 to 6 in the tool you develop. It helps you, and, above all, it helps those who will review and approve the changes you recommend.

Rows 7 and 8 are critical. This is where we make our best estimate for the deployed weeks and utilized hours expected in the year ahead. Review what they were (rows 2 and 3), ask for input from others in the organization, and use your best judgment to develop realistic values. An estimated rate is an estimated cost divided by an estimated deployment or utilization, and errors in estimating deployment or utilization have the same impact on the rate calculation as errors in the estimated cost.

Rows 9 to 13 summarize the three classifications of owning costs you will need to recover in the year ahead: depreciation charges; remaining charges due to capitalized repairs; and other owning costs for items such as licenses, insurances and property taxes. I have done this to emphasize the fact that the low depreciation experienced in older machines (11-1 and 11-2) is frequently negated by the need to amortize the cost of capitalized repairs or rebuilds.

Two things are important about the owning cost calculation. First, there is not a lot of uncertainty about the magnitude of the costs and charges. They were largely fixed when you acquired the machine, and it should be possible for you to obtain accurate estimates for the numbers given in rows 9, 10 and 11. Second, the costs in rows 9, 10 and 11 are mostly fixed annual costs, so the number of billable hours the machine generates in order to recover these costs has a huge impact on the hourly rate.

Companies frequently manage this impact and the risk of owning-cost recovery by basing the owning-cost rate on 40 hours per deployed week and billing jobs a minimum of 40 hours per week regardless of the number of hours a particular unit actually works in a week. The example is based on this assumption. The owning-cost recovery rate of $31.93 per hour (cell F13) is calculated by dividing the estimated owning cost for the year ($172,408) by 40 hours per week for the estimated 135 deployed weeks for the year ahead (cell F7). We are estimating less deployment than last year (135 compared to 145 weeks), and we expect the machines to be utilized for only 34 hours per week (4,600 utilized hours in 135 deployed weeks) in the year ahead. But we are confident in our deployment estimate of 135 weeks and know that the minimum 40 billable hours per week requirement will enable us to recover the $172,408 in fixed costs over 5,400 billable hours (135 times 40) at a rate of $31.93 per hour.

Rows 14 to 19 cover operating costs. Row 14 gives the actual operating costs for the past year, and row 15 is your best judgment of how operating costs per hour will change in the year ahead. Row 16 is the estimated operating cost for the unit based on the estimated rate in Row 15 and the estimated utilized hours in Row 8.

It is dangerous to expect that tomorrow will be like yesterday when it comes to estimating operating costs. Row 17 provides for this by making it possible to add lump sum estimates for any “special” events you expect to occur and be expensed in the year ahead. We see an estimate of $15,000 for unit 14-1. Cell F18 totals everything, and cell F19 shows that we will have to charge a rate of $35.43 per hour to recover the estimated cost of $163,000 over the estimated 4,600 utilized hours for the year ahead.

Cells F13 and F19 are totaled in cell F20 to give a final estimated owning and operating cost recovery rate $67.56. We could keep the rate for the RTL-1 class the same or increase it a little for the year ahead.

Here are the learning points.

- Develop your own spreadsheet-based tool to help structure and communicate your calculation in a systematic and logical way. Rate adjustments—especially if they are upward—are contentious, and you need to present your calculations in a straightforward and easily understood format. The tool you develop will be more comprehensive than the one in our example, but keep it simple and remember that communication is the key.

- Make sure you summarize the most recent relevant data as you go into the process. You have to know where you have been as you plan for the future. Record your baselines and be prepared to discuss where, why and how your proposed rate differs from the existing rate.

- The estimates for weeks deployed and hours utilized have as big an impact on the calculation as the costs. Estimate these with care, diligence and honesty. Do not make unrealistic estimates. Lower-than-expected levels of deployment will result in unrecovered fixed costs.

- Treat the calculation of your estimated owning and operating cost-recovery rates differently. With owning costs, you know the dollar amounts but are at risk when it comes to weeks deployed and billable owning hours. Operating costs are the opposite. How much you will spend is a risk, but hours worked is not important because most of the costs are hourly costs.

For more asset management education, including Mike's Learning Modules, visit the Executive Institute.