Uncomplicate Labor Costing

Complicated software problems often occur where workflows require one system to “talk” to another so that they can exchange data or perform different parts of the same workflow.

Most of us have been challenged by the interface between our maintenance management software (MMS) and our enterprise resource planning software (ERP). To be specific, many of us have wondered exactly how our work-order system interfaces with the formal and fully compliant payroll system within the ERP.

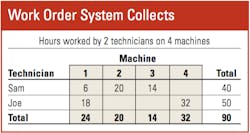

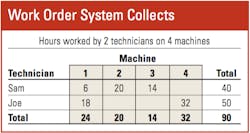

Let’s see if we can shed some light on how it all works. We will keep things simple and assume that we have a company that has four machines (numbered 1 through 4) and two technicians: Sam and Joe. You will most certainly have more, but the principles remain the same.

Let’s assume that you have a work order system that, among other things, records the number of hours worked by each technician on each machine. The first table shows the data collected for a given week in our imaginary organization.

We see that Sam worked a regular 40-hour week while Joe worked 40 hours plus 10 hours of overtime. Six of these were on Saturday and four on Sunday. We see that they spent time on all four machines for a total of 24, 20, 14, and 32 hours, respectively.

Although this is simple and straightforward, it does not end there. Data recorded at a unit level in the MMS must be transferred to the payroll system in the ERP to be processed in compliance with all the current rules and regulations regarding prevailing wages, overtime, social security, unemployment taxes, worker’s compensation, public liability insurance, and fringe benefits.

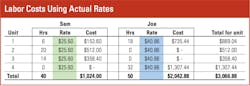

Payroll calculations are not simple, so we need to make some assumptions to keep our example reasonably straightforward. Let’s assume that Sam has a base pay of $20 per hour and Joe has a base pay of $28 per hour. Let’s assume that Saturday overtime is time and a half and that Sunday overtime is double time. Let’s assume that taxes, insurance, and fringe benefits come to 28 percent of base pay.

The second table shows the weekly payroll calculation for Sam and Joe based on these assumptions. We see that our two technicians cost us $3,066.88 for the week at an average hourly rate of $34.08 ($3,066.88 divided by 90 work hours). Sam’s hourly rate for the week came to $25.60, and Joe’s rate came to $40.86.

We now need to work out the cost of technician labor for each of the four machines. Two methodologies are in fairly common use.

The first methodology uses the actual weekly rate of the actual technician that worked on the machine and applies this to the hours worked by the technician on the machine for the week. This is normally done in the work-order system with the rates being transferred from payroll to the work-order costing system in order to calculate work-order labor costs for each unit in the fleet. A sample calculation is shown in the third table, where we see the hours worked by Sam and Joe on each machine multiplied by their actual rates for the week: $25.60 and $40.86, respectively.

This is certainly an accurate way of allocating technician costs to the units, but the question can be asked: Why should Unit 4 be unduly burdened by the fact that Joe has a higher rate and worked a lot of overtime? This is not an unreasonable question, and the process can introduce fluctuations on unit costs based solely on individual technicians’ rates and overtime. Also, and very importantly in many cases, this approach causes individual technician’s labor rates to become known to anyone working in the work-order system.

A variation of this methodology seeks to solve these problems by using the average rate for technician labor for the week and applying this to the hours worked by technicians on machines during the week. This answers a lot of concerns regarding fluctuations that occur with different technicians and different amounts of overtime, and it causes individual pay rates to remain confidential. It does, however, still mean that you cannot calculate labor costs on work orders until you have transferred hours to the payroll system and transferred the actual average rate for the week back from payroll.

The second methodology solves the complexity of these workflows by estimating a standard hourly rate for all technicians and using this to calculate work order labor costs within the MMS. Nothing is passed to and from the ERP or payroll system except the hours data needed to perform a formal and fully compliant payroll calculation. If we assume that our example company has calculated a standard shop rate of $36 per hour for Sam and Joe, then the calculation is shown in the fourth table.

The use of an estimated standard rate will, of course, introduce inaccuracies, but these are not seen as material when it comes to determining work-order labor costs and other operational statistics used in fleet decision making. The difference between the actual cost of $3,066.88 in third table and the standard cost of $3,240.00 in the fourth can be “trued up” in a separate calculation, but this reintroduces a complexity to the workflow that many companies see as unnecessary.

The secret to success in standard costing does, of course, depend on the accuracy of the estimated standard cost. This is not a complex calculation, and the accuracy is relatively easily monitored in a technician labor variance account which compares the actual costs experienced for technician labor ($3,066.88) with the costs recovered at the standard rate ($3,240.00).

The process is complex, yet, as with many things, we are caught in a box defined by complexity, simplicity, precision, and accuracy. Work order costs calculated in the MMS are not the final word. They provide good information and operational statistics that that help us run our fleets. Payroll costs calculated in the ERP are the final auditable and reportable word. Precision is more important than material accuracy.

Understand what is going on, know what you want, and make reasonable decisions that simplify workflows as much as possible. Make sure you have the information you need for good, well considered management decisions. Don’t add complexity for unnecessary precision.

For more on asset management, visit the Construction Equipment Executive Institute.