When you are falling off a cliff, it is always good to have a parachute. It’s the people jumping on that you have to worry about.

More 2013 Annual Report & Forecast

Construction outlook

Construction equipment fleets

Water infrastructure

Home building

Remodeling

Nonresidential

As Congress debated on whether or not it should stick a bungee chord on a U.S. economy that was headed straight for a vertical drop, many in the road and bridge industry were not dangling in a state of panic. The sequester, which allowed federal program cuts to kick in on January 1 if nothing was done by those in power in Washington, would create about an 8-percent cut in transportation funding, but the blow would not be felt until 2014. However, other sectors of construction would not be as fortunate and may just attempt to do business in the road and bridge market, where competition for jobs is at an all-time high, in an act of desperation.

“The sequester, while it might not have a direct impact [on the highway industry], I think that the impact on other construction markets would certainly migrate over to the highway market,” says Brian Deery, senior director, Highway & Transportation, at the Associated General Contractors of America (AGC). “You are talking about more contractors coming over with lower bid prices.”

Since MAP-21, passed back in September, is tied to the transfer of general fund money, program cuts would cause a slight stir, but there still is money in the Highway Trust Fund to allow the industry to cope during 2013.

Congress could work out a much bigger deal before mid-2013, and this so-called “grand bargain” is being used as a grand entrance by highway lobbyists to push for an increase of the federal gas tax one last time. The last two times the fee was increased was during deficit-reduction negotiations.

Contractors, engineers and owners probably will not want to rewind 2013. Most industry experts are predicting a flat or slightly down road and bridge market.

“I think flat is about the best we could hope for on a national level,” says Ken Simonson, AGC chief economist.

According to a recent survey by the American Road & Transportation Builders Association (ARTBA), 57 percent of transportation contractors are expecting sluggish growth in the market, while the rest are “pretty much expecting a recession,” says Alison Premo Black, ARTBA’s chief economist. “We are not looking at a growth scenario.”

Rise in bridge work

Still, a different viewpoint does tell another story. According to Premo Black, the bridge design and construction market is operating at an all-time high in terms of activity. ARTBA is expecting that sector of the industry to produce more than $28 billion of work in 2013, up from $26.6 billion in 2011. In 2002, bridge construction was valued at just $12.5 billion.

Pavement work is where many could see, and feel, a dip. Road building was up just $500 million in 2012 ($47.5 billion total) from 2011 ($47 billion), and Premo Black is not expecting an uptick in activity moving forward. Usually when Congress passes a major transportation bill there is a surge in growth, but MAP-21 lacks the strength exerted by six-year measures. ARTBA is seeing a 10-percent decline in highway contract awards over the past 12 months, and 48 percent of survey respondents indicated they are working at below 75 percent capacity. As a result, the labor force continues to deteriorate. The ARTBA survey revealed 47 percent of respondents recorded declining employment levels in the third quarter 2012 compared to third quarter 2011.

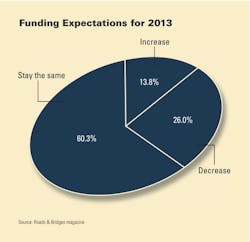

Despite the grim outlook, companies in the transportation sector are, for the most part, holding down the fort. According to Roads & Bridges’ State of the Industry Survey, 39 percent rated 2012 as a good year compared to 10.4 percent that experienced a poor one, and 47.5 percent of respondents expect revenue to at least stay the same this year compared to 2012.

Shrinking state DOT budgets are beginning to take their toll, though. When asked about the current economic conditions, in terms of money generated for road and bridge construction, in their state, 47.4 percent rated it fair and another 27.3 percent indicated it was poor. Just over 25 percent rated the situation better than average.

Rural and urban roads continue to suffer, with more than half of all respondents in both categories ranking conditions fair. In addition, many states have been slow to upgrade their bridge network. Some 54.9 percent said their structurally deficient bridge list went unchanged in 2012, and 57.8 percent said nothing was done to shorten the functionally obsolete bridge list in their state.

Overall, just fewer than 47 percent of respondents said their state did not have enough funds to adequately maintain the current system. However, more DOTs are becoming thriftier, as 45.8 percent revealed that more recycling (both asphalt and concrete) would be done in 2013.

Material prices appear to be tamer these days, and little will change in 2013. Simonson said diesel fuel prices will continue to be volatile, but the cost of steel, asphalt and cement is not expected to spike over the next 12 months.

Equipment sales in 2013 are expected to drop, but more contractors will rent or lease until conditions improve.