To sum up 2023, look no further than the word “inflation.” The problem raged through 2022 and 2023, refusing to abate as a flood of dollars spurred spending that ran smack into ongoing supply problems. The macroeconomics of supply and demand drove up the price of groceries, fuel, and construction equipment and parts.

For fleet managers and the organizations they support, inflation has removed the luster of a strong construction market. In fact, it threatens the efficacy of the Infrastructure Investment and Jobs Act (IIJA) as dollars spent on these projects will not go nearly as far as was hoped in 2021. Inflation may just suck out the fruitfulness of the nation’s investment in infrastructure.

Read also: 2024 Construction Forecast Holds Steady

Equipment prices over the past four years illustrate the extend of this trend. According to Associated Builders and Contractors, the price of construction equipment has increased 27% since February 2020. Even so, 44.1% of respondents to our survey of fleet asset managers either have not increased budgets to keep pace with inflation or do not know how inflation will affect acquisition plans for 2024.

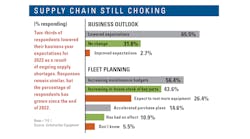

Business, however, seems to be paying little heed. For 2023, respondents said business was better than expected, in fact mirroring 2022 as a “very good” year. Expectations for 2024 are also “very good.” Expectations rise with fleets’ estimated replacement value (ERV), with fleets less than $500,000 ERV forecasting a “good” 2024 and the largest fleets—those with ERV above $10 million—expecting 2024 to be “very good.”

Highway/heavy construction fleets are the most optimistic—optimism fueled by IIJA spending on roads and bridges—but materials producers are the least, expecting only an “average” year.

Contract volume expectations are also highest among highway/heavy fleets, with 52.7% forecasting an increase and 14.5% expecting a decrease for a net of 38.2%. For all fleets, the net for changes in contract volume is 28.4% (44.1% expecting an increase minus 15.7% expecting a decrease). This continues the upward trend of 2023, which recorded a net of 23.8%.

Fleet trends

Business expectations and volume growth are reaching pre-pandemic levels. Acquisition and replacement plans have been tweaked in the interim to extend useful machine life or to keep under-utilized equipment in the fleet for future work. The rate of fleet expansion has been below expectations since the pandemic hit in 2020. Fleet expansion last year was higher than expected—also measured as a net between the percentage expecting an increase in the number of machines minus those expecting a decrease. For 2023, that rate was 27.5% compared to a forecast of 21.4%. That number remains similar for 2024 with an expected expansion rate of 26.6%. Highway/heavy fleets expect slightly more expansion, with a net of 38.2%.

Read also: Fleets Boost 2024 Budgets in Response to Inflation, Supply

More telling is the change in fleet replacement rate. In 2023, respondents put that rate at 10.7%, the highest in the past 20 years. This outpaced the forecast of 8.6%, but it grows to 12.1% for the 2024 projection. Telling also is the fact that this projection is slightly less than the 13.8% replacement rate forecast in 2019, followed by decreasing actual rates.

For highway/heavy fleets, the 2023 replacement rate was 13.9%, and expectations for 2024 rise even higher, to 14.2%

Without rehashing the supply problems of those interim years—many of which remain—managers have been able to extend useful life and continue to support the work their organizations have performed. Now, as machine life reaches the point where it affects utilization and reliability, managers face inflation, high interest rates, and supply challenges as they attempt to replace equipment. Although 20.6% have increased their acquisition budgets for 2024, 26.0% have not. Four in 10 (40.2%) said that they are increasing maintenance budgets.

Maintenance spending continues to increase in response to supply chain disruptions, too. Some 41.4% of respondents said that their budgets would increase for 2024 to continue efforts to extend the useful life of equipment. About one-quarter (24.1%) will increase in-house stock of key parts, and 21.1% will accelerate purchasing plans to ensure that they have the equipment when it is needed. Increased use of rental was cited by 19.2%.

Short-term rental continued to be used by fleets in 2023. The percentage of respondents who decreased the practice compared to 2022 was 10.9%, the lowest rate of decrease in several years. Six of 10 (60.4%) said their use of rental stayed the same as in 2022, again an historical high.

Read also: Equipment Investment to Grow 2.2% in 2024: Finance Group

As an acquisition strategy, 32.1% of respondents used rental/purchase agreements or short-term rental in 2023. Some 18.9% used leases or lease/purchase agreements. With regard to purchasing new machines, 48.5% of respondents said that they purchase outright and 35.2% finance new-equipment purchases.

Fleet health continues to improve, although still not to the levels reported in 2020. In 2023, 46.1% rated their fleet as “excellent” or “very good,” up from the 43.6% responding similarly in 2022. The percentage of respondents rating fleet health as “fair” or “poor” in 2023 was 12.7%, down from last year. Although that number is higher than the 9.3% recorded in 2020 and the 7.4% recorded in 2021, it is in line with historical health figures.

A fleet’s relationship with its primary dealer/distributor can directly affect efforts to maintain fleet health, utilization rates, and reliability. In 2023, 45.5% of respondents said that they would rate their primary dealer’s ability to partner with them on service/support of their fleet as “excellent” or “very good.” About one in 10, or 9.5%, rated them as “fair” or “poor,” down from 14.2% in 2022.