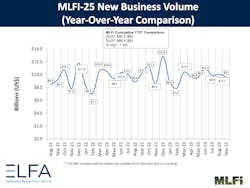

Overall new business among 25 leasing and finance companies dropped 5% in September, compared to September 2022, according to the Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25). New business volume was $9.7 billion. Volume was down 4% from $10.1 billion in August.

Year-to-date, cumulative new business volume was up 1.9 percent compared to 2022.

“Respondents to the September survey show a slight decline in new business volume, providing fresh evidence that liquidity issues brought about, in part, by high interest rates and stubborn inflation are having a somewhat negative impact on demand for business equipment in select sectors,” said Ralph Petta, president/CEO, in a statement. “Of equal or greater concern is the quality of equipment finance company portfolios, as losses and delinquencies continue to edge up slightly. Both bear monitoring as we enter the fourth quarter of the year.”

Said Bill Stephenson, global CEO, PEAC Solutions, in a statement:

“After the positive growth of recent months, the September survey results underscore the near-term challenges being faced by the U.S. economy. With monetary policy remaining restrictive and the cloud of further rate hikes still hanging in the air, business confidence has continued to soften and curtail investment activity. Our industry has demonstrated its resilience, having successfully navigated these economic headwinds for most of 2023 and delivering year-over-year growth. However, recent adverse events, such as the escalation of hostilities in the Middle East, will weigh on market sentiment and could further slow activity in the final months of the year.”

The MLFI-25 survey also indicated that receivables over 30 days were 2.3%, unchanged for the second consecutive month and up from 1.5% in the same period in 2022. Charge-offs were 0.36%, up from 0.34% the previous month and up from 0.17% in the year-earlier period.

Credit approvals totaled 73.6%, down from 75.1% in August. Total headcount for equipment finance companies was down 2.7% year-over-year.