The equipment rate—the estimated cost to own and operate a given machine for a given period of time—is not a simple number. It is a complex, high-risk estimate that plays a major role in many aspects of the business.

There are three things to understand about equipment rate: the risks involved in the rate calculation, the role that the rate plays in a construction company, and what can be done to improve performance.

Let’s say you are going to undertake a journey—from Anchorage to Miami—and someone asks you to estimate your average speed for the whole journey. It will not be easy to do, and the chances of doing it right are pretty low due to the uncertainties and unknowns inherent in a long and complex journey. There will be good days and bad days. There will be straight roads and twisty roads, and you will stop to enjoy the scenery and rest a while. Estimating the average speed for a journey of this nature is a high-risk and difficult thing to do.

Click here for more asset management.

It is much the same with your equipment rate. You buy the machine and embark on a journey of almost infinite variability and uncertainty. And yet, you have to estimate what it is going to cost you in dollars per hour, day, or month to arrive in Miami, on time and on budget.

Many factors impact the rate. Some, such as purchase price and residual value, impact owning costs; others, such as parts, consumables, and labor, impact the operating costs. More importantly, operation and application bring great uncertainty. The skill and ability of the hand that turns the key and the hand that turns the wrench are also critical factors.

Do not be overconfident in your ability to estimate an owning-and-operating-cost rate with confidence and certainty. It is a long and complex journey with just too many variables. The size of your fleet and the number of machines included in a given rate group helps a lot. The more machines, the more likely a balance can be struck between winners and losers. Knowledge, experience, and good data are, of course, invaluable.

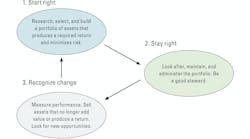

The impact of the rate as a high-risk number is made all the worse by the fact that it plays a critical role in many aspects of the business. Let’s look at the diagram to see how it works.

The lower left-hand block represents the estimating process. The vast majority of companies estimate the equipment cost in a bid by estimating how much equipment time is required to complete the work and then multiplying this number by the estimated rate. Equipment cost is thus an estimated quantity times an estimated rate.

Compare this with determining the estimated cost of concrete where the quantity of concrete required can be calculated with a fair degree of accuracy and where the unit cost of the concrete is most likely fixed by agreement with a supplier. With equipment, the “quantity” of equipment required is a function of the flow and sequence of the work and the productivity of the crews. Thus the equipment rate becomes “an estimate within the estimate.”

The upper left block is where you build the work and where you find out how much equipment was actually used to do the job. The cost of equipment to the job is a product of the actual quantity of equipment used (utilization) and the set hourly, daily, or monthly rate. Everything possible must be done to ensure that the equipment rates used in the estimate (how you put the equipment costs into the estimate) are the same as the equipment rates used in the job-costing system (how you take the equipment costs out of the job). This means that any equipment job-cost variance (the difference between budget and actual) is a function of operational performance and not of a change in the equipment unit rates.

The middle lower block shows how the internal equipment charging process causes the actual equipment charges levied against the job to turn around and become the budget against which to manage the actual cost of the equipment used on the job. Again, it is complex. The jobs are charged and the equipment account is credited with utilization times an estimated rate calculated for the full lifecycle of the machine; the equipment account is debited on a daily basis with the actual owning and operating costs of the equipment. Owning costs—depreciation and finance charges, licenses, insurance, and property taxes—occur on an annual basis, and many large operating costs come in spurts when undercarriages are replaced or engines are rebuilt. The way the budget flows into the equipment account—rate time hours worked—is starkly different from the way the actual costs are experienced. Again we see that the rate must be set so as to average things out throughout the lifecycle, much like the average speed on the journey from Anchorage to Miami.

A relatively large fleet or rate group with a well-managed average age will be easier to manage than a small rate group or a rate group with predominantly old or young machines. Regardless, the rate and the rate calculation assume that all things are equal and that all expenditures are spread evenly over the full lifecycle of the machine. We absolutely know this is not the case.

Our diagram clearly shows three principal functions for the rate. First, it is used in the estimating process where it is an estimate within the calculation used to estimate the equipment cost for the job. Second, it is used in the job-costing process where it determines the job-level actual cost of the equipment used to build the work. Third, it is used to establish a budget against which to measure and manage the actual owning and operating costs of a given rate class of equipment. It is clearly an important number. There are five things that will improve performance.

- Recognize and accept that the rate is an estimate. It is a single number used on an ongoing basis in many places to represent or average out a vast array of transactions that occur at various points throughout the lifecycle of a machine. Some of these transactions will be big, some will be small. Some will occur on an annual basis, and some will be directly proportional to the hours worked. Representing them with one hourly, daily, or monthly number is more art than science.

- Recognize that the use of the rate in calculating job-cost variances and equipment-cost variances affects only intra-organization measures of performance. The only critical use of the rate is in estimating, where it influences the contract value of the work to be built. Recognize the risks involved, provide sufficient contingency, and mark up to cover them. Do not, however, pad budgets and lower expectations.

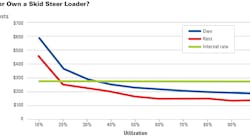

- Be reasonable and realistic when setting the two most important numbers in the rate calculation: expected life and annual utilization. If expected life is too long, you will lower the depreciation portion of the rate but you will most certainly increase the repair, parts, and labor portion of the rate. If annual utilization is unrealistically high, you will lower the rate but constantly under-recover the fixed cost of ownership.

- Understand the difference between owning and operating costs and estimate an owning rate and an operating rate as two different and distinct portions of the total rate. Owning costs are largely fixed when you ink the deal, and the major uncertainty lies in your estimated annual utilization. With operating costs, your major risks are application and operation. Use your data; they reflect your conditions. Focus on the skill of the hand that turns the key and the hand that turns the wrench.

- Know the components of the total rate and use these subrates and your cost-coding system to generate budgets, actuals, and variances by principal cost type such as depreciation, repair parts and labor, wear parts, and fuel. Review, calibrate, and adjust your rates on a regular basis using your knowledge of which principal cost type is gaining or losing. Do not let gains in one cost type subsidize losses in another. Know where the gains and losses lie, take action, and adjust the appropriate subrate if you must.

The rate is not just a simple number. It is the lifeblood of your equipment estimating, job costing, and cost-management systems. Treat it as such.