The replacement decision is complicated because there are many options. All require good information and a measure of clairvoyance regarding both the nature and the volume of future work. It would be easy if we knew what we would be doing in four years when the new crane we plan to purchase is in the prime of its life. Uncertainty is definitely part of the process, but there is much we can do to understand options, manage risks, and improve decisions.

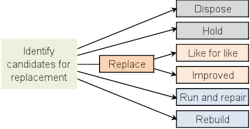

We start by identifying candidates for replacement. All units in the fleet are, or will at some time in their life be, candidates for replacement. It is important to develop and maintain a ranked list of units you think should be replaced, and to have a defendable reason why some units rank higher than others. “Because I think so” may be a good reason, but there is invariably a need to quantify the selection and ranking process by using metrics such as age, increasing cost, decreasing reliability, and lack of utilization. Techniques that successfully identify candidates for replacement typically rely on more than one attribute and combine age in years or hours with metrics for cost and reliability. Regardless, it is absolutely essential to maintain a list of candidates for replacement, to know why units are on the list, and to use the list to develop both a replacement strategy and a competent capital budget.

The diagram shows six replacement options. Let’s start with the two on top: dispose and hold. Some units on the candidate list will not be replaced, they will simply be retired on the basis that work loads or work patterns are shifting and there is no need for similar units in the fleet. The age, cost, or utilization of the unit would have made it a candidate. The fact that utilization is low and that there is no need for units of this nature makes it a candidate for disposal.

The hold option is similar but the outcome is different. The machine would have reached the end of its life or would have finished the task for which it was originally purchased. We must decide whether to dispose of it or keep it as a strategic asset pending future work. The hold decision should not be taken lightly. An excess of optimism regarding future work often results in units standing for extended periods waiting for that one special job. Idle units cost more than nothing. Deterioration continues and obsolescence can easily become a critical factor. You do not want money tied up in the bank of idle equipment.

The two options at the bottom—run and repair, and rebuild—are similar. For run-and-repair decisions, candidate machines should be replaced, but concern about either capital expenditure or future work load makes investment in a replacement machine or a rebuild difficult to justify. Instead, we decide to spend a little, extend life, and delay replacement to a more opportune time. The rebuild decision takes the concept further. The candidate unit is inspected carefully, and we make a planned, focused decision to invest in a rebuild, extend life, and delay replacement well into the future. The calculations involved are complex and risky. There is a huge gray area between a run-and-repair decision used to bridge a short-term problem and a rebuild decision used to extend life, improve performance, and lower cost.

True replacement decisions are shown in the center of the diagram. We again see two options: like-for-like replacement, where it is possible to replace the candidate unit with an essentially similar unit; and improvement, where the candidate is replaced with an improved and more productive version of the machine. In both cases, the capacity and capability of the fleet remains essentially unchanged; and in both cases, the decision is based on the belief that the volume, nature, and characteristics of the work will remain the same. This continuity of work means that the replacement decision is a matter of timing; it is not a matter of if the candidate machine will be replaced, it is a matter of when this is best done. The continuity-of-work assumption also means that you can reasonably expect the replacement machine to be used for its full economic life when it will, in turn, become a candidate for replacement.

Glossary

Defender: The current machine under consideration for replacement

Challenger: The machine being considered as a desirable replacement for the defender

Defender’s marginal cost: The cost of owning and operating the defender for the next production period

Challenger’s minimum life cycle cost: The minimum life-to-date cost per production period that can be expected if owned and operated through its full lifecycle.

Replacement point: When the defender’s marginal cost systematically exceeds the minimum lifecycle cost expected from an equivalent and desirable challenger.

Early authors who worked to define economic life and the replacement decision used two descriptive words for the situation. The current machine—the machine under consideration for replacement—was called the defender, and the machine being considered as a possible replacement was called the challenger. The defender keeps its position in the fleet until the challenger is shown to be superior by achieving higher standards in safety, quality, and cost.

In order to be a candidate for replacement, the defender is likely to be close to, at, or beyond its economic life. This means that the defender’s marginal cost—the cost of keeping it one more year—is higher than its average cost to date and that it has a “positive inferiority gradient.” Things are only going to worsen as time progresses.

In order to mount a successful challenge, the challenger must have a minimum life cycle cost that beats or is less than the defender’s marginal cost. This brings up the classic concept that replacement should occur when the defender’s marginal cost exceeds the minimum lifecycle cost expected from an equivalent and desirable challenger.

How to decide when to replace a machine?

This is a simple three-step process.

First, focus on the future. Past expenditures have no place in the replacement decision. The fact that you have recently replaced the hydraulic pump should not influence a replacement decision based on a predicted engine failure.

Second, estimate what the defender’s marginal cost is likely to be looking into the future. Use your history, project out for a year or two. Estimate when the next spurt in expenditure is likely to occur. Watch the trends.

Third, know and have on hand a reasonable estimate for the minimum lifecycle cost for an equivalent and desirable challenger. Gather the information and know what a replacement is likely to cost.

Replace when the defender’s marginal cost—the value from step 2—systematically exceeds the minimum that can be expected from an equivalent and desirable challenger—the value from step 3.

In a like-for-like situation, the defender and challenger will have the same minimum lifecycle cost and therefore the replacement interval and the defender’s sweet spot life will be the same. This seldom occurs because most challengers exhibit some form of improvement and are either more expensive or more productive or both. When this occurs, the defender’s sweet spot life is no longer the optimum time to replace. If you look at cost only, you will have to delay replacement until the defender’s marginal cost has grown to equal or exceed the minimum lifecycle cost for the challenger. If you wish to factor in productivity improvements, then you can increase the defender’s marginal cost by a factor that reflects the fact that each hour of defender time produces fewer units of work.

It is complex and requires you run the numbers. But two things are important. First, each and every replacement decision gives an opportunity to change the size and configuration of the fleet. We work in a changing industry; use replacements as opportunities to make adjustments to the size and composition of your fleet. Second, equipment is used up in the production of completed construction. You may be able to defer replacement, but in the long run, you cannot deny replacement. It is called the cycle of life.