The industry buzzword “rightsizing” has largely been associated with a focus on shrinking equipment fleets, yet one area that is regularly overlooked and arguably just as important to consider is the rightsizing of an organization’s cost structures and systems. This type of rightsizing is crucial for any company that wants to boost its efficiency and profitability in both the short and long term.

Check out the quiz below after reading Craig's article.

I have seen hundreds of costing, coding, and billing structures, and in 30 seconds or less I can tell you if the structure is supporting the company or adding complexity and costing money. Let me explain further.

First, let’s look at an equipment dealership comprising Sales and Service departments. The Sales department generates revenue when a customer buys a piece of equipment, and the Service department generates revenue when it repairs or maintains a piece of equipment.

Read also: Six Steps to Create an Asset Structure

These departments engage in two distinctly different types of work activities in the business, resulting in two revenue streams and two profit-and-loss statements. This separation exists because both departments function as profit centers, with the equipment serving as the primary commodity.

Next, let’s look at an end-user scenario involving Operations and Maintenance teams. At first glance, one might liken Operations to Sales and Maintenance to Service because functionally they are similar. The Operations team generates revenue when it utilizes the equipment to produce a finished product for their client, and the Maintenance team incurs costs as the equipment is repaired and maintained.

Unlike the Service department of an equipment dealer, however, this Maintenance group does not directly generate revenue. Consequently, although both end-user teams engage in distinctly different types of work activities, there exists only one revenue stream and a single comprehensive P&L statement. In other words, while Operations functions as a profit center, Maintenance functions as a cost center.

When focusing on the equipment side of these two types of organizations, nothing seems different if you are a mechanic, admin, or even a manager. You receive broken equipment, and you fix it for your customer.

Cost coding must strike a balance between simplicity and complexity. Go too simple and you lose data quality, which translates to an inability to monitor costs with cost overruns inevitably ensuing; go too complex and you’re adding time and resources to input, administrate, or analyze, which translates to delays in decision-making with more costs.

To rightsize cost codes and structures, “think like a boss.” If you are unsure where the inefficiency or waste is in your area, talk with a fleet admin, invoice clerk, supervisor, or lead mechanic. They will certainly tell you what codes and practices are not being used with varying levels of candor. Be sure to balance this feedback with a data-driven approach and look to your equipment rate build-up. If you have more cost codes than build-up categories in your rates, now is the time to challenge yourself to rebalance these.

To find what specific codes are not adding value, look at historical costs by code. The accounting department may have a report called a “trial balance”; ask for a three-year history. The above example provides four ways to condense costs codes.

Four steps to condensing cost codes

- Codes/Accounts. See if the quantity and types of codes seem reasonable for your business model and flag any codes you suspect could be unused.

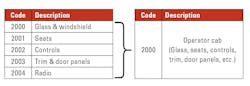

Note: Equipment costs tend to come in spurts. If your cost codes are too granular, you’re going to have strange spikes and gaps in cost data. Inversely, having too few codes obscures spending by cost segment or machine system, instead presenting only a large pool of monies with no discernable breakdown (for example, generic terms such as running repairs, miscellaneous, parts, and so on). Both make it difficult and time-consuming to trend and project spending, which is a mandatory requirement for managing costs. - Spend/Transactions. Look at the total dollar value and quantity of transactions. A good rule of thumb to follow is when there are less than 5% of the spending and transaction volume going to any one code, consider consolidating or removing it. For example, if you have separate cost codes for Glass & Windshield, Operator Seats, Controls, Gauges, Trims & Door Panels; all these can be consolidated into a single account called “Operator Cab.” Consider moving Radios to a separate code called Electronics and Instrumentation.

- Function/Systems. Analyze cost codes and consider where you can group them into functions or machine systems. Think about equipment components and start with the big items such as Engines, Torque/Trans, Drivetrain (Final Drives, Axles), Electrical, Hydraulic. Work your way down the list to items such as Tires/Wheels/Tracks, Attachments (Buckets/Box), etc.

You will be left with a systems-based cost code structure that represents your equipment in a level of detail any layperson could understand. - Value. Finally, ask yourself, “Does this code add value?” The easiest way to do this is to review your new list with those same people you spoke to earlier and be prepared to make a few more refinements.

After this review process, put the list into action. Work with Accounting and IT to close/lock/remove the codes from your systems so they no longer plague you and your people in the day-to-day operation.

Amid todays’ competitive markets with cost and supply pressures as well as staffing shortages, there has never been a better time to look inward at your business to ensure the work activities, cost structures, and systems are supporting its ability to generate revenue.