The construction industry learned quickly that “essential” does not guarantee success. As governmental responses to the coronavirus pandemic threatened to extinguish hospitality and entertainment businesses, its labeling of construction as an “essential” business ensured that work could continue—if it was available.

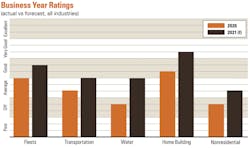

Comparing 2020 as a business year to 2019 does not mean much, even less when measured against the extraordinary optimism of 12 short months ago. A thriving economy succumbed to the pandemic response. The business outlook for 2020 was “very good” to “good,” but the reality plummeted to “average” and “off.”

2021 Construction Sector Reports

Nonresidential and water infrastructure was hardest hit, reporting business as “off.” Home building called the year “good,” as home-bound workers sought safer or more comfortable space, or further feathered the nests they already inhabited. Fleet managers and those in the transportation markets labeled 2020 as “average.”

Each of these markets is covered by Scranton Gillette/SGC Horizon publications, siblings of Construction Equipment.

Most regions reported that 2020 was “average,” again off from what many expected to be a “very good” year. Mid-Atlantic and Pacific regions were “off,” perhaps as they housed many coronavirus hot spots and shut downs. Mountain reported a “good” 2020.

Most respondents, by vocation and region, expect a soft bounce back in 2021, with the aggregate business forecast of “good.” Pacific expects to move from “off” to “average,” while Mid-Atlantic expects to leapfrog from “off” to “good.” Home building expects to attain “very good,” but nonresidential moves up slightly to “average.”

Demand may be putting the damper on expectations.

The Associated General Contractors of America released a coronavirus survey in October in which 78 percent of respondents said they were experiencing project delays or disruptions due to the virus. Three out of four respondents said an owner had postponed or canceled upcoming work.

“The survey results make it clear that the months-long pandemic is undermining demand for projects, disrupting vital supply chains, and clouding the industry’s outlook,” said Ken Simonson, chief economist.

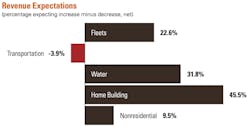

Most vocations expect contract volume to bounce back in 2021. Trends are measured as a net percentage, subtracting the percentage of respondents expecting a decrease in volume from those expecting an increase. For the group, that net is 24.1 percent, a good improvement from the net of -6.3 percent reported for 2020. The forecast for 2020 had been a net of 43.5 percent. Again, home building is bucking the trend, with the only positive net for 2020 (16.6 percent) and strong 45.5 percent forecast for 2021.

Historical Construction Business Reports

Bid price forecasts are fueling volume expectations, with the industry trend a net of 59.6 percent. Home building (77.6 percent) and water infrastructure (64.4 percent) are above the trendline; nonresidential (47.1 percent), transportation (49.4 percent), and fleet managers (51.6 percent) are below it. Not much variance from the trendline exists across regions.

Material prices, a component of bid estimates, are also expected to increase by many respondents in 2021. Against a trendline of net 71.2 percent, water infrastructure was highest at 77.8 percent net, and nonresidential lowest at 66.7 percent net. Again, most regions were in line except for Mid-Atlantic, where the net was far above the trendline at 87.4 percent.

Markets across the industry are either “intensely” or “very” competitive for 65.0 percent of respondents, down slightly from 2020. Among nonresidential respondents, the percentage who labeled competition as “intense” or “very” dropped from 79.4 percent to 59.9 percent in 2020. Similar competition was reported by 48.2 percent of water infrastructure respondents. Nationally, markets were most competitive in the South Atlantic, with nearly 77.5 percent describing them as “intensely competitive” or “very competitive.”

The pandemic response to a resurgence puts pressure on overall firm health heading into 2021. Some 69.9 percent of respondents described it as “very good” or “good,” down from 80 percent at the same point last year. Among nonresidential respondents, 57.1 percent described that level of firm health; among homebuilders, it was 76.9 percent.

Annual Report & Forecast Methodology:

Scranton Gillette Communications and SGC Horizon publish several magazines in the construction sector. Participants in the 2021 Annual Report & Forecast asked their subscriber bases about not only overall construction trends, but also trends specific to the sector in which they work. Each publication sent email invitations to its subscriber base, inviting participation in an online survey. About 1,700 responded. Respondents by market include fleet managers, 400; transportation, 247; water infrastructure, 296; nonresidential, 171; and home builders, 612.

Case Construction Equipment partnered with Construction Equipment in presenting the Annual Report & Forecast. Case is a full-line manufacturer of earthmoving equipment.