The telehandler market looks strong for 2018, and manufacturers are ready, increasing choices for equipment managers, particularly in the compact size class, and doubling down on ease-of-use and ease-of-maintenance features.

“The telehandler market is rebounding nicely from a 2016 drop,” says Bob Mayo, product manager for Pettibone. “We saw the 2017 market levels back to where they were in 2015. The upcoming year looks strong with an economy that looks promising. Trending numbers from market data point out these improvements, as well as customers approaching us to increase their rental fleet counts and retiring old, tired product to replace it with new.”

Other OEMs have noticed fleets being refreshed, as well.

Josh Taylor, Genie product manager, Terex AWP, says the up market is due to a combination of factors. “Refleeting is one component of this growth,” Taylor says. “It appears that some fleet replacement was thrown off its normal cycle by the 2018 downturn, and again by the 2015 headwinds in the oil and gas industry. As 2017 and 2018 have seen positive growth in the construction and oil and gas segments, the demand for telehandlers has once again become very strong.”

Smaller telehandlers are also fueling the trend, so compact machines have received emphasis from OEMs. “We anticipate the market to remain at healthy levels in 2018,” says John Boehme, senior product manager for telehandlers at JLG. “Machines with capacities from 6,000 pounds to 12,000 pounds continue to be the backbone of the telehandler market; however, popularity of super compact and higher-capacity telehandlers continues to grow.”

Braden Spence, product manager for Skyjack, agrees. “Some classes performed better than others, and the upward movement of the compact classes is notable,” Spence says. “In the short term, we see continued growth for compact telehandler classes in North America.” Skyjack has bet on that growth with its SJ519 TH introduced at The Rental Show this year. Xtreme and Snorkel are among the other telehandler makers that have also recently added compacts.

Whether it’s a compact telehandler or one in the 6,000- to 12,000-pound market wheelhouse, managers have multiple factors to consider in making the purchase.

There are the basics, such as capacity and lift height matching job requirements, but there’s also the reality that there are two different telehandler customers. “Choosing the right tool for the job, namely having the proper-size machine, is No. 1—for both rental and owned fleets,” Mayo says.

“While acquisition cost is important, quality and durability of the product also have a big impact,” says Mike Peterson, Caterpillar telehandler product application specialist. “Rental operations need to consider the risk for downtime and trade-outs when considering new units, which impact time and financial utilization.

“Quality, durability, and ease of maintenance are also key in an owned fleet,” Peterson says. “With the economy in growth mode, the telehandler must be dependable to meet project timelines. While a very low-cost acquisition might seem to look great initially, if it’s not dependable, it can lead to delays. Many rental locations are highly utilized, so even a short-term replacement may not be available if the owned unit experiences an interruption to service.”

Rebecca Yates, telehandler product manager for JCB, also sees different considerations for owners and renters.

“For an owned fleet, buyers should consider machine versatility and the potential to deploy a machine to multiple applications to derive greater value from a machine,” Yates says. “For example, JCB tool carrier telehandlers provide the added functionality of a bucket to dig or push, along with forks for material handling.

“Rental fleet buyers will likely prioritize simplicity of operation and maintenance, with the intent to minimize the effort required of their rental customers and ensure optimal machine availability,” she says.

This is why, Yates says, her company offers a range of telehandlers up to 10,000 pounds that require no DPF, DEF, or regeneration. And she adds a financial factor that’s common to both owners and renters.

“Machine owners and rental fleet buyers should also consider machine resale value, which ultimately drives down the total cost of ownership,” Yates says.

“For rental companies, the key is return on investment, and like any asset, if it’s not earning, it’s not doing its job,” Skyjack’s Spence says. “So reasonable initial acquisition cost and uptime are key factors to consider. The focus is also on reliability. Of course something can always go wrong and maintenance is always a factor—the rental telehandler has a hard life. Operators and working conditions are rarely kind to the machine, which translates into the need for a robust machine that can withstand such rigors.”

Genie’s Taylor points out specific features owners are drawn to.

“Fleet owners tend to invest more in operator comforts, such as enclosed cabs and air conditioning,” Taylor says. “Owners are also more likely to add visibility aids such as proximity alarms or backup cameras. All Genie telehandlers have an optional rear proximity alarm, and they can also be pre-wired for a proximity alarm if the owner wants to add one in the future.”

With the two different types of owners—rental operations and private fleets—does brand make a difference? Two OEMs who chose to answer Construction Equipment were split.

“We do not have evidence that there is a brand preference among renters,” Taylor says. “That said, we do everything possible when we design our machines to drive preference among our end users.”

