Reading, writing, and arithmetic—if you get them right, you will be on your way to great things. The same is true for the repair/rebuild/replace decision. Get it right, and many of the requirements for success fall into place.

As with most sound bite titles, it is best to start with some definitions. “Repair” means the decision to keep a relatively old machine in the fleet and repair it for the foreseeable future without any major expenditure. You keep it and keep it running. “Rebuild” means to make a significant investment in the future of the machine by replacing major components and doing the work needed to extend life, lower future repair costs, and improve performance. You keep the old machine but invest the money needed to give it a longer future. “Replace” means to retire the machine and bring in a new equivalent or nearly equivalent. You dispose of the old and commit to a newer unit that will produce a lower lifecycle cost.

Good repair/rebuild/replace decisions follow a three-step process.

First, you need to identify candidates for replacement: the machines you believe require an explicit decision as to whether you should continue to run them and repair them, rebuild them now, or replace them in the next short while.

Second, you need to do the numbers. You make the estimates you need and analyze costs going forward for repairing, rebuilding, or replacing each of the identified candidates.

Third, you need to decide and act. Doing nothing to the identified candidates is not an option.

Identifying candidates for replacement and supporting your decision with hard facts and figures is not easy. We can no longer say, “This old dozer is at the end of its life, it is time for it to go.” We must plan and manage capital expenditure, and increasingly complex justifications are required to show that all alternatives have been quantified and considered. Many of these justifications are based on two factors: a preset “trigger point” that defines when a machine is likely to be a candidate for replacement, and a given “burn rate” used to track the situation as units progress toward and perhaps beyond their trigger point. The spreadsheet below shows how it works. (Download a PDF of the graphic at the bottom of this article.)

Columns A, B, and C give the details for seven articulated dump trucks in the rate class used in our example. Column D gives the trigger point or the number of hours we expect the unit to work before it is likely to become a candidate for replacement. This will most likely be the number of hours of expected life that was used in the rate calculation, and it can be set using knowledge and experience or a detailed minimum lifecycle cost calculation. It can be simple or complex, but there is no way you can properly manage or cost a given rate class of equipment if you do not know, set, or assume an expected life and establish a trigger point for decision making. The spreadsheet shows that we expect 12,000 hours from HT6-21; 18,000 hours from HT6-26 on the basis that we performed a fairly substantial rebuild a short while ago; and 14,000 from the other newer-model 37-ton trucks.

Column E is the burn rate or the number of hours our data shows us the trucks are or are likely to work in a year. We see that we expect 1,500 hours per year for all the trucks except the three 37-ton units working extended shifts on a landfill project. Column F gives the current age, and columns G through K give the expected age at the end of the next five years. The calculations for columns G through K are not complex; HT6-21, for example, has worked 13,000 hours to date and has a burn rate of 1,500 hours per year. We can therefore assume that it would have worked 14,500 hours (13,000 + 1,500) in one years’ time and 17,500 hours (13,000 + 4,500) in three years’ time.

The visual impact comes from the standards set in the first two rows of the spreadsheet. Here we see that the cells in columns G through J will be green if the estimated hours worked falls between 60 percent and 80 percent of the trigger point, orange if the estimated hours worked falls between between 80 percent and 120 percent of the trigger point, and red if the estimated hours worked is greater than 120 percent of the trigger point.

It is easy to see that HT6-21 is a present candidate for replacement and HT6-26 is not far from that point. Having been rebuilt once, HT6-26 is a clear candidate for replacement. HT6-32 and HT6-33 are not far behind, and we will have to start thinking about rebuilding or replacing them. HT6-37 and HT6-40 are young and will still see a lot of service.

The spreadsheet is simple, easy to understand, and a visual way to identify candidates for replacement and give insight into challenges that may lie ahead. Its simplicity is a bit of a disadvantage in that it relies on one parameter—age—to rank candidates. More complex tools such as the multi-parameter tool discussed in May 2016 are clearly better because they can be structured to include parameters such as availability, reliability, and utilization. But complex methods may be seen as “smoke and mirrors,” so it is often a good idea to use a simple tool that gets the job done. The given spreadsheet certainly works.

The next step, doing the numbers and analyzing options, can be complex. Remember that repair/rebuild/replace decisions are about the future. You are at a given point in time and are concerned with costs and hours worked going forward. Money spent and hours worked to date are behind you. You must look forward and optimize the future, not rework the past.

The run and repair decision is relatively easy. You know what it cost last year, you know it is at or beyond its sweet spot, and you know that the next year’s costs are likely to be the best costs in the future of the machine. The question is, are they the best costs that you could obtain if you were to rebuild it and keep it for a few more years? Are they the best costs you could obtain if you were to replace it and keep the new unit for its optimum life?

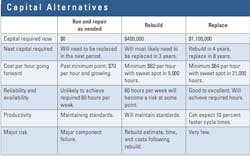

Many factors come into play, not the least of which are differences in the amount of capital required to implement each alternative and the time spans over which the alternatives are optimized. The nearby table gives the kind of results obtained and the factors that must be considered in a typical study. As you can see, you are definitely not comparing apples with apples and in many cases the intangibles and risks will rule the day.

Step three is decide and act. Understanding the alternatives and doing the numbers give you the framework for your decision. It is complex and may depend on your strategic plans, the work you have on the horizon, and your confidence in the future. You gather your data, do your analysis, look forward, and exercise your best judgment. Again, no right answers, just intelligent decisions.

For more on asset management, visit ConstructionEquipment.com/Institute.

Download: Here