Well, things have changed. We are in a position to access a lot more data and can make better, more confident estimates of what we are likely to receive when we sell machines in the future. Also, the days of being conservative are largely over. It is nice to leave some profit in the iron, but it is not good to experience losses because of bids we never won.

Let’s run the numbers and see if we can understand the impact of either excluding or including residual market value in our rate and economic life calculations. Let’s see if we can use this information to improve equipment costing and age management.

The table to the right contains the numbers for the example machine we will analyze. The purchase price, not shown in the table, is assumed to be $100 and all other costs have been normalized relative to this value. Column A shows the hours worked, life to date (LTD), in thousands. Column B is the cumulative operating cost LTD for the machine, and column C is our best estimate of the residual market value percentage for the machine.

Column B is valid because the numbers follow the well-accepted upward sloping cumulative curve with the values that are in line with an old rule of thumb that says cumulative operating costs come to about the purchase price at about the sweet spot life.

Column C is also in order. The percentages decline aggressively as the machine ages and finally settle down to a value of a little over 20 percent in the later stages of the machine’s life. This is in line with our experience, so we can confirm that the base numbers in columns B and C are in order.

D is the expected residual market value (RMV) if the machine sold at the age given in column A. It is calculated as column C times the normalized $100 purchase price.

Column E is the owning cost per hour LTD if residual market value is excluded. The calculation is nothing more than the normalized $100 purchase price divided by the hours worked LTD in column A. Column F is the owning cost per hour LTD if residual market value is included. It is calculated by deducting the residual market value in column E from the normalized $100 purchase price and then dividing the result by the hours worked LTD in column A.

Column G is the operating cost per hour (column B divided by column A).

Column H totals columns E and G to give the owning and operating cost per hour if residual market value is excluded. Column I totals columns F and G to give the owning and operating cost per hour if residual market value is included.

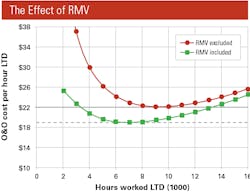

Using these data and calculations, we can graph columns H and I and learn from the results. The graph is at the top of the page.

The red line, a plot of column H, shows that the owning and operating cost per hour LTD makes a minimum of a little over $22 per hour at 9,000 hours if we exclude residual market value. The green line plots column I and shows that the owning and operating cost per hour LTD makes a minimum of a little under $19 per hour at 7,000 hours if we include the residual market values given in column D. These two points are the two highlighted minimum values in columns H and I.

The two lines on the graph clearly show that residual market value impacts both the magnitude and the timing of the sweet spot. Let’s discuss the impact on magnitude first.

The 14-percent reduction (from $22 to $19) in the magnitude of the sweet spot is about what you would expect based on the fact that residual market value at the sweet spot was estimated to be about 24 percent and that owning costs are about half the total owning and operating cost. The impact is even smaller for machines where the rate includes fuel and where owning costs are about a third of the total expenditure on owning costs, operating costs, and fuel. Under these conditions, it is a fair to say that including a 24 percent residual market value in the calculation would reduce the total owning, operating, and fuel rate by about 8 percent. If equipment is one-quarter of the labor, equipment, materials, and subcontractor costs that make up job costs, then it is a good approximation to say that including a 24-percent residual market value in the rate calculation will reduce job cost by about 2 percent. This is significant, but it is not big enough to make a systematic difference at the bid table.

The impact of residual market value on the timing of the sweet spot is another question. The difference between a sweet spot at 9,000 hours and a sweet spot at 7,000 hours is significant and should be the subject of serious thought. It is, in many ways, a self-fulfilling prophesy. If you neglect or disregard residual value, then you have no expectations for cost recovery and you keep machines until they really are old and worn out. If you include residual market value in your calculations, you will include the benefit in your rate and expect to recover the residual market value. This will motivate you to manage life; achieve residual value expectations; and have a younger, more reliable fleet.

Our example machine has relatively rapidly increasing operating costs. This leads to a short economic life and pronounced sweet spot. This is not the case with large long-life machines such as mining trucks where operating costs do not increase rapidly with age and where the sweet spot is much further out and much less pronounced. Under these conditions, residual market value assumptions have a big impact on economic life and the timing of the sweet spot. There are, as a result, two different approaches: either disregard residual market value and run the units as long as possible to amortize the total purchase price over an extended period, or look seriously at residual market values and run the units for a period sufficient to cover owning costs and avoid high operating costs, high downtime, and low reliability. We see how that residual market values play an important part in the decision.

Yes, times have changed. We have the data we need to estimate residual values, and competition will simply not allow us to leave hidden profits in the iron. We need to include residual values in our rate and sweet spot calculations, and we must have the ability to maintain and operate our fleet so that we do indeed harvest the residual values built into our calculations. Although it is nice to have profit in the old iron when we sell it, we must be as competitive as possible.