Now in its 10th straight year, the American economy continues its recovery from the Great Recession, and growth has accelerated since passage of tax reform legislation. Virtually all sectors of the economy are performing robustly, though labor shortages are constricting new home starts and other construction projects. Economists report consumer confidence is at its highest since 2000. Willingness of consumers to spend money on all kinds of goods includes millions of motor vehicles in general and pickup trucks in particular.

Fears of tariffs on products from our NAFTA trading partners have dissipated as President Trump has announced that Canada and Mexico are exempted from his duties on foreign steel and aluminum. Although the 25 percent and 10 percent tariffs, respectively, still threaten to ignite trade wars with other nations, disruption of the automotive supply chains in North America might not occur after all. Then again, Trump could still slap tariffs on vehicles and components. Stay tuned.

As they have for years, light trucks and sport utility vehicles lead the sales figures and profit margins for the domestic original equipment manufacturers who dominate the market.

“When we look at the pickup business, we are seeing growth year over year, and almost every segment is growing,” says Dave Sowers, head of Fiat Chrysler Automobiles’ Ram Brand. “While the auto segment is shrinking, pickups should be at least flat” in 2018. Mark Namuth, senior manager of commercial vehicle sales at Nissan-USA, agrees: “We see the truck market leveling out, a slight softening, but not much. It’s a pretty strong market for all the OEs, a pretty happy time for trucks.”

John Schwegman, director of commercial product and medium duty at General Motors Fleet, is likewise bullish: “Pickups are real strong, 13 percent of the automotive industry compared to 10 to 11 percent historically.” At Ford, “SuperDuty sales are very strong, particularly on the fleet side,” says Kevin Koester, medium duty truck and SuperDuty fleet marketing manager. “Everybody’s buying.”

Like the economy, pickups are becomig bigger and arguably better as the OEMs fashion product improvements in their quest to become more competitive and capture market share. Ford’s aluminum bodies and beds have gone over well, as its F-150 is still the single most popular vehicle in America and buyers are grabbing the recently aluminized SuperDuty models.

“Testers have become customers,” Koester says. “Fleets that don’t go all-in right away on the new product are now buying….Aluminum is a very positive story for us.” Notwithstanding some early grousing in online discussion groups, “very small numbers (of reports) are coming back with any wrinkles. On the commercial side, there’s a strong familiarity with aluminum” so there are very few fears about body repairs, one of Ford’s considerations in planning the new-to-pickups material.

GM’s Chevrolet and GMC brands, especially those with upscale trim, are selling very well, and in Heavy Duty versions, crewcab 2500s and 3500s with the Duramax diesel are now 60 percent of sales, Schwegman says, “accelerating to a high amount in the last two years.”

Says Namuth at Nissan, “The crew cab is the biggest selling vehicle in the States. The regular cab is really falling off. The regular cab was 10 percent, and it’s now down to 3 to 4 percent. The driver is all-important, and fleet managers say, ‘What the hell, for a couple thousand more, I can go to a King Cab, and they’ve got more room and can store tools inside the cab.’ But we’re prepared either way.”

Meanwhile, GM reawakened the midsize-pickup market with the Chevy Colorado/GMC Canyon several years ago, and Ford is about to join in by bringing back the Ranger, though in a slightly larger form than it was when it left the market in 2011. Toyota’s Tacoma and Nissan’s Frontier continue to feed demand for compact pickups. All in all, customers win, not only by enjoying more choices in vehicle styles and equipment, but also by seeing stiff MSRPs tempered by cash discounts and rebates, touted in an almost unrelenting barrage of national and local print and broadcast advertising.

Commercial-use trucks remain simpler than consumer types, but chassis improvements and comfort, convenience, safety, and infotainment equipment, both standard and optional, tend to migrate to work trucks, as well. For example, although fleet customers tend to buy two-door regular-cab models, those cabs are roomier than in previous years.

“When we went to aluminum, we had a bit of a stretch in cab size so fleets can operate in a regular cab now,” says Koester. “The retail side is heavy on crew cabs.” Overall, crew-cab sales comprise about 70 percent of sales, a figure common among Ford, General Motors and Ram.

Lightweight materials

Aluminum hoods and tailgates, meanwhile, add to weight savings achieved by high-strength steel, so that a typical 2019 Chevrolet 1500 pickup weighs about 450 pounds less than before, and a ’19 Ram 1500 weighs 225 pounds less. Upon introduction for 2015, Ford’s all-aluminum nose, cabs, and beds in its F-150s saved 450 to 750 pounds, depending on cab style and size. SuperDuties went aluminum for the 2017 model year.

High-strength steel (HSS) was part of Ford’s weight-saving recipe, and GM and Ram have now employed HSS extensively on their pickup offerings. HSS adds strength but cuts weight because less material is needed than with traditional carbon steel. Put another way, high-strength, low-alloy steels, as they are more properly called, are usually 20 to 30 percent lighter than carbon steel with the same strength, and have fewer amounts of ferrite, or almost pure iron, so are more resistant to corrosion.

They “vary from other steels in that they are not made to meet a specific chemical composition but rather to specific mechanical properties,” says a Wikipedia listing. “They have a carbon content between 0.05 to 0.25 percent to retain formability and weldability.” The special steel also has up to 2 percent manganese and an array of other elements in very small quantities; for strengthening purposes, titanium, vanadium, and niobium are added. Because of HSS in floors, beds of the 2019 Chevrolet Silverado 1500 (above) are about 7 inches wider inside because less material needs to be used in forming the carbon-steel side walls, Schwegman says.

