The DNA of Equipment Costs

Balancing an equipment account and taking the right action when things go wrong is extremely complex. It takes a deep understanding of costs and the costing process to pinpoint problems and take appropriate action.

Three things are absolutely essential for effective equipment cost management. Let’s go through them in detail.

1) Clearly split equipment costs into owning cost and operating cost. Understand the differences in their DNA.

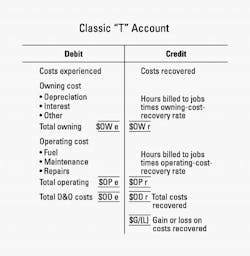

Everyone uses slightly different language for equipment cost and revenue. We will use the language in the diagram above, which shows a stylized version of a classic “T” account for a particular unit in the fleet. Equipment costs experienced owning the unit and putting it to work are listed as debits on the left side of the account. These include the actual cost of labor, parts and materials recorded and coded to the unit through the payroll, accounts payable and work order systems, as well as the depreciation charges levied against the machine through the asset register system.

The right-hand side of the “T” account shows the credits, or revenue, earned by the machine. We assume that it is a company-owned machine working on company jobs and that credits accrue in the form of cost recoveries arising from the machine being billed to company jobs. The difference between debits and credits posted to the “T” account gives the gain or loss on costs recovered (costs experienced minus costs recovered) for the machine.

Effective equipment management and costing absolutely requires that the costs experienced by a unit be recorded, coded and totaled into at least two principal cost types—owning and operating cost. These two cost types have different characteristics, they behave differently, and they require different management skills. Their DNA is different. Knowing how much is spent in each principal cost type and knowing the differences in their DNA helps to manage costs and take the right action when there are problems with either over-expenditure or under-recovery.

The table below gives a brief but workable definition of owning and operating cost and lists the three top characteristics of their DNA. It is clear how they differ and how much can be achieved by managing each with the skill, care and attention it deserves.

2) Clearly split costs recovered into owning-cost and operating-cost recoveries. Know which side of the house has problems.

Splitting costs experienced into total owning cost ($OW e) and total operating cost ($OP e) as shown in the diagram is an important first step in the cost-management process. The second step requires that the costs recovered by charging jobs an hourly, weekly or monthly cost-recovery rate for the equipment are clearly split into two cost-recovery streams—one designed to recover and account for the lifecycle owning cost of the machine ($OW r), and the other designed to recover the life cycle operating cost of the machine ($OP r).

This requires that the total owning-and-operating-cost-recovery rate be split into two clear sub-rates and that each sub-rate is multiplied by the hours billed to the job. Many companies use 40 hours per week regardless of utilization as a measure for the ownership hours billed a job and use actual hours worked as a measure for operating hours billed to the job. Regardless, the two cost-recovery streams must be independently calculated and credited to the machine’s “T” account.

This makes it possible to calculate the difference between owning cost experienced and owning cost recovered ($OW e - $OW r) as well as the difference between operating cost experienced and operating cost recovered ($OP e - $OP r). This information is essential to the critical process of determining whether problems in the equipment account lie in the owning or the operating side of the house.

This information, together with a knowledge of the differences in the DNA of owning and operating costs, makes it possible to act appropriately with focused corrective action.

3) Use your knowledge of the DNA of owning and operating costs to take the right action at the right time.

Differences between costs experienced and costs recovered on the owning side of the equipment account are most likely to be under-recoveries arising from lower than expected utilization. Owning costs are largely fixed, and there is little risk associated with variations in the costs you will experience from month to month. The major risk is in the deployment or use of the equipment and in the hours, weeks or months billed to jobs. Appropriate action must thus focus on utilization and the steps that can be taken to ensure that the fleet is deployed and working to the maximum extent possible.

Differences between costs experienced and costs recovered on the operating side of the equipment account are completely different. They are caused by an increase in either the cost or the consumption rate of the resources required to put the machine to work and keep it working. Appropriate action must thus focus on buying better, reducing waste, improving maintenance, developing operator skills, and balancing fleet average age.

Inappropriate action results if costs experienced and costs recovered are not clearly split between the owning and operating sides of the equipment account, and if there is little understanding of how the DNA in these two cost types helps to lead you toward a solution. Instead, you solve the problem you believe to be the problem and not the problem that is the problem. You cut maintenance costs because it is easy to do. You do not have the information needed to know the problem is on the owning side, so you do nothing to fix the fact that the fleet is underutilized and unable to recover its fixed costs.

Implement or perfect these three steps to help you unscramble your equipment account and determine what is needed to stay on track.

Cost DNA |

||

|

Owning cost |

Operating cost | |

| The cost of acquiring a machine, bringing it into your fleet and keeping it there. | The cost of turning the key, putting the machine to work and keeping it working. | |

| Three top characteristics of owning cost DNA |

Three top characteristics of operating cost DNA |

|

| 1. They are largely fixed when you ink the deal. There is not a lot you can do to change the cost of acquiring a machine and bringing it onto your fleet once the selection and acquisition decisions have been taken and commitments made. |

1. They are highly variable and depend on the application, operation and age of the machine. There is a lot that can be done to manage operating costs through improved maintenance, improved operator skills correct application and timely replacement. |

|

| 2. Most owning costs accrue on an annual or monthly basis and are proportional to the age of the machine in years. | 2. Most operating costs accrue on an hourly basis and are proportional to the number of hours worked by the machine. | |

| 3. They have to do with depreciation, finance and the cost of capital and are the province of specialists in acquisition, finance and financial management. | 3. Operating costs have to do with oil and grease, parts and labor. They require good day to day decisions and are the province of operating managers who work with the fleet, in the field each and every day | |