“Techonology Monitor” from research firm MacKay and Company is gauging what fleets are “considering, evaluating, planning, and purchasing” related to new technologies for on-highway assets.

For the sake of the study, alternative power is defined as CNG, LNG, electric, and hydrogen.

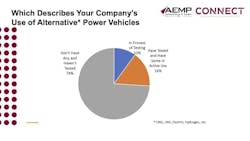

How many fleets have alternative vehicles?

Seventy-four percent don’t have any alternative vehicles and haven’t tested any. Sixteen percent have tested and have some vehicles in active use; 10 percent are in the process of testing.

“Grants and incentives play a big role in whether or not those fleets with alternative-powered vehicles were likely to purchase them,” says John Blodgett, VP of MacKay and Company. “88% of those with these vehicles said it was not likely they’d have purchased them without the financial help.”

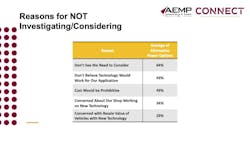

Reasons fleets are not investigating and considering include not seeing the need, mismatched applications, up-front costs, maintenance considerations, and resale value, a big mystery for every manager this early in the process.

Why consider alternative power?

The primary reasons MacKay uncovered for managers investigating alternative power vary. Some 51% want to compare its TCO to diesel. Thirty-nine percent cite intellectual curiosity and 33% consider it their responsibility to explore new technology. Bringing up the rear are “directed by company management” and “customers are pushing us to explore,” at 24% and 23%, respectively.

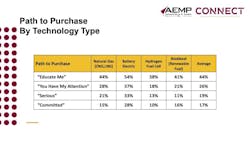

“Many fleets have are in the ‘Educate me’ phase,” Blodgett says. “This includes reading articles on the technology, attending meetings about it, and discussing its use in the fleet with manufacturers or dealers.”

Others have researched eventual technician needs for working with the technology and have spoken with peers at other companies.

Blodgett also outlined a “You Have My Attention” phase. This is where fleets research the impact on shops, define anticipated costs to make the shop safe for the technology, meet with energy providers to determine infrastructure needed, and complete a TCO analysis versus current diesel-powered units.

Oh, and they’ve also taken test drives.

Fleets at the “Serious” level have had one or more demo units to test and have researched grants, incentives for purchase of a vehicle and charging/dispensing equipment.

The “Committed” phase is proposing a purchase to management, receiving RFPs, ordering support equipment, or ordering vehicles.

The slide above sums up where firms surveyed are in their process.

Those fleets that are not currently using alternative-powered on-road vehicles fall into three categories, according to MacKay & Company. Fifty-six percent say they have exhausted their research and have no plans to purchase, 37% are researching but have no timetable for purchasing.

Finally, 7% are still engaged in research and hope to purchase.

About the Author

Frank Raczon

Raczon’s writing career spans nearly 25 years, including magazine publishing and public relations work with some of the industry’s major equipment manufacturers. He has won numerous awards in his career, including nods from the Construction Writers Association, the Association of Equipment Manufacturers, and BtoB magazine. He is responsible for the magazine's Buying Files.