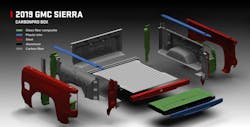

Reflecting its upscale bent and differentiating it from Chevrolet, the GMC Sierra 1500’s beds (above) for 2019 are of carbon fiber, a first for the industry, the GM division claims. Called CarbonPro, the material is highly resistant to dents, scratches, and corrosion, thus increasing overall durability. Carbon fiber is also light in weight, so it saves 62 pounds compared to a steel bed. GMC has another innovation for 2019 in its MultiPro tailgate, with six functions and positions. They include a flip-up panel that keeps long loads inside the bed when the tailgate is down; a half-fold, allowing an easy reach-over to access cargo at the bed’s rear; and an integral step with a built-in handle. The tailgate has optional power operation and is fashioned largely of aluminum and carbon fiber.

More power

Lighter materials have helped improve payload and towing capacities of pickups, as have stronger suspensions and axles. Propelling it all are ever-more powerful engines and multispeed automatic transmissions. Among heavier pickups, diesel horsepower is now well above 400 and torque over 900 lb.-ft., numbers similar to that of heavy-duty engines of generations ago and more than those in medium-duty trucks. That’s because the powertrains in midrange trucks are derated to reflect the more consistently high loads they see compared to loads intermittently hauled by light-duty trucks, even the “heavy duty” models.

Ford currently claims best-in-class diesel figures of 450 horsepower and 935 lb.-ft. of torque, each up by 10 over the previous year. However, GM and Ram are not far off those numbers, and the Big Three have leapfrogged over each other with diesel-output claims since the turn of the century. GM’s Duramax diesel is so popular among Silverado and Sierra HD buyers that production at its Moraine, Ohio, factory has recently been boosted twice and may have to go up again, says

Schwegman. The 6.6-liter Duramax V-8 is very close in displacement to Ford’s Power Stroke V-8 and Ram’s Cummins Turbodiesel inline-6, each with 6.7 liters—a curious bit of engineering agreement in what is otherwise an extremely competitive marketing arena.

For several years, Ram alone has offered a diesel in its half-ton, 1500-series pickup, and a spat with federal agencies over NOx emissions has been settled. Ram’s 3-liter V-6 comes from VM Motori, a supplier with a long relationship with Fiat, the “F” in FCA. But diesel competition is coming: Ford has announced its 2019 F-150 will also have an optional 3-liter V-6, though of course sourced from within the company. And GM also has a diesel in the works for its Silverado and Sierra 1500s, but has not announced any details except it will also be called a Duramax. These will satisfy demand for higher fuel economy and torque from many customers; perhaps more to the point, they will deliver bragging rights about who is more serious about the motor in his truck, Dave with his diesel or Gus with his gasser.

Big 6-liter-plus gasoline V-8s make over 400 horsepower, and that output is approached by smaller V-8s and V-6s—part of a trend toward lower displacement in the automotive industry—though torque is well under half that of diesel. OEMs say that gasoline tends to be more popular among fleet buyers, who realize that gasoline remains moderate to cheap in price, and usually a half a buck less than diesel. So the 30 or so percent penalty in economy is balanced by the cheaper gas, and it’s further offset by an upfront price that’s several thousand dollars less. In other words, the $4,000 or $5,000 saved out the door can buy a lot of gas, and the owner doesn’t need to buy diesel exhaust fluid, either. The Big Three OEMs’ gasoline engines can burn propane or natural gas when built with hardened valves and valve seats, an option costing only a few hundred dollars. Some buyers specify the option even if alternate fuels are not in their plans because resale value can be higher.

Eight- and nine-speed automatic transmissions are taking over from six-speeds, which in turn replaced the four- and three-speeds of yesteryear. More ratios keep engines in their most economical or strongest rpm range, boosting economy and performance. Manual transmissions are all but gone, with the sole exception being a 6-speed manual still available on the Ram 2500 HD with a derated Cummins Turbodiesel.

New hybrid electrics

Electrification is now more than a buzzword, as trucks begin following cars toward hybrid propulsion. GM fielded “2-Mode” hybrids in 2008, but they did not sell well and were soon withdrawn. First to hit the current market is a “mild hybrid” just announced by Ram Trucks. It uses a 48-volt electric motor-generator with a Pentastar V-6 engine, and will be standard on Ram’s revised 1500 pickup trucks for 2019, debuting on the Tradesman work-truck series. Called eTorque, the system will also be available with V-8-powered 1500-series pickups.

Dave Sowers says eTorque will include a battery pack behind the rear seats of Crew and Quad Cab versions of the 1500 series. The system will capture energy during braking and store it in the batteries, then add torque to the drivetrain when a truck launches: 90 lb.-ft. with the V-6 and 130 lb-ft. with a V-8.

“The extra torque really helps when starting out with heavy trailers,” Sowers says. “With the volume of trucks we sell, this will be largest application of mild hybrid technology in the industry.”

A 48-volt motor replaces an alternator and enables a quick and quiet stop-start capability for the engine. The engine shuts down during stops of more than a few seconds, then restarts when the driver removes his foot from the brake pedal. The system helps improve fuel economy and reduces exhaust fumes from the idling engine, even if those fumes now carry few pollutants. A non-eTorque version of the Hemi V-8 will also be offered in 2019 Ram 1500 pickups. Regular cab Ram 1500s will not be offered with eTorque, and will continue for some time in the current 2018 configuration.

Infotainment systems from most OEMs can not only inform and entertain drivers, but many can also help business customers keep track of expenses and inventory. Ram Truck is going a step further with remote monitoring, called Ram Telematics. It is “a vehicle connectivity platform that provides fleet owners and managers with a broad range of vehicle data, diagnostics, and driver behavior information to help them better understand how their vehicles are being used and improve operational efficiency,” the builder says. It uses Verizon cellular connections to enable monitoring from a customer’s office. This is a page taken from the Class 8 truck book, where for several years, remote telematics has been enhancing management capabilities.