Much of 2017 has been a year of uncertainty for business in the water and wastewater industry. Despite the mass media attention paid to the happenings in Flint, Mich., and the public’s attention on and desire for updated water and wastewater infrastructure, plans have not moved forward quickly.

Construction Sector Reports

President Trump’s infrastructure plan promises a massive influx of funding in the amount of $200 billion allocated in his budget to leverage an additional $1 trillion in private investments, but it is not clear how that money will be allocated between roads, bridges, transportation upgrades, and, of course, water and wastewater infrastructure.

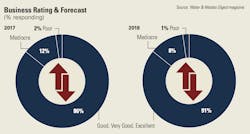

What is clear, however, is the industry’s outlook. Compared to 2017, respondents to Water & Wastes Digest State of the Industry survey are far more optimistic about their business’ future in 2018. With that in mind, there are a handful of market areas in water and wastewater that are seeing technological advancements, innovations, and growth in adoption. The general trend among all these advancements is greater efficiency, whether that is energy efficiency, water conservation, or simply a time savings for operators and workers.

Resins and pipe

When it comes to pipe, much has remained the same for decades. However, some chemical companies are looking for ways to improve materials used in pipe. Tjerk Lenstra, senior business manager for Noryl resins portfolio in Europe for Sabic, said he sees movement away from metal pipe to allow for more design freedom.

“From an engineering point of view, our growth theme is replacing metal,” Lenstra said. “Metal is becoming, sometimes, more difficult to be used. it’s more expensive. There is less design freedom. And plastics, especially the high-end plastics we’re talking about here, we have more design freedom.”

Among those changes to pipe design are new kinds of plastics, the introduction of specialized plastic weave to handle greater pressures, and infusing pipe with other materials, like glass, for easier installation as it does not expand as much. This makes it easier to cut pipe to size for certain applications. Lenstra said all these innovations have been tested in Sabic’s labs to meet the needs of those looking for new pipe and stay ahead of changing regulations.

Human machine interfacing

With the advent of cloud computing and cloud data management, human machine interfaces (HMI) give companies ways to make remote monitoring through supervisory control and data acquisition (SCADA) systems.

A big driver behind that are communication protocols for equipment, namely OPC Unified Architecture (OPC UA) and Distributed Network Protocol (DNP3). Remy Echavarria, PLC/HMI product manager for Delta Products, said these protocols have become a requirement for new products entering the market.

“We see a lot of people looking for remote maintenance and remote connectivity,” Echavarria said, noting the information can be stored in the cloud. “All you do is log into the cloud account and you can access it from anywhere in the world. You can use that to bug issues in your plant or even actually view the status of your plant.”

Echavarria said this immediate access to information can cut costs. Plant managers don’t have to send an engineer or operator out to a plant when they receive an alarm that something is wrong. They can see where the issue is on their computer, phone, or mobile device and address it remotely.

Combined heat and power

In the past five years, combined heat and power (CHP) technologies have been rising in popularity at a speedy rate. Clifford Haefke, acting director of the Energy Resources Center at University of Illinois-Chicago, said there are several reasons for this, the greatest being regulatory changes and a push toward greater energy efficiency to deal with increasing energy costs.

“We’re also seeing treatment plants looking to become net zero,” Haefke said. “It’s energy efficiency projects. It’s also generating your own energy on site whether it’s solar or if they have anaerobic digesters, can they use the biogas to generate electricity and thermal energy for their facilities? For those plants trying to go net zero, CHP definitely seems to be one of the components that they need to achieve this.”

Haefke said the growing trend toward CHP does not look to be regional in nature, rather it seems to find success in smaller plants.

“Part of that is due to receiving high-strength wastes that they’re importing in; not just from the normal sewage system, but getting it delivered to the plant—fats, oils, and greases—substrates that have high energy content that need to get disposed of,” Haefke said. “When it gets brought into a plant, it can help boost the biogas production.”

While reusing biogas is the most popular way to incorporate CHP, natural gas is also an option. Haefke said the interest is there for natural gas, but no projects have come to fruition on that front yet.

Lastly, while net zero is often the goal of CHP, there have been instances where plants have overproduced energy and sold it back to the grid. This is more rare, however, as once energy is resold, there are a new set of regulations governing power-producing facilities that come into play.

Ultrafiltration, reverse osmosis

Ultrafiltration (UF) and reverse osmosis (RO) innovations are also trending toward greater efficiencies for better conservation of water and circular systems. Most notable for RO adoption is its growing use in the industrial sector where minimum liquid discharge (MLD) and zero liquid discharge (ZLD) being driven by regulations in China and India are forcing facilities to adapt.

Eduard Gasia Bruch, region marketing manager for RO and UF for Europe, Middle East and African for Dow Water & Process Solutions, said the key trend for RO is wastewater reuse, especially in regions plagued by water scarcity like India and Africa.

“Basically, there are competing sources of water so the withdrawal of water from fresh sources is more expensive as well as there are increasing trends in regulations for discharge,” Bruch said. “So all this leads to wastewater reuse—so maximizing recycling, maximizing the recovery of the use of water, and minimizing the waste.”

Although ZLD is required for Chinese industrial applications, it is an expensive process to maintain. As such, Bruch said MLD is gaining popularity elsewhere as it recovers 95 percent of water, but cuts expenses considerably.

MLD trends have also led to more adoption of UF to pretreat water before it goes through an RO system, Bruch said, but the biggest drivers for UF are seen in the municipal market. New UF technologies, he said, improve total dissolved solids and salinity levels for drinking water.