Taylor offered two examples: The 74-horsepower engine offerings that require no DEF or regeneration, which is a favorite among rental centers and their customers who don’t want to be involved in maintenance; and the company’s multifunction joystick that allows operators to control all lifting functions simultaneously.

Ease of maintenance and ease of use are keys for many customers, but Manitou America’s Steve Kiskunas, product marketing manager, telescopic handlers, disagrees on brand proclivity. He notes a brand preference in the market.

“We do see some brand preference by renters; however, the most popular brands vary a great deal from one market area to the next,” Kiskunas says. “That variation leads us to believe the local dealer or rental company has a great effect on what brands are preferred based on their level of customer service and support.”

Pettibone’s Mayo stresses familiarity along with ease of use. “Operators gravitate toward products they become accustomed to,” he says. “We remedy this with a simple and intuitive design, allowing operators of any experience level to become proficient in a short time. [They want] machines that offer good visibility, a stable seat-of-the-pants feel, the capability of handling payloads in a precise and controlled manner, and also reliable machines that offer uptime and are easy to maintain.”

Managers can keep telehandler costs down by sticking to maintenance.

“The key to almost all equipment is ensuring the maintenance schedule is maintained,” Cat’s Peterson says. “It seems simple—that moving components need lubrication. It’s more challenging to ensure that equipment on the job site receives proper lubrication, as in quality to specification, quantity, and timeliness, when pressures to keep operating costs down weigh heavily.”

The consequences of not properly maintaining telehandlers should scare every manager. “The time it takes to perform the maintenance is minimal compared to the lost productivity of a machine being taken out of service because it wasn’t maintained properly,” Taylor says.

Proper use is important, as well.

“Telehandlers are often used incorrectly on the job site, in ways for which they were not designed,” Peterson says. “Misapplication can lead to both immediate and eventual product failures and repairs. For example, boom extension should not be used to push objects or ensile material, boom retraction should not be used as a winch, and a bucket is not a compaction device.”

Along those lines, JCB’s Yates reminds managers that making the right machine choice is important. “Choosing the right telehandler for anticipated tasks is important for optimal efficiency, productivity, and safety,” she says. “A conventional lift-and-place telehandler, for example, is well suited to fork work but is not designed for digging and pushing applications.”

Training is also critical, manufacturers say, to ensure operators are using the machine according to standards.

“A common error many telehandler operators make is not operating within the guidelines set out by safety standards related to the machine they’re operating on,” Spence says. “This misuse of the telehandler creates potential job site hazards, which could lead to personal injury or increased cost of operation. The remedy is simple: the correct training and monitoring of operator actions by supervisors.”

Safety has been enhanced by OEM-driven technological advances, and manufacturers are expecting even more telehandler innovation in the future.

“The market is seeing more devices added to assist operators in proper load handling and placement,” Mayo says. “[These are] devices such as payload weighing, self-recognized attachments, load moment indicators, electronic charts and manuals, and cameras. Keeping the equipment protected and operators safe will continue to be focused on in the future. We may even begin to see hybrid or fully electric drivetrains.”

Taylor says advancements will still have to be keyed to ownership costs.

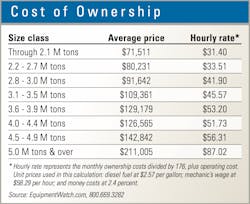

“Total cost of ownership is the main driver of value to customers, so our product development is always focused on this metric,” he says. “In the industry, finding ways to not only stay competitive on price but also provide lower maintenance requirements and increased productivity is paramount. Development according to these drivers can play out in a number of ways.

“One can expect that experimental powertrains that require less engine power will start to become more cost effective, and thus more prevalent,” Taylor says. “There are also regulatory drivers that can change the industry. For example, in Europe, a more complex load management system is required for telehandlers. This is not yet required in ANSI markets, but the technology is out there and manufacturers may adopt strategies to differentiate using parts or all of these technologies.”

Some of the future-sounding technology is available already. “Technologies that help provide operators with a greater level of confidence and awareness are being requested more frequently,” JLG’s Boehme says. “The 1644 and 1732 are available with optional SmartLoad Technology, a bundle of three integrated technologies that work together to deliver a greater level of operator confidence. The first component of the SmartLoad Technology bundle, attachment recognition, allows a telehandler to identify an attachment and display the appropriate load chart to the operator.

“The second, a load-management information system (LMIS), graphically depicts the location of the load within the load chart, provides the operator with an indication of compliance, and prevents the operator from violating boundaries of the chart,” Boehme says. “The third technology, a load-stability indicator, works in conjunction with the LMIS to limit operation when a load is nearing the maximum capacity indicated on the load chart.”