The rate at which prices are increasing is starting to level, but higher costs linger. The Producer Price Index for construction equipment and machinery recorded a 2% increase in September but is 30% higher than it was in 2020. Fleets continue to feel those effects.

Inflation is biting into budgets, which drives up the operating cost of equipment, reduces available capital to replace older machines, and ultimately slices into profitability. Operations must adjust to increasing equipment costs, and bids on upcoming projects will need to apportion more expense to cover the equipment needed to do the job.

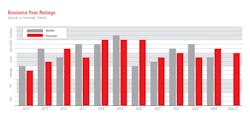

Business ratings for 2024 fell after “very good” years in 2022 and 2023. Although expectations for 2024 were “very good,” respondents rated it as “good.” Their forecast for 2025 is also “good.” Cross-tabulated results show the “good” outlook across all fleets sizes, measured by estimated fleet replacement values (ERV).

Analyzed by vocation, expectations for 2025 are highest among highway/heavy construction respondents, who forecast a “very good” year. General building contractors, those who do both highway/heavy and general, and material producers look for 2025 to be a “good” business year.

2025 Annual Report & Forecast Construction Industry Report

Revenue decreased for 28.7% of respondents in 2024 for a net of 8.8%, measured by subtracting the percentage indicating a decrease from that noting an increase (37.5%). Expectations for changes in 2024 revenue were substantially higher, at 28.4%. Only 15.7% forecast a decline in revenue for the year when asked at the end of 2023. The 2024 net of 8.8% was the lowest recording since the pandemic year of 2020.

Again, highway/heavy contractors bucked the trend, with 15.8% citing revenue declines for a net of 23.1%. Material producers suffered revenue declines among 43.2% of respondents, resulting in a net of -10.8%.

Expectations for changes in revenue in 2025 are slightly higher than expected for 2024. Increases in revenue are forecast by 45.3% of respondents, and 13.7% expect revenue to decrease for a net of 31.6%.

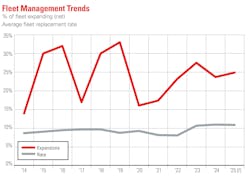

The fleet replacement rates continued healthy in 2024, at 11%, and is expected to be the same for 2025, at 10.9%. These are historically high rates of replacement, signaling that fleets may be reaching the end of extended lifecycle management brought on by substantial increases in new-machine prices and supply chain issues. Plans to push machine life a bit further may be morphing into a return to fleet-replacement strategies centered on traditional useful life.

Replacement rates increase by fleet size. Fleets with ERV above $1 million report plans to replace nearly 13% of their equipment and trucks in 2024. Material producers, on the other hand, plan to replace 7.1%.

Fleet expansion, measured by the percentage of respondents saying that the numbers of machines in the fleet will increase or decrease, also remains strong. For the third consecutive year, the net expansion was above 20%. For 2024, the net was 23.7 (33.7% saying the number of machines grew minus 10.0% saying it decreased). The net in 2022 was 23.2% and in 2023 27.5%.

Expectations for 2024 fleet expansion were 26.6%, slightly higher than the actual results. Expectations for 2025 are in line with 2024, with a net of 24.9% (30.8% expecting to grow fleet size minus 5.9% expected to decrease it).

Digging into the data reveals that larger fleets are more likely to add more equipment in 2025. The net for fleets larger than $10 million ERV is 41% (53% expect to increase fleet size minus 12% expecting it to decrease). Fleets with ERV of $500,000 or less report a net of 6% (14% to increase minus 8% to decrease fleet size). Highway/heavy contractors report a net of 31%, with 36% planning fleet expansions minus 5% planning decreases in fleet size.

As managers move to expand fleets and replace equipment, inflation puts pressure on equipment budgets. Almost a quarter, 23.0%, of respondents are increasing their acquisition budgets in 2025 in response to inflation. This is up from 20.6% the previous year. One in five (20.9%) said that their total budget has not increased to keep pace with inflation. This is down from 26.0% the previous year.

The ability to boost budgets increases with fleet size. Among fleets with $10 million or more ERV, 37.3% will increase their acquisition budgets next year. For fleets with ERV of $500,000 or less, that number drops to 11.1%.

Maintenance needs have increased as fleets attempt to extend machine life. Inflation is affecting those budgets, too, with 41.2% of respondents reporting that they will increase maintenance spending in 2025. By fleet size, 22.2% of small fleets will increase spending and nearly half of large fleets will bump up their maintenance budgets.

Although 20.9% of respondents have not increased total budgets to keep pace with inflation, 23.7% said that they expect to rent or lease more equipment in 2025 rather than buy new.

As an acquisition strategy, short-term rental is employed by 16.7% of fleet managers, and leasing is used by 8.9%. Half of respondents with purchase outright, and 31.9% will purchase by financing. Rental-purchase and lease-purchase are used as acquisition strategies by 16.7% and 8.6%, respectively.

Two-thirds (65.8) of respondents said that they will keep their use of short-term rental, measured by machine hours, the same in 2025 as it was the previous year. Some 22.8% said that they will increase their usage, the lowest number reported after several years of increases in the 30% range.

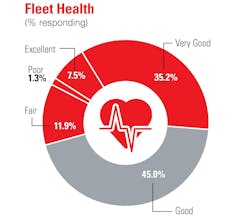

The percentage of fleets in “excellent” condition dropped 4.2 basis points to 2021 levels. The combined rating of “excellent” and “very good” also dropped in 2024, from 45.1% to 42.7%. “Good” grew 3.8 basis points to 45%, suggesting an overall diminishing in fleet health.

Machine data has become solidly integrated into asset management with only 15% saying that they do not use the information to management maintenance. About two-thirds (64.1%) manage data in-house and manage their own maintenance. Two in 10, 22.2%, say their dealers manage their fleet data. Half of those, 11.5% say that their dealers perform their maintenance and 10.7% say that their dealers alert them when maintenance is due. Another 6.6% use third-party data management services that alert them when maintenance is due.

A fleet’s relationship with its primary dealer/distributor directly affect efforts to maintain fleet health, utilization rates, and reliability. In 2024, 42.0% of respondents said that they would rate their primary dealer’s ability to partner with them on service/support of their fleet as “excellent” or “very good.” About one in 10, or 9.4%, rated them as “fair” or “poor,” similar to ratings in 2023.

About the Author

Rod Sutton

Sutton served as the editorial lead of Construction Equipment from 2001 through 2025.