We spend a lot of time discussing what it costs us to own and operate a particular machine. There is no doubt that this is important, but from a company and strategic level, it is not the final word. We absolutely need to know what it costs us to “own and operate” the equipment account as a business on its own and as a critical part of the company. We must understand the risks and opportunities and know what to do when things change at a macro level.

The revenue credited to the equipment account through the internal equipment cost-recovery system varies a lot from month to month. Our costs also vary from month to month, and some months show losses while others show big gains. There is a lot on the go inside the equipment account, and many factors, particularly monthly revenue, are outside of our direct control. It certainly is a risky business.

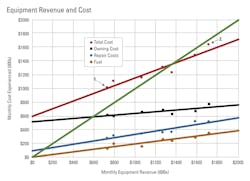

The best way to understand the relationship between cost and revenue at a macro level is to draw a classic break-even chart like the one nearby. Let’s look at it carefully and see what it tells us. We will start by focusing on the red and green lines.

The horizontal scale shows monthly equipment revenue, and the vertical scale shows actual equipment costs experienced. Each plotted data point shows revenue and cost for a given month. As we can see, we have data (the red dots) showing revenue and cost from an example company for the past seven months.

The lowest revenue month (marked 1 and probably a November or a December when it rained or snowed a lot) shows the revenue was a little over $700,000 and the cost was close to $1,000,000. The highest revenue month (marked 2 and probably a June or July when summer was in full swing) shows a revenue of a little over $1,700,000 and a cost just over $1,600,000. The remaining five data points give the corresponding figures for each of the other five other months in our study period.

The seven data points work together to define the position of the red line, which is a good estimate of the way in which our monthly costs vary with changes in monthly revenue. We see that if monthly revenue were to go down to zero, it would most likely still cost us $600,000 to “keep the lights on.” We see that if monthly revenue were to go up to $2,000,000, our costs would most likely be close to $1,700,000.

The green line goes up at 45 degrees and shows the monthly revenue plotted on the vertical axis so that we can easily see the difference between cost (the red line or the red data points) and revenue (the green line). If the red line (or any one of the red data points) is above the green line, then cost exceeds revenue and the equipment account “loses money.” If the opposite is true, then the equipment account “makes money.” The intersection of the red line and the green line is the break-even point. For all points to the left, cost is likely to exceed revenue. For all points to the right of the break-even point, cost is likely to be lower than revenue.

We see the example company reaches its break-even when revenue is about $1,350,000 per month. We also see that revenue has exceeded cost in only three out of the past seven months shown on the graph.

It is important to understand two things before we look a little deeper and start discussing the black, blue, and brown lines.

First, the red line and the green line have different slopes and whether we make money or lose money depends entirely on the monthly revenue earned. Doing the numbers shows that the red line goes up $0.55 for each $1 in revenue earned. (The red line goes from a cost of $600,000 at a revenue of $0 to $1,700,000 at a revenue of $2,000,000. Cost goes up by $1,100,000 while revenue goes up by $2,000,000, or cost goes up by $0.55 per dollar of revenue.) That means that it costs us $0.55 to earn an incremental $1 of revenue. Or, to put another way, every $1 of incremental revenue above the break-even costs $0.55 and produces a “profit” of $0.45. In exactly the same way, every $1.00 of incremental revenue below the break-even produces a “loss” of $0.45.

Second, the break-even point is dependent on two things: the height and the slope of the red line. If we can reduce the $600,000 per month required to “keep the lights on,” or if we can reduce the $0.55 needed to earn $1 of incremental revenue, we will dramatically reduce the break-even point and reduce the risk inherent in the equipment account.

Let’s now turn to the thin black, blue, and brown lines. The example company coded its costs appropriately and determined how much was spent on owning costs, repair costs, and fuel in each of the seven months in the study period. The resulting data was plotted on the graph to produce the black, blue, and brown points and lines. Let’s look at each line in turn.

The black line shows the vast majority of our fixed costs ($500,000 out of the $600,000) come from the fixed cost of owning our own fleet. This is understandable and completely correct. The black line does slope a little to show that owning costs did grow a little with increasing revenue. This was possibly due to the increasing use of rental equipment to handle the increased revenue. The question is, how much can we reduce the fixed cost of owning our own equipment, get the black line to slope a little more, and reduce our break-even point?

The blue line shows how the cost of repair parts and labor changed as revenue increased. We see the slope is, as you would expect, fairly steep: The more revenue you earn, the more you will spend on repair parts and labor. If you do the arithmetic, you will see that repair parts and labor come to about $0.25 per $1 of revenue. You will see that there is a relatively small fixed cost ($100,000 per month) associated with repair parts and labor. Although a portion of labor cost is fixed, it may be possible to reduce it and lower the break-even point.

The brown line shows the situation with regard to fuel. As you would expect, there is no fixed cost. The more revenue you produce, the more fuel cost you experience. In fact, it slopes at a rate of $0.18 per $1.00 of equipment revenue. Evaluate this number to determine if it is in line with the rate calculations.

There is no doubt that you have the data required to produce a break-even chart like the one shown. Monthly revenue varies a lot, and single-point budgeting based on an assumed monthly revenue can be dangerous. You absolutely must know your fixed costs, your variable costs, and your break-even point in order to set goals and take appropriate action.

The equipment manager in our example company did not assume his monthly revenue and fix his budget at a given amount. He said his budget was $600,000 per month plus $0.55 per $1.00 of equipment revenue. He knew the height and slope of his red line and could manage accordingly. He knew how to measure performance relative to budget regardless of whether it is a snowy December or a sunny July.

For more asset management, visit Construction Equipment Executive Institute.