The question is, do these investments place us on the threshold of a new and different future? The answer is, undoubtedly, “Yes.”

But it will require a lot of change and new levels of cooperation between manufacturer, distributor and end user. We will need to redraw some boundaries, and learn to appreciate the value of data as a raw material of business and use it to create a new form of value, innovation and service1.

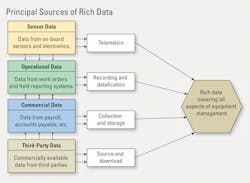

The diagram shows four principal sources that provide the rich data we need to add depth to and improve the predictive capability of any analytical study. Let’s look at each in turn and see what can be done to go beyond reports based on sensor data and move into the brave new world of big data, predictive analytics, and computer science.

Sensor data

These are the data fields and fault codes collected from the on-board sensors and electronic systems common in many modern machines. Much has been written about the need to standardize data fields, and ownership of the data remains a controversial subject. There is undoubted value in telematics and sensor data, but we must understand that it covers only a small part of the broad spectrum of information required to manage an equipment fleet. Fuel burn is important, as is idling time.

Data always speaks and it always has a story to tell. The story based on sensor data alone is, however, narrow and often insufficient for managers to make quality decisions.

Operational data

This is data that is available in the work order and field reporting systems we use to manage daily operations. The challenge is “datafication”: the process of turning records and observations made in the normal course of business into computerized data for use in analytical studies1. We record the service meter reading, the reason for opening the work order, and the action taken on every work order. Can we turn these records into the data needed to determine the frequency with which breakdown work orders are written and measure for the effectiveness of our maintenance program? Can we combine the sensor data on fuel burn and gear shifts with operational data on transmission life to design new haul roads and gain new insights into machine performance? The more we combine sources of data, the richer is its vocabulary and the more insightful are the stories it tells.

Commercial data

The back-office accounting systems are awash in data. Modern systems make sure that it is datafied and stored in a well-structured database. Blending commercial data with telematics data and the data available in cost reports and work orders adds another level of richness to the story the data is able to tell. Payroll data can tie operator or technician name to high-frequency work orders or excessive idling. Accounts payable can tell us how frequently we replace head lamp lenses, give us parts purchased by serial number, and warn us when we order $30,000 worth of parts for a machine that is a clear candidate for replacement.

Third-party data

We live in a data-rich world and many sources of third-party data are available to assist in equipment selection, costing and decision making. Auction results, standard industry rental rates, and cost benchmarks that are available should be used to add breadth to the data generated within a single organization. The quantity, quantity and value of third-party data are growing on a daily basis and this source of broad market intelligence cannot be neglected. You have to know what the world is doing and use that to calibrate your thinking.

Technology has, or soon will, make sensor-based telematics data a given. Implementation has occurred over an extended period of time, and data derived from on-board sensors and electronics has become a commodity. Competitors have advanced together in relatively small steps, and little separates the leading products and services available. Implementation and the use of on-board sensor data to develop fault codes and record the performance of a single machine in real time has undoubtedly improved the state of the art. It is a worthy pursuit, but it is not the Holy Grail of equipment management.

The future lies in data fusion: the process of combining data from disparate sources to obtain new and different insights. This is the real challenge. Succeeding and basing equipment big data and predictive analytics initiatives on a full spectrum of sensor data, operational data, commercial data, and third-party data brings us closer to the Holy Grail.

Reaching this goal will require more cooperation and more trust between manufacturers, distributors and end-users. All parties will have to accept that current computer technologies make it possible to collect significant volumes of valuable data “behind the scenes” without conscious effort or conscious knowledge. Very little is a secret, and you truly live in a fool’s paradise if you believe that transaction data is neither freely available nor freely shared.

Working across organizational and commercial boundaries to define and share data is a challenge. We are used to shielding access to “our data” and are uncomfortable with the datafication that occurs every time we purchase online. It seems to be an intrusion, but we have been doing it for years. Dealers have known what parts contractors have been buying: They have just not been able to analyze the data and use it to manage inventories, measure component lives, and quantify the benefits that flow from improved engineering, design and manufacture.

In terms of secrecy, there is little to lose. In terms of improved knowledge, understanding and ability to manage large complex fleets, there is an immeasurable amount to gain. Predictive analytics will not only confirm your hunches by testing relationships that seem to make sense, it will also explore boundless possible truths beyond the realms of intuition.2

Analysis will suggest explanations and solutions to problems that have defied resolution for years. We will know whether small, frequent work orders can be used as a predictor of future cost; and we will be able to suggest solutions to the concerns that cause us to run components to failure when all our instincts tell us that it is better to repair before failure. We will, without doubt, discover new relationships and correlations we have not, as yet, thought to test: therein lies almost limitless possibility.

Technology and technology implementation is a competitive advantage. But, it is not a sustainable competitive advantage. Manufacturers who are developing capability in big data and predictive analysis know this and are moving beyond telematics. They have access to operational and commercial data through in-house rental fleets and customer agreements. They continue to change and push boundaries, and to use data to extract new insights and create new forms of value that will change markets, organizations and relationships.1

Implementing telematics and developing the protocols we need to share, analyze and extract value from data in the digital age has been a difficult first step. We can walk; it is time to run.

I would like to acknowledge assistance and support given by Professor Mark Embree and the Computational Modeling and Data Analytics program at Virginia Tech.

References: 1) Schonberger and Cukier, “Big Data,” First Mariner Books, New York, NY. 2013; and 2) Siegel. “Predictive Analytics,” John Wiley & Sons, Hoboken NY, 2013.