A Way Through the Complexity of Telematics

Modern fleets are a rich blend of telematics sources, both factory-installed and aftermarket, that produce an abundant amount of machine data. Equipment managers face numerous logins, interfaces, separate reports, and superfluous data. It’s hard to see ROI for the APIs.

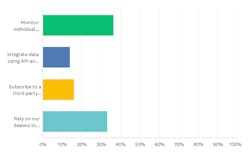

Even with the telematics standard developed by the Association of Equipment Management Professionals and the Association of Equipment Manufacturers 15 years ago, few fleets have the resources to fully integrate all the data coming in. In new research on telematics conducted by Construction Equipment, only 14 percent of respondents are using the telematics standard, ISO/TS 15143-3:2020, to monitor data in-house. Others monitor individual dashboards or rely on their dealers to monitor data.

One in three fleets still do not use telematics at all.

Another option to cost-effectively access fleet data is the use of third-party aftermarket telematics suppliers. These solutions replace layers of complexity with simpler technology that directs all the incoming equipment data into a single system designed to display relevant information via a single user interface. Third-party systems recognize the incoming data type and position it for easy access by various computing functions.

How telematics providers help fleets

Third-party systems enable mixed fleets—those with multiple brands—to integrate multiple sources of data. Dave Swan, SVP at Trackunit, says that all fleets are mixed when all the data-making devices are considered.

“The construction industry is a very interesting market for digitalization as there are so many specialized categories of machinery built for specific tasks,” says Swan. “For example, when we look at the data points from a scissor lift compared to those from an excavator, that data is largely dissimilar. However, the 19 data points [covered in the ISO standard] will be mainly what is common to both categories of machines and therefore useful to fleets and owners.”

A telematics system “conditions” data flowing from multiple digital sources, which eliminates the inconsistencies and harmonizes the data types and frequency, according to Swan. Fine tuning allows fleet managers to arrange the incoming data into workable solutions.

Telematics solutions also simplify data management by moving it from legacy hardware and networks to cloud-native systems.

Cloud-native technology means the entire telematic system’s configuration is built fully in the cloud. Functions including services (email), data integration, computing, and archiving all reside at one cloud address—not in the fleet owner’s computer. Tasks once handled by hardware or separate programming have been replaced with digital functions, which streamline processing and connectivity. Task-specific modules (apps) and background programming stay in the cloud until they are called up to work. Fleet managers no longer need to buy and maintain various software programs because the web-based versions are immediately accessible via the internet.

Where there once was dedicated and somewhat mysterious computing devices tended by an IT department nestled somewhere in the fleet owner’s facility, there is now an internet portal with a single sign in and immediate access to fleet data using almost any device: laptop, tablet, or smartphone. The on-premises products (and IT department) are gone.

With little tangible physical presence required, cloud-native systems are nimble and allow software and computing procedures to update with little fanfare or effort. The Software as Service (SaaS) computing model doesn’t store any programming on devices and mimics traditional desktop applications. The apps and services that reside in the cloud are portable and connectable over the internet. Features such as unified mapping, pre-formatted report queries, and maintenance management come in lightweight prepackaged modules that can be clicked into the systems with little effort.

Work projects produced using the cloud SaaS protocol can be saved online, archived on an in-house computer or network, and easily shared. Frequently, access to SaaS is by subscription that includes product updates, patches, and pre-formatted modules that welcome customization.

Cloud-native systems also function smoothly with industry-specific APIs that “borrow” data and functionality from other applications without digging into underlying code. This agility is important for making sense of multiple data streams.

Scalability is central to how Omnitracs reduces complexity.

“Omnitracs solutions allow fleet managers to control what and how much data they deem necessary to their operation,” says Richard Pearlman, VP of business development for Omnitracs / Solera. “Small- and medium-sized contractors want to stay on top of what data is reported but tell us they don’t have the time or desire to sit in front of a computer all day. The ability to filter in and filter out data lets contractors parcel together workable amounts of information and keep things concise. They want to produce condensed reports for communication with field managers.”

Scalable systems also give seasonal contractors the option to scale back their data use during off season without losing all their data and computing capabilities. This option works well for smaller fleets who want to leverage their telematics capabilities and manage technology costs paying only for services they use.

Pearlman says matching the system’s capabilities with the manager’s needs simplifies use. “If you can use Google maps, you can use us.”

Less complexity also results from simplifying bells and whistles. Tony Nicoletti, VP of sales and business development with DPL Telematics, says fleet managers shopping for a third-party program frequently tell him they want to use all their data. “All of it? Are you sure?” Nicoletti says he asks them.

“They don’t realize the sheer volume of data their fleet will produce,” he says. “They’re going to be swimming in it, picking through it all looking for the one or two things they’re actually interested in.”

Instead, Nicoletti suggests that fleet managers start with single questions or situations such as “Where’s my stuff?” and build confidence using the system to find that answer.

“Work from the issue back to the data,” he says. “Start simple with location data, add in runtime data, then pull the more complex CAN bus data such as fuel, temps, pressures, fault codes, and engine-direct data.

“DPL telematic hardware and system software is designed specifically for the construction industry,” Nicoletti says. “We understand that not all assets are created equal, and what worked on a truck yesterday might not work on a loader today.” DPL pairs the appropriate products to the fleet’s assets, he says.

Third-party vendors of all designations are encouraging their customers to plan for the future.

“Contractors now expect to have telematic systems with their new equipment delivery, as opposed to just a few years ago when telematics was considered an option,” says Oded Ran, co-founder of Clue Insights. “Today, telematics are a standard utility.”

Ran sees bringing AI into telematics configurations as an excellent way to add predictive maintenance scheduling to a fleet’s management. Ran says that too much of telematics use is based on past events—what has already happened. With the addition of AI capabilities to enhance telematic functionality, fleet managers can set actionable parameters that give the machine permission to take action when faced with recognizable data.

“Contractors will be able to train their telematic system to automatically respond to a vehicle’s data,” Ran says. For example, if AI recognizes a pattern of operations data that has led to repairs previously or in other machines in his fleet, the system can proactively alert the operator that he needs to adjust his operation.

Ran sees new data points emerging that will satisfy legislative or policy requirements such as measuring real-time carbon emissions to report CO2 offsets and tracking battery health in EV machines.

As data analysis sharing improves, historical data trends based on a manufacturer or dealer’s much larger equipment databases will allow equipment managers to predict problems or repairs by comparing specific models operating in similar conditions.