For the 10 to 20 percent of asset managers who use telematics data, wading through the hundreds of pieces of information from each machine in the fleet often seems not worth the effort. For some, they yearn to turn off the unwanted and constant “pinging” of alerts; others just want to figure out a way to incorporate a few key pieces of information into a single report.

According to managers and telematics providers alike, this morass of data is a key reason telematics as a management tool remains mired. No one denies that telematics holds great potential for the asset manager to capture and track key machine performance data. Nor does anyone deny that using the data to build cost history and provide operating guidance enables managers to field more reliable and efficient fleets.

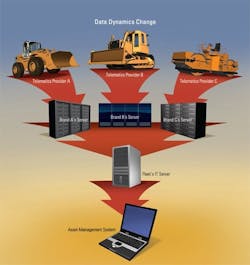

But with fewer than one in five fleets taking the step to actually implement telematics into their management process, the gap between technology and real-world benefit is wide. The Association of Equipment Management Professionals (AEMP) identified that gap more than two years ago and decided to bridge it. Initial discussions among fleet managers, OEMs and telematics providers found that integration into fleet-management systems was expensive, time-consuming, or even impossible. It identified the need for a generic report that would provide key machine data in a manner easily integrated into a fleet’s management software system, regardless of the type of system in place. AEMP then created a telematics standard development subcommittee to hash out the details.

Last month, this strategic meeting of the minds unleashed its result: AEMP Telematics Data Standard 1.1 provides five key machine data points in a generic format that will automatically integrate into a fleet’s management software systems.

“Data is siloed,” says Pat Crail, fleet information manager for The John R. Jurgensen Cos. and chair of AEMP’s subcommittee. “I have to reach out to Caterpillar and view it in one application, then jump to others. Each manufacturer had its own set of data points, their own method of presentation. We need that data to feed into our management reporting systems.”

Three choices face fleet managers. They can manually access each OEM’s telematics website, retrieve the data, and enter it into the organization’s fleet-management system; they can write a program to retrieve data from each provider’s data feed, which is costly; or they can turn to a third-party telematics provider as a turn-key system, which may or may not be able to access the communications protocols within individual OEM’s control modules.

The telematics standard is a stepping stone to full integration of machine data into an organization’s fleet-management systems, Crail says. It will take a “minimal IT (information technology) investment to develop one API (application programming interface) that goes out to each OEM’s server and retrieves the telematic data from each supplier in a common format, parse the data, pull out what you’re looking for, and drop it into your existing database.”

With a programmatic solution, fleet managers will find it easier to run the reports within most existing accounting or enterprise systems used by construction organizations. By eliminating “touches,” including data entry, asset managers will find increased accuracy and quicker delivery and access to data.

As a stepping stone, the standard produces only five data points. AEMP’s subcommittee quickly realized that an initial solution could not cover all the data available. Discussions did reveal, however, that five data points delivered 80 percent of the information asset managers needed to take advantage of telematics: location, cumulative hours, cumulative fuel used, fuel used in the past 24 hours, and distance traveled.

“This set of five is low-hanging fruit,” says Will McFadyen, president of McFadyen & Associates and member of the AEMP subcommittee. “This is the first time that we’ve ever been able to quickly and easily get hours, location, fuel consumed into the back-end systems across a field that has multiple telematics systems.

“This isn’t pie-in-the-sky stuff,” he says. “It’s readily achievable, with a few thousand dollars, to be able to make happen and derive a bunch of benefit out of it.”

The significance of this advance cannot be understated. After all, 80 to 90 percent of fleets do not currently use telematics data for fleet-management decisions. Mike Vorster, president of CEMPCentral, says the standard just might have saved the technology itself.

“[The benefits are] very significant,” he says. “Without a standard of this nature, the whole telematics thing would have become so complex and bereft of real payback that it probably would have died. With a standard, we have a chance of reducing complexity and increasing value. I think it is ‘the’ thing that will get this to finally work.”

How it works

“The thing” is simply an XML document that easily flows into software, regardless of what operating system or programming language is being used, McFadyen says.

“That common thread is XML,” he says. “XML is a way to universally transmit the same information back and forth. It’s more cost-effective because everybody who’s in the telematics industry and has adopted the standard is utilitizing this exact same format for that XML document.”

In order to retrieve the data document, end-users’ software systems will send a message request to each telematics provider’s server, and the server will return the XML document. Each provider will register end-users and assign user IDs and passwords. The document will deliver the most recent data points and will include a time stamp indicating its age. Each OEM will determine how much historical data will be available, but no data will be archived by the OEM.

The gap between the telematics source and the fleet manager’s system must be closed with an IT solution, which is the API developed to query the telematics source and then integrate it into the management software. Because of the wide variety of fleet-management software systems and databases in use, each end-user will need a custom-built API to retrieve and import the data.

“The first step is to determine what your target is for this data to be fed into,” McFadyen says. “That might be an accounting system, that might be a fleet-management system, that might be an estimating application.”

Then, each telematics provider must be able to provide the data as a web service. Acquire the proper log-in credentials so the information can be retrieved, then the tough choice: in-house development or outsourced.

Outsourcing requires a technology integrator, McFadyen says. “This integrator is going to build a bridge between your back-end system and the telematics providers’,” he says. “They will be able to craft a piece of code that will reach out to each one, using the same methodology to access each one, and retrieve and then store it in the database that is your fleet management information or whatever information system that you’re feeding that pertains to your business.” His company provides such a service.

McFadyen says 90 percent of information systems can accept data from outside sources, so asset managers quickly need to bring their IT systems departments into the conversation. “Each end-user needs to spend some time with their systems’ technical people to be able to say, ‘Here’s what I’m trying to do, where does this information need to go?’

