We struggle with capital expenditures (capex) and capex budgets every year. It is invariably a long and complex process, and we often feel that things have not gone our way. We believe that we must spend a certain amount to maintain fleet average age and to grow. The president and the board of directors often feel differently: They do not want to spend as much on the fleet, they want to do other things with their money, and they frequently believe our requirements are not all that important.

What can we do to improve our chances of success in the capital budgeting process, and what can we do to make a better case for the capital funds we need to spend on our fleet? Let’s look at the world through the eyes of an investor and discuss five truths critical to success in the capital budgeting process.

1) It is about capital investment, not expenditure.

We need capital funds to replace old equipment, support our plans, and improve efficiencies. We want to lower costs and generate profits. All of those are true, and all are important.

Investors, however, see the world differently. They do not see fleet as a capital expenditure, they see it as a capital investment. They make investments to strategically grow the business, produce returns, and secure the future. To them it is not about buying a piece of equipment to do a job; it is about investing in the future of the business, positioning it for success.

Budget applications must include clear and concise statements about how the requested capital investment will improve business performance and build a better strategic future.

2) Capital is a scarce and expensive resource.

No organization has or can afford to have an unlimited supply of capital. It is a scarce resource that must be used profitably and efficiently. We are accustomed to demonstrating the profitable use of capital and to showing that our rates recover owning and operating costs while putting ourselves in a competitive position at the bid table. We believe we know how to use capital profitably, but do we know how to use capital efficiently? Is the investment necessary? Is there another less capital-intensive way to acquire the productive capacity we need in our fleet? Are we sure we will use the investment to earn the contract revenue needed to support our business and produce a return?

Organizations must balance the profitable use of capital with the efficient use of capital. Buying equipment with our own financial resources often appears to be the cheapest solution, but is it the most efficient solution? Short-term rental, rent-to-own, or lease solutions may be a bit more expensive, but they will certainly be more capital-efficient. It is not just about profit, it is about return on investment. Most important, it is about how much contract revenue we generate for every dollar we have invested in our fleet. Know and understand the benchmarks, know how efficiently you use your capital.

It is, of course, all about utilization. You cannot justify investing in an asset if you do not use the asset. Support your budget request by showing how the assets will be utilized to produce contract revenue and emphasize the fact that the proposed investment represents a profitable as well as efficient use of capital.

3) Replacement expenditure has competition.

Capital required to replace equipment that has come to the end of its economic life is not exciting or new. You have the machines, they are working, they are well depreciated, and as we all know, replacement can always be deferred.

On the other hand, capital investments in new opportunities, expansions or diversifications carry a sense of excitement and urgency. We need to seize the moment, exploit an opportunity, or do something new and different. Replacement is ho hum: It can wait for next year.

Motivating a budget for the capital investment needed to replace old equipment is not easy. Demonstrating need in terms of increasing cost, decreasing reliability, or pending major expenditure is relatively straight forward. Demonstrating what will happen if replacement is deferred as the money is invested in a new quarry acquisition or a diversification into the fishing industry is much more difficult.

Two things are important for success. First, you must know and understand the relationship between the age of your fleet and the cost of the repair parts and labor needed to achieve required levels of availability and reliability. The new venture may appear to be an efficient use of capital, but deferring replacement will most certainly increase operating costs and reduce profitability in the old venture.

Second, you must drive home that deferring replacement does not deny replacement. Machines on the list for replacement this year will be on the list next year if they are not replaced now. They won’t go away. The replacement-capital can is kicked down the road. In the meantime, repair parts and labor expenditure is growing, reliability and availability are getting worse, and the problem is growing.

Deferring replacement creates a downward spiral that can be difficult to break. Emphasize this in your budget request.

4) Long-term investments require long-term planning.

Investing $1 million in replacing some of your excavator fleet is not and should not be a short-term, knee-jerk reaction. Equipment investments are long-term decisions that require long-term plans. It is therefore important to watch the current age of your fleet and be in a position to plan replacements well into the future. A common planning tool lists all the units in a particular rate class and their current ages. Their expected ages at the end of future years are also listed. Units that are more than 11,000 hours old are colored orange; units more than 13,000 hours old are colored red. The object of the exercise is to plan ahead and set a long-term strategy that keeps the average age for the rate class fairly static and does not result in more than one or two units being in the red zone.

Long-term plans of this nature confirm for investors that long-term thought has been applied to the problem, and the plans clearly show that any red zone units not replaced this year will still be on the candidate list for replacement next year. Capex budget requests must include forward-looking plans that put the requested amount into context that shows how the situation will change depending on whether or not the request is approved or denied. Investors like plans; they like to see where their investment fits into the big picture.

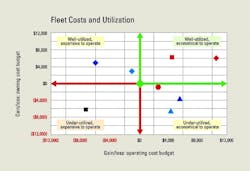

5) Investors back winners.

The last and most obvious truth is that investors back winners. Wise, prudent and financially focused folk are unlikely to invest in a particular class or category of equipment if it is showing a loss or if the current rate is insufficient to recover the owning and operating costs experienced. The diagram above shows the gain or loss on the owning-cost budget and the operating-cost budget for seven rate classes in a particular fleet. Classes in the top right quadrant are gaining on both owning and operating costs and are therefore seen to be well utilized and economical to operate. Rate classes in the bottom left quadrant are exactly the opposite: underutilized and expensive to operate. Rate classes losing on their owning cost budget are seen to be underutilized, and any request for capital expenditure to replace units or expand these classes is unlikely to be successful. Rate classes in the top left quadrant are well utilized but expensive to operate. All things being equal, replacement would be a wise and easily motivated decision. Charts such as this must be included in a capex budget request. They must show that the rate class for which capital funds are requested is a winner. Investors like winners.

Without ample preparation for this complex process, your chances of success are lessened considerably. To succeed, think like an investor. Use these five truths to build your case. Know that no one is going to make a substantial investment in your fleet unless you can show that it will be a wise and prudent use of a scarce and expensive resource.