Equipment managers have more viable acquisition strategies available to them. It is no longer as simple as buying a machine and adding it to the fleet. Now, managers have stronger incentives than in the past to consider leasing and even renting equipment in an effort to maintain costs in a market that remains sluggish in many areas.

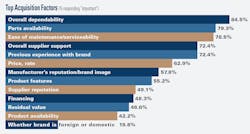

Above: Respondents labeled several factors as “important” when it comes to acquiring equipment, with overall dependability garnering the most, at 85 percent. Service-related factors were next in importance, with parts availability (79 percent), serviceability (79 percent), and overall supplier support (72 percent) ranking highly. Residual value is considered “important” by almost half of respondents.

The high cost of Tier 4 equipment combined with the lack of sustainable backlogs of construction projects have forced careful evaluation of whether to rent, lease, or buy equipment. A focus from top management on the financial aspects of fleet, notably residual values and cost of ownership, now means equipment managers run more analysis before acquiring machines.

Construction Equipment set out to determine how managers approach fleet acquisition in today’s environment of higher new-machine acquisition costs, tepid infrastructure spending, and the move toward managing iron as capital assets.

We invited our subscribers to participate in an online survey to determine current thinking on acquisition strategies, garnering 132 responses. Click below for insight into how certain machine types are acquired and why.