Experience tells us that operating cost per hour will continue to grow as the machine ages and experiences down events.

In the first of two articles on the subject, we will show how to calculate the hourly operating cost for an example machine using a set of assumed data, and then work through the hourly owning cost calculation using policy assumptions regarding annual depreciation charges. Next month, we will show how to do the hourly owning cost calculation using the estimated residual market value of the machine, and how to bring hourly operating and hourly owning costs together to determine a true “minimum life cycle cost per hour” or “minimum hourly cost of ownership.”

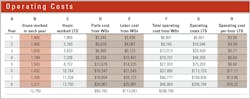

The first table (top) focuses on the operating cost per hour calculation.

Column A shows that we have owned the machine for eight years. The hours worked in each year are shown in column B, with the hours worked life to date (LTD) accumulated in column C. Columns D and E show the parts and labor expenditure on repair and maintenance work orders opened against the machine and are combined in column F to show the total operating cost for the machine in each the year. Column G accumulates these costs and shows the total operating costs for the machine life to date.

Column H is the critical column. It shows the average operating cost per hour life to date and is determined by dividing column G by column C. We see that the operating cost per hour for the first 12,750 hours of the machine’s life averages out at $16.22 per hour ($206,794 divided by 12,750 hours).

There is nothing complicated about this table. The data in columns B, D, and E should be readily available in the work order system. Future years will result in additional rows in the table, additional data in columns B, D, and E, and additional values in column H.

Many things such as more effective preventive maintenance, improved fluid cleanliness, and better operator training can minimize money spent on operating costs. This will reduce the values in columns D and E, and decrease the LTD operating cost per hour shown in column H. You can minimize or reduce expenditure on operating costs, but experience tells us that operating cost per hour will continue to grow as the machine ages and experiences larger and more frequent down events. There is, therefore, no such thing as a minimum lifecycle operating cost per hour. It depends on the lifecycle itself: Keep the machine for a short time, and lifecycle operating cost per hour is low; keep the machine for a long time, and lifecycle operating cost per hour is high.

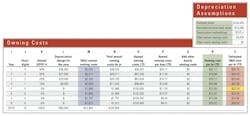

The second table (above) shows how to estimate owning cost per hour based on the purchase price of the machine and policy assumptions regarding depreciation and book value. The next article will show how owning cost per hour is calculated using assumptions regarding the estimated residual market value of the machine.

Organizations that use depreciation and book value assumptions to calculate owning costs believe that machines must be charged a defined annual depreciation to ensure that the book value reflected on the balance sheet is consistent with accepted accounting principles. This ensures that the capital used to purchase the machine is returned to the corporation within a given period and that asset values remain conservatively stated in the books of account.

The assumptions made for our example machine include the following. The purchase price of the machine was $100,000, and the organization plans to carry the machine on its books for a terminal book value of $10,000. Depreciation charges against the machine must, in the end, total $90,000 ($100,000 minus $10,000). It uses a four-year sum of years’ digits methodology (SOYD 4) to determine how much of this $90,000 is charged in each year of ownership. The years’ digits and resulting annual SOYD percentage factors are given in columns J and K.

The organization also estimates that the other annual owning costs for licenses, insurance, property tax, and the like will come to $2,000 per year and that a $2 per hour provision needs to be made for various hourly owning costs.

The depreciation charges levied against the machine are shown in column L and are calculated by multiplying the $90,000 total depreciation to be charged against the machine by the percentage in column K. There is little uncertainty associated with these charges, and they can be calculated with confidence once the purchase price is known and the depreciation policy is set. The machine “comes out of depreciation” in year 4 when it has returned the $90,000 depreciation and the book value has been written down to the terminal value of $10,000. Column M gives other annual owning costs based on records and payments made for licenses, insurances, and property taxes. Column N provides the total owning charges and costs.

Column O accumulates column N to give the annual costs and charges for the machine life to date. Column P is column O divided by the life to date hours worked given in column C of the first table. Column Q adds the $2 per hour owning cost provision to produce column R, the owning cost per hour, life to date for the machine.

The owning cost per hour LTD in column R goes down as the machine accumulates hours over which to amortize or absorb depreciation charges and other annual costs. There is no such thing as a minimum total hourly cost of ownership. As with operating costs, it depends on the lifecycle itself: If you keep the machine for a short time, lifecycle owning cost per hour is high; if you keep the machine for a long time, lifecycle owning cost per hour is low.

Column S totals column H of the first table and column R of the second table to show the owning and operating cost per hour, life to date. The interaction between owning and operating cost is obvious: Column S is high early when owning cost per hour in column R is high, it is high late when operating cost per hour in column H is high. The optimum life cycle works out to be five years or 8,700 hours, at which time the minimum lifecycle owning and operating cost per hour comes to be $22.10 ($8.60 for operating cost per hour LTD plus $13.50 for owning cost per hour LTD).

Life-cycle costing is a complex subject, requiring an understanding of how costs change over the life of the machine and of how owning and operating costs combine to create the optimum life cycle. More on the subject next month.