Categorization and rate grouping of an organization’s assets allows it to track and report on those assets. What data are tracked and reported is largely determined by stakeholders commonly responsible for your key profit centers, cost centers, and support centers.

Below are six steps to creating an asset structure that will allow successful tracking, reporting, and decision-making.

1) Collect asset lists

This first step is to determine the correct and complete list of assets to organize and track. For most construction-equipment-using organizations there are three key areas: operations, equipment/maintenance, and accounting/finance.

See more: Executive InstituteAccounting/Finance is tasked with producing accurate financial statements such as balance sheets and income statements. Accountants only need to track and report on assets that meet certain regulatory or monetary thresholds, so financial data regularly misses assets that are fully depreciated or those that are expensed. For many equipment-intensive companies, that threshold could be north of $40,000.

Operations is tasked with utilizing the company’s resources to produce revenue with a profit. A visit to a job site reveals much more equipment than is on the accounting list. Operations needs this smaller-dollar equipment to perform their work. In many instances, they can bill clients for their purchase or use.

Maintenance/Equipment is tasked with ensuring that equipment is available and ready to work when Operations needs it. This center must plan and execute the maintenance as well as perform any repairs that arise. It must not only track the assets deployed, but also must track usage and basic parts and consumables in order to properly plan and execute the routine services. This list of assets will look different than the list of equipment the Operations team uses because it will have a level of detail associated with tracking components plus meters, such as hours or mileage.

Although all three centers play a vital role in the overall success of the company, each group has a distinctly different function. The result is multiple “sources of truth” for what should be a clean and clear list of the company’s assets. An equipment executive is best served when they establish a structure that ensures accountability that delivers consistent outcomes rather than expecting operations or others to self-manage the data of an organization’s most valuable assets.

In order to categorize assets in a way that satisfies the unique information needs of each center, consider harnessing the built-in functionality of the Enterprise Resource Planning (ERP) system used. Almost every ERP system has standard functionality for hierarchical and tiered setup of assets that looks something like this:

| Level 1 | The asset class--addresses the finance center needs |

| Level 2 | Function--addresses operations |

| Level 3 | Capacity--addresses the fleet department needs |

Below level 3 is where individual assets themselves will reside.

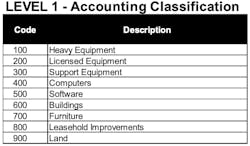

2) Define asset classes

Create the categories that accountants need to summarize and report on the financial and/or taxation-based categories unique to the types of assets. These classes will often have a linkage to a corporate depreciation policy and use simple yet high-level terms. In our example, accounting classes are three-digit codes such as 100 for heavy equipment, 200 for licensed equipment, 300 for support equipment, and so forth.

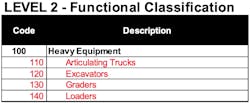

3) Categorize by function

Break down the relevant accounting classifications into smaller function-based groupings that are more applicable to departments such as Operations. Let the asset list be a guide, but keep these functions broad yet representative enough to cover a wide range of asset groups and possibilities.

In our example, the Level 1 code of “100” would be given Level 1 codes such as 110 for articulated dump trucks, 120 for excavators, 130 for graders, and so forth.

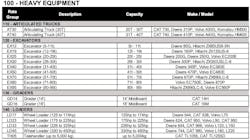

4) Group by capacity (rate groups)

Group assets within the functional categories into capacity-based groupings by looking at make and model details.

Some would argue that companies should group machines in a way that allows them to charge more for newer versions. This, however, distracts from charging a price the market will bear for all assets with that capacity or capability. Look at it another way. When it comes to utilizing assets (which is what this structure is about), which of these two options matters most: A) Sites use a new Caterpillar, old Deere, or a rental Volvo; or B) sites use a 30-ton ADT?

Option “B” allows true functional needs to run the business.

The table above provides an example of capacity-based groupings. When assets have been grouped by capacity, estimating and utilization of equipment—a 30-ton ADT or 45-ton excavator—becomes evident. If not, either redo the categories and groups or add another level. Just remember that more levels introduce more complexity, and more complexity introduces more administration and costs.

With these newly created groupings, it becomes much easier to create an internal rate or transfer pricing system for each of these capacity-based rate groups at a 1:1 level.

5) Cleanse unit detail

This step is optional but highly recommended. With the data and details of the fleet assets garnered from the asset lists, including the research into specs, functions and capacities, take the opportunity to clean up asset records.

Start with reviewing, verifying, and updating basic data such as Unit#, description, serial number, etc. Add columns or user-defined fields for details on options such as ADT ejectors, high-flow hydraulics, and auxiliary circuits. For example

| Unit # | Function | Make, Model | Options |

| AT30.001 | ADT | Deere 310P | w/ ejector |

| EX45.001 | Excavator | Hitachi ZX450LC | w/ 13m long reach & auxiliary circuit |

6) Update system data

Finally, update the asset details across the organization’s systems—ERPs, Work Order modules, Continuity Schedules—to reflect these updated classes, functions, capacities, and cleaned-up asset data.

Once assets are properly categorized, the equipment executive can improve data quality and decision-making while simplifying administration and reporting. Following these six steps leads to effective simplicity and lasting success.