The talk continues to be about the skilled labor shortage in the road and bridge construction market. The fear of steel prices crippling productivity is only creating a slight pause, and after checking the damage it is business as usual.

Of course, throwing additional weight on the labor shortage is the fact that business continues to be good; work is flowing in most states. In the latest Roads & Bridges State of the Industry survey, 38 percent said business in 2018 was “very good,” and another 33 percent say it is “good.” It looks even better in 2019, as 47 percent expect a “very good” campaign and 28 percent predicting it to be “good.” The American Road and Transportation Builders Association forecasted almost $193 billion in road and bridge construction activity in 2018, and is predicting a slight bump in 2019 to $199.2 billion.

“I would say business is good, but it’s not booming,” Brian Deery from the Associated General Contractors of America, says. “I think it is a relatively flat market, but having the FAST Act in place really means a lot in terms of states are putting out bigger projects, more long-term projects whereas when we start getting into the reauthorization cycle states really start cutting back and putting out a lot of paving and smaller projects.”

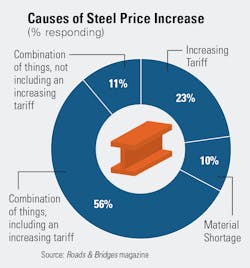

The reauthorization cycle is about to start again. FAST Act runs into 2020, a time when the Highway Trust Fund could be teetering on a dangerous cliff. President Trump campaigned on doing more for infrastructure, but a massive tax cut was the focus of the last year, and the cross hairs were turned on China behind a number of tariffs, one of them dealing with steel. On the national scale, the steel tax has ramped up production at steel mills, but U.S. producers have used the tariff as an opportunity to raise the price of the material. Almost 40 percent of respondents said the price of steel has gone up 6 percent to 10 percent in their area, and 56 percent said the reason behind the spike is a combination of things, including the steel tariff.

Deery said most of contractors had their prices in place before the steel tariff came into play, but there is some uncertainty heading into 2019.

“They are expecting prices to go up as we move forward,” he said.

Tariffs have certainly put pressure on steel prices, with more than three-fourth of respondents citing them, but they dismiss the long-term effect.

Max Kuney, president of Max J. Kuney Co., which specializes in bridge, highway, and transit work in the Pacific Northwest, acknowledged that accelerating inflation in construction is going to be an issue, among other things.

“We certainly saw some major labor increases in the latest round of union negotiators in Seattle,” he says. “The amount of money available for construction did not go up, so there is going to be some effect. There might be a project or two that falls out.”

The Puget Sound region is booming with construction, and the Max J. Kuney Co. is enjoying the ride. However, there is a shift in how the money is being spent on the roads and bridges side following an increase in the state gas tax in 2015. Kuney recalled attending an Associated General Contractors of America meeting two years ago where the Washington State Department of Transportation made a presentation. A couple of pie charts told the story—about 25 percent of new projects from the tax increase would go towards design-build projects, but 75 percent of the total funding would be poured into those types of jobs. Megaproject activity also is on the rise, and the focus of Max J. Kuney Co., a mid-sized regional contractor, has been on joint ventures.

Max J. Kuney recently completed a four-year job on I-5 that involved the construction of two bridges over the expressway in Tacoma, Wash.

“There were a lot of traffic phases, a lot of night work and it was challenging because there are frequent accidents there that have nothing to do with construction and the freeway is locked up for hours,” said Kuney.

Construction of the Pacific Avenue bridge was especially complex due to a steep slope, and Kuney had to order some additional parts for their bridge paver in order to get the legs of the machine adjusted at the right level and make sure it could keep a level pour while it was climbing.

Work is currently being done on a light rail project for Sound Transit that includes a 1,275-ft-long bridge over a wetland area. Installing the drilled shafts right up against the environmentally sensitive area has been a challenge.

“When you start doing that right next to a wetland area there are all kinds of opportunities for things to go wrong,” said Kuney.

Kuney took its work bridge sections used to cross rivers and stacked them three, four, and even five high to create a solid platform for equipment during drilled shaft activities for the light rail bridge. Precast girders are in place and in mid-November work was being done on the diaphragms.

The Missouri Department of Transportation (MoDOT) cannot get a handout from taxpayers. In November, a measure on the ballot that would increase taxes was soundly defeated. MoDOT has been trying to generate additional funding for decades now, with each effort failing.

Business has still been strong for Herzog Contracting, which specializes in asphalt paving and, on a national level, rail and transit construction.

“MoDOT has been spinning down some reserves to have a respectable program and to get matching federal funds, so it has been OK, but they were counting on the gas tax to pass and provide a little wiggle room,” Kyle Phillips, VP of civil construction, says.

Steady work also appears to be the theme for Herzog in 2019, even though the commercial paving market has dried up in recent years. At the very worst Phillips sees a flat year over the next 12 months. “We have some jobs on the books that are good jobs,” he said. That doesn’t include a couple of major highway construction jobs in Missouri and Kansas that Herzog was bidding on in mid-November.

Herzog was wrapping up a $5 million job on I-35 in Harrison County, Mo., that involved an overlay and the replacement of rumble strips. According to Phillips, rumble strips have been deteriorating rapidly in northwest Missouri, and the job involved milling out the old strips and fixing them prior to laying down an overlay.

Earlier in the construction season work also was done on State Highway 36 close to Cameron, Mo. There crews executed a curve realignment and placed asphalt on 14 miles worth of a four-lane divided highway.

Steel prices do not come into play for Herzog, but a recent drop in crude oil may relax the price of liquid asphalt for the contractor. The cost of aggregates is on the rise.

Since he was elected, President Trump has been talking about a $1.5 trillion infrastructure bill that would include funding for roads and bridges. However, tax cuts came first and there simply was not enough time to pass anything more leading up to the mid-term elections. The Trump administration has indicated that the infrastructure bill is again top of mind, but the Republican party lost control of the House of Representatives. With the Democrats calling the shots, the focus could now turn to impeaching the president rather than helping the economy. Some also are skeptical that the Dems would be interested in handing President Trump a major victory like the passage of one of the largest infrastructure bills in history.

“Can they work in a bipartisan manner to fund it? I think they can write a highway bill today that everyone would love, but how do you pay for it? That is going to be the challenge,” said Kuney.

States, however, continue to make gains on the funding gap. On Nov. 6, voters in 31 states approved 79 percent of 346 state and local transportation ballot measures. The one everyone was watching was Proposition 6 in California. If approved, Caltrans would lose $5 billion in transportation funding annually. That measure was defeated by a 55 percent-45 percent count. Colorado, however, suffered a setback, as two measures to increase road, bridge and transit investment were soundly defeated. Proposition 109, a measure to provide one-time funding with a $3.5 billion bond, was rejected, as was Proposition 110, which would have increased the state sales tax by 0.62 percent for 20 years and provided an initial jumpstart with a $6 billion bond. The Colorado Department of Transportation estimates it is facing a $25 billion transportation funding gap over the next 25 years.