Time to rethink the equipment rate calculation

The rate calculation has not changed much over the years. I remember the days when we estimated the cost of gasoline for the pony engine to the penny and used the crazy assumption that “repairs, including labor” for a track type tractor came to 100 percent of “the depreciation charge.”

The world has changed. We no longer have pony engines, and we have both the data and the analytics needed to estimate the cost of “repairs, including labor” with reasonable confidence.

Want to learn more about asset management? We have it here.

Yet we still format the rate calculation in the same way. You estimate an ownership period and a utilization, determine the cost per hour for all the owning and operating cost categories, add them together, and believe that there is one number—expressed in $ per hour—that reasonably represents the likely cost of owning and operating the machine.

Current trends in machine acquisition and finance have led to a situation where a substantial portion of most fleets is acquired by entering into fixed finance, lease, loan, or rental with option to purchase agreements (RPOs). This means that most owning costs are fixed time certain payment commitments. Loan, lease, and rental payments do not go away when the machine is not utilized and utilization—expressed in hours worked per month—is the single highest risk in the rate and the rate calculation.

The conventional hourly owning and operating cost calculation determines an hourly owning cost based on the estimated ownership period and annual utilization. This disguises the fact that owning costs are largely fixed and that expressing them as a rate per hour is extremely risky. Few people realize that the hourly owning rate is only valid if and when the estimated ownership period and annual utilization are realized, and even fewer realize how sensitive the rate calculation is to the assumed utilization.

A machine’s owning costs are typically monthly costs. Lease payments, for example, licenses and insurance, and other costs of ownership are fixed, and they are charged on a monthly basis. For illustrative purposes, assume $9,660 per month.

The associated operating costs, however, remain as hourly charges. Fuel, maintenance, repair parts and labor, and wear parts are all charged based on utilization, which is measured by the hour. For this illustration, assume $99 per hour for operating costs.

Are operating costs monthly or hourly?

In this way of thinking, owning costs are clearly monthly costs, which dispels the myth that owning costs are variable costs able to be expressed in dollars per hour. The definition of the rate as $9,660 per month plus $99 per hour makes it possible to do the rate calculation for a range of values for utilization (hours per month) and expressly show the relationship between utilization and cost.

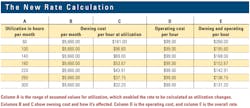

This is done in the table below, where column A gives a range of assumed values for utilization expressed in hours per month. Columns B and C give the owning cost expressed in dollars per month and dollars per hour. Column D gives the operating cost per hour and column E is the total of columns C and D.

Note that owning cost per hour goes down as the $9,660 monthly cost is spread over an increasing number of hours worked. This causes owning and operating cost per hour to go down as utilization increases and confirms that a given hourly rate per hour is unique to a given utilization assumption.

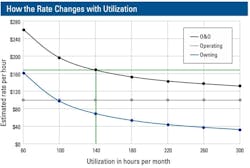

Columns C, D, and E are plotted on the nearby graph. The green lines show that a quoted rate of $168 per hour carries with it the implicit assumption that the machine will work and recover the fixed costs of ownership for 140 hours per month.

The graph also shows that the hourly rate is sensitive to utilization. If the machine is only used for 5 hours per day (110 hours per month), then the rate has to be set as high as $186 per hour. If it will be used 10 hours per day (220 hours per month), then the rate can be set as low as $143 per hour.

The increased use of outside finance (loans, leases, and RPOs) and the fixed time-certain payments associated with these agreements have significantly increased the risk of fixed-cost recovery. The classic rate calculation disguises this risk by building in an estimated value for utilization at the beginning of the calculation and by creating the illusion that you can express owning and operating costs as a single rate per hour. This illusion lies at the heart of many of the budgeting and cost recovery problems so frequently encountered.

A fixed cost is a fixed cost, and a fixed time-certain financial commitment cannot be denied. Fixed-cost recovery risk is therefore real, and procedures must be in place to ensure that the problems associated with lack of utilization are measured, quantified, and managed by those able to reduce the risk to an absolute minimum.

The process starts by understanding that the rate for a given machine is not defined by a single number. The estimated rate for the example machine is not $168 per hour: It is $9,660 per month to own plus $99 per hour to operate.

Three changes in equipment costing

Three changes in equipment management result from this new way of thinking about costs.

- Understand the difference between the fixed costs of bringing a machine into your fleet and keeping it there, and the variable costs of turning the key and putting it to work.

- Express the rate in two portions: one to cover the fixed costs of ownership and one to cover the variable operating costs.

- Leave the high-risk utilization calculation to the end of the calculation, and make an explicit statement about the relationship between utilization and cost.

About the Author

Mike Vorster

Mike Vorster is the David H. Burrows Professor Emeritus of Construction Engineering at Virginia Tech and is the author of “Construction Equipment Economics,” a handbook on the management of construction equipment fleets. Mike serves as a consultant in the area of fleet management and organizational development, and his column has been recognized for editorial excellence by the American Society of Business Publication Editors.

Read Mike’s asset management articles.