“Those are the kinds of questions a good systems integrator is going to ask even before they start,” McFadyen says. “‘Let me call this maintenance software company and make sure this information is going from the telematics system into the maintenance system and is being put in a place that is going to effectively trigger that maintance interval to say, “This piece of equipment has 500 hours on it, it’s time for that 500-hour service.”’”

For those who choose to implement with in-house IT departments, asset managers must also quickly communicate what is coming. “We’re fortunate to have a robust IT staff,” Crail says. “If we decide to use our own people, it will only take a couple of days.”

Others will have to wrangle precious IT time for this project. “In order for the customer to assimilate this data, they’re going to have to support their fleet managers,” says Ken Calvert, director of product support systems for Komatsu Americas, and a member of the AEMP subcommittee. “They’re going to have to make an investment in their own infrastructure, some back office, to integrate the data. When the fleet manager gets in line for IT resources, they need to be given some priority for this.”

Sam Simons, another subcommittee member, and director of business development for OEM Controls, concurs. “The standard is a huge event, but it’s only half the battle,” he says. “The next step of the battle is getting the organization’s IT department’s attention and involvement to import the data.

“Having the standard is a great idea,” he says. “However, the bigger challenge is integrating the right data into the organization so management can make profitable decisions.”

Another third-party provider on the subcommittee is Mike Baker, VP of sales for North America, Navman Wireless. Both Baker and Simons say that their products and service already provide a one-stop telematics solution. Each provides units, so-called “black boxes,” that are placed on individual machines and transmit data to a central repository.

“Data is transmitted to a data warehouse,” Simons says. “We capture the data, provide reports, then we integrate it with our customer’s software. We work with our customers to configure hardware that best fits their process. Then we spend time with their IT department working to understand their data format and needs to automate the data import/export into the corporate computer system.”

Baker says their product works on any brand of machine and will provide a turnkey solution. “For the end-user who has a mixed fleet, they don’t have to worry about having multiple products. They can totally use our service and our application to do everything they need to do.”

This single-source scenario is unlikely to play out, however. So third-party providers have targeted the vast majority of machines that are not outfitted with telematics at all. “The legacy, nonequipped equipment is the opportunity,” Baker says.

As are the machines manufactured without standard telematics. “Many of the OEMs have no interest in providing telematics,” Simons says. “They realize their expertise is bending metal and making machines. Telematics has little to do with their core capability and provides them with little direct value, so they stay away from it.”

Integration and suppliers’ role in it go back to the data. Crail wrote in an online forum on the topic, “The standard provides fleet-level integration of data for periodic reporting (daily or weekly, for example), while the telematics providers’ existing websites provide real-time information, a great level of machine-specific detail, and full geofencing functionality, among other features.” The AEMP standard complements existing telematics data sources, he wrote.

“When these numbers start flowing, you have the potential to improve management across the country,” says Randy Jaminet, manager, customer support for John Deere Construction and Forestry, one of the OEMs serving on the AEMP subcommittee.

Cost and future benefit

Among the OEMs serving on the AEMP subcommittee—Deere, Komatsu, Caterpillar and Volvo—the impetus to help develop the standard came in part from the desire to spur adoption of the technology overall.

“This solution is a game-changer,” says Jaminet. “It eliminates some of the variation across contractors and how they manage their business. I think it will drive a lot more conversation between contractors and OEMs about what else they want.

“It’s now up to us to leverage the solutions we provide to better take advantage of this,” he says.

OEMs say the investment in developing the system on their end was incremental, but should not be ignored. As much as end-users will require IT investment to accept the newly formatted data, OEMs needed to garner support and investment from their own IT departments. This process is, in part, why the standard was not released until October. At press time, initial testing of the standard and its APIs was ongoing with OEMs working with select customers to ensure communications and implementation would indeed proceed smoothly.

Expect OEMs to levy a one-time cost or maybe an additional subscription fee to help recover these development costs. “It’s clear to us that the customer understands that there is a cost associated with supplying these kinds of services and will be open to reasonable fees for services that improve his business,” says Komatsu’s Calvert.

Equally important to OEMs, and of real potential for asset managers, is the opportunity to forge closer partnership between the three sides of the Equipment Triangle: manufacturers, distributors and end-users. Distributors also have access to OEM-generated machine data and can work with machine owners to manage operating costs, maintenance management, and more.

“[Our dealers] have been on board with telematics from the very first day,” Calvert says. “They have staff resources, ongoing training and planning to become more of a consultant. Telematics are allowing dealers to help customers manage the entire machine.”

The next generation of OEM machine-management technology will certainly address the opportunity for distributors to become more active, if asset managers desire, in the machine-management process.

“It could be that two years from now, instead of having these few pieces of information, contractors are looking for us to recommend how to run their business based on this data,” Jaminet says. “If so, then there is other data that could help: prognostics, for example, which is really trending machine performance over time and tracking what’s changing. That’s a service that we and other OEs could provide that could be sent out in this same data format. This could be priced into the telematics service. In terms of the benefit to us, it’s how we take advantage of this channel to present recommendations to our contractors on how they manage their business.

“So here’s an application where we take inputs from machine information, we process those abnormal conditions, marry up with recommended actions, and send that file to the dealer or contractor to generate a work order.”

Vorster foresees just that future for asset managers who take advantage of telematics using the new standard. He calls it “the pebble thrown into the pond.”

“This telematics standard is an enabling technology for [the next frontier in OEM management systems],” he says. “These systems will be massively facilitated by the standard. If you’re going to develop software that interprets data, then you getting the data into the interpreter is very important.”