Construction equipment distributors have increased their willingness to invest in technology in order to support the machine data requirements of equipment managers, according to exclusive research by Construction Equipment.

Although fleet managers can monitor machine health, primarily with the advent of sensors that allow real-time transmission of various data related to everything from location to performance, those data also flow to the equipment manufacturer and the distributors. The availability of data opens opportunities for dealers to help equipment managers use the data to full advantage.

“Our concern is the weakness in the dealer link,” said editorial director Rod Sutton. “We have been calling for stepped-up investment and understanding in data management.”

Responses to the 2020 Annual Report & Forecast and preliminary data from the 2020 Technology in Construction report indicate equipment dealers are growing in their ability to understand technology and partner with fleet managers.

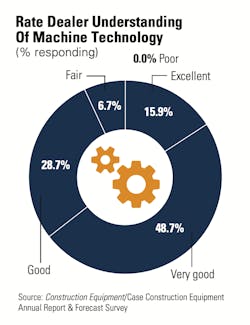

More than 50 percent of end-user respondents to the Annual Report & Forecast rated their primary dealer as either “excellent” or “very good” in its ability to partner with them on service. In addition, 64 percent said their dealer was “excellent” or “very good” at understanding machine technology. This is an increase of five basis points over the previous year, a notably improvement.

Preliminary results from the Technology in Construction survey indicate similar improvement. The percentage of fleets that collect data via telematics grew from 30 percent in 2017 to nearly 40 percent three years later. Although that is fewer than half the fleets responding, it shows growth. The results measure how fleets actually use the data stream in management, not simply the number of machines that are “wired.”

Of those fleets that do not collect data (60 percent), one-quarter say that their dealers “monitor” the data stream and “advise.”

“With a bit of math, we see that more than half of fleets use data in fleet management, a percentage similar to the number we reported in January,” Sutton said.

“For some, that’s a tipping point,” he said. “For our readers, it’s a sign that dealers are seeing the value of data. For the industry, it means fleet asset management is poised to evolve into a data-driven profession that will elevate production and performance.”