Last year brought bold moves that bolstered nearly every realm of the construction industry. Tax cuts and reduced regulations buoyed the stock market, and many construction firms geared up for a continuation of the growth seen during 2017. Then came the tariffs tiff, igniting a trade war affecting broad swaths of the nation’s economy.

The optimism of early 2018 began to ebb. The mid-term elections were less disruptive than expected, but the year ended with a bit more uncertainty than it began.

The industry as a whole performed well in 2018, and expectations remain broadly positive for this year. The momentum of 2018 should keep pushing construction forward. Ken Simonson, chief economist for the Associated General Contractors of America, said this in his analysis of the first nine months of 2018:

Sector Reports

“Construction spending has increased among nearly every project type and geographic area this year. Despite month-to-month fluctuations, the outlook remains positive for modest to moderate increases in most spending categories at least through the first part of 2019. However, damaging trade policies, labor shortages and rising interest rates pose growing challenges to contractors and their clients.”

The many surveys cast at the end of 2018 that make up our Annual Report & Forecast support this conclusion.

Respondents are managers in the various construction markets. Construction Equipment has surveyed equipment users and construction managers about business and fleet performance for nearly 35 years in order to present an annual business review and outlook for the industry.

In the interview below, Case executive Michel Marchand discusses dealer relations as well as the 2019 outlook.

A win is a win

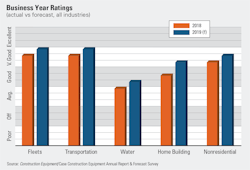

Business scored a second consecutive positive year in 2018, although disappointment in the water infrastructure and home building markets kept it from being a broad win across all construction vocations. The numbers broke more favorably when scored by region, with all reporting that 2018 was a “very good” or “excellent” year for business, according to results from this year’s Annual Report & Forecast. The performance in 2018 mirrored business expectations provided at the end of 2017.

Historical Business Reports

Transportation, nonresidential, and fleet managers scored last year as “very good,” and each forecast the same for 2019. The momentum begun in 2017 appears to be sustainable in these vocations. Home building and water infrastructure also expect 2019 to perform better, after each fell short of expectations in 2018. Respondents in the home building arena expect to move into “very good” territory this year; those in the water industry expect to move from an “average” 2018 to a “good” 2019. Each of these markets is covered by Scranton Gillette/SGC Horizon publications, siblings to Construction Equipment.

According to Ken Simonson, chief economist for the Associated General Contractors of America, September 2018 construction spending was up 5.5 percent over January of that year. Both public and private spending were up in September, 7 percent and 5.1 percent, respectively. Spending is expected to stay “robust” in 2019, he said.

“Despite month-to-month fluctuations, the outlook remains positive for modest to moderate increases in most spending categories at least through the first part of 2019,” Simonson said in November.

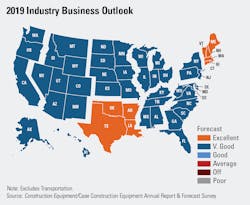

Expectations for 2019 remain high for New England, and Southern Plains joins in the “excellent” forecast. Other regions expect this year to be like 2018: “very good.”

In our surveys, all regions of the country reported that last year was “very good,” with New England performing better than its expectations with an “excellent” year. New England is joined by the Southern Plains region in forecasting an “excellent” 2019, with all other regions expecting another “very good” business year.

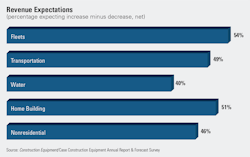

Business ratings for 2019 are fleshed out by contract revenue expectations for the year, a forecast that indicates growth beyond that seen in 2018. About 56 percent of respondents expect revenue to grow this year. Subtract the 8 percent expecting it to decline, and the net is 48.1 percent. Home building respondents are the most optimistic, with a net of 51.3 percent, and water is the least, recording a net of 39.8 percent.

There are several regions where optimism ranks even higher. In the Mid-South, the net of those expecting revenue increases minus those expecting decreases is 61.7 percent. Hovering near a net of 60 percent is the South Atlantic at 59.5 percent, Mountain at 58.5 percent, and Pacific at 57.7 percent.

Expectations are that bid prices will increase in 2019. Overall, 78.5 percent of respondents expect prices to go up, and only 2.1 percent expect them to go down. The net is 76.4 percent. Outliers are nonresidential, with a net of 83.3 percent, and transportation at 65.8 percent. By region, Mountain respondents reported a net of 83.8 percent, with 84.6 percent expecting bid prices to rise and 0.8 percent expecting decreases.

Revenue growth is expected to continue grow in 2019, with net percentages up only slightly from last year.

Material prices continue to pressure bid prices, with tariffs perhaps intensifying that this year. For the construction industry, 87.1 percent expect material prices to increase this year, and after subtracting the 0.9 percent expecting decreases, the net is 86.2 percent. Home builders reported the lowest net, 80.7 percent. The Mountain region reported the highest, 90 percent, with none predicting decreases in materials prices.

Two of three respondents labeled their markets as “intensely competitive” or “very competitive,” the same as in last year’s study. Fleet managers reported the most competition, with 72 percent calling it “intensely” or “very” competitive, perhaps because rising equipment prices are boosting rates, which are then passed along in bids (see page 7 for more details on fleet price increases). The most competitive region is New England, with one-

quarter of respondents saying it is “intensely competitive.”

Overall firm health solidified in 2018, with 77.6 percent reporting that it was “very good” or “good,” the same percentage as in last year’s study. Water respondents were below the industry average: About two-thirds of water firms indicated health was “very good” or “good” in 2018.

Annual Report & Forecast Methodology

Construction Equipment partnered with sibling publications in specific construction vocations for a broad view of the construction industry. Our Scranton Gillette/SGC Horizon partners include Building Design+Construction, representing the nonresidential market; Professional Builder, representing the homebuilding industry; Roads & Bridges, on the transportation front; and Water & Wastes Digest, which covers the country’s water infrastructure issues. Each magazine’s editor analyzes their individual market for a more detailed look at the upcoming year.

Construction Equipment has partnered with Case Construction Equipment since 2003 in presenting the Annual Report & Forecast. Case is a full-line manufacturer of earthmoving equipment, and its support of this project allows us to publish substantial amounts of data and analysis for the industry's use.