Large asphalt paver manufacturers have reason to smile as the market is good overall, and though there is some caution about possible headwinds, they continue to incorporate technology to increase contractor efficiency and control.

“It’s been a really good year but the perception by some in the industry is that it hasn’t been, because 2017 was such a great year,” says Kyle Neisen, product managers for pavers and MTVs at Roadtec. “The industry is down some from 2017, but it’s still good progress. In 2017 we saw the fruits of the FAST Act Bill, and 2018 was the tail end of that.” Neisen adds that heavy rains over much of the country affected the ability to schedule some jobs.

“While we don’t see any major market growth for asphalt pavers, it’s reasonable to believe that there could be expected modest growth on the basis that, according to industry experts and construction associations, most states are beginning to transition from the rapid bridge-replacement programs and are starting to let more Interstate reconstruction projects through,” says Bill Laing, paving product manager for Volvo Construction Equipment. “A specific example of the expected shift in focus was cited by the Pennsylvania DOT, which is forecasting a 7 percent increase in total number of asphalt projects compared to 2018.”

BOMAG says it is also seeing increased funding by states and municipalities.

“We are experiencing a strong market for large asphalt pavers like our Cedarapids CR400, CR500, and CR600 series pavers,” says BOMAG paving products manager Henry Polk. “And we see reports of increased funding for road projects at the state level. With more work on the books, paving contractors are comfortable with making the investment for asphalt paving equipment. We are also seeing an uptick in asphalt paving equipment investment at the municipality level—state, county, and city.”

With recent stock market instability, a rise in interest rates, and stormy political waters, Construction Equipment asked OEMs if there were any headwinds on the horizon that might carry a whiff of recession.

“As an industry, instability in politics can affect bidding of future projects, and uncertainty about future infrastructure funding makes it difficult to plan and bid,” Neisen says.

“It does look like we might be heading into slower economic activity than in recent times,” Laing says.

“We do not anticipate headwinds specific to the asphalt paving market at this time,” Polk says. “Oil prices have remained relatively consistent, and over the years, many contractors have built up a good stockpile of recycled asphalt.

“We have seen a trend of more mobile asphalt plant sales to paving contractors, which is an indicator of a strong paving market,” Polk says. “Contractors have enough confidence in the market to expand and invest in asphalt production to control their asphalt supply and lower trucking costs.”

The FAST Act’s expiration, and concern about its replacement, is causing at least some uncertainty, but Jim Holland, VP of Wirtgen’s Vögele brand, is optimistic.

“The FAST Act expires Aug. 31, 2020, less than two years, and we must have a new bill in place by Sept. 1 of that year,” Holland says. “Even more, we must enhance revenues for surface transportation as the existing revenue streams are inadequate to support the funding authorized by the FAST Act. Fortunately, these issues are being explored inside the Beltway and in our age of partisan politics, infrastructure legislation is uniquely nonpartisan, so I anticipate progress there.”

The skilled labor shortage also concerns manufacturers.

For years, Volvo has offered its Road Institute as a training ground for operators. “Volvo’s Road Institute offers different classes throughout the year—offering training in paver and compactor operation and maintenance, large asphalt compactor mechanics, and automatic grade and slope systems,” Laing says. “The courses’ times vary.”

BOMAG cites the retirement of long-time equipment operators as one of the reasons it is establishing two new training courses at its South Carolina Fayat Academy training center.

“Experienced operators continue to retire at a high rate, leaving an experience gap for paver operators,” Polk says. “The need for quality training programs for less experienced replacements is nonstop and will continue to be of growing importance as companies lose more long-term employees to retirement.” The company’s classes will focus on operators as well as service and maintenance training.

“Ensure that your crews are trained well,” Caterpillar’s global sales consultant Jon Anderson adds. “How the crew runs the paver can have a large impact on the wear of the machine. A properly trained crew can minimize down time, reduce wear on the machine, and improve overall machine efficiency.”

Before buying a new asphalt paver, managers should ask a number of questions.

“Consider how you use the paver—are you primarily doing mainline paving, urban, or commercial applications?” Anderson says. “Do you need the flexibility to use 2D or 3D guidance?”

Anderson also advises that managers consider their crews. “Are they experienced, or a mix of old hands and novices? How easy are the controls to use?

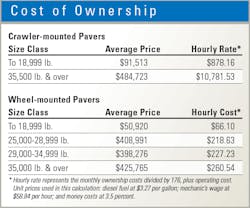

“Finally, consider the total cost of ownership: purchase price, operating costs, maintenance costs, and resale potential,” Anderson says.

BOMAG’s Polk also urges managers to look long term when purchasing a large paver.

“With proper preventative maintenance and adhering to service schedules, these pavers are designed to give companies more than 10 years of reliable service,” he says. “Work with the manufacturer to get a clearer picture of total cost of ownership, so long-term operating costs are considered.

“Also, the contractor should study the market potential for the area in which it operates. If there is a mix of large commercial and highway/Interstate work, then a contractor could benefit from a highway-class paver,” Polk says, pointing to the versatility of a 10-foot paver that can pave 28-foot widths at highway speeds yet still has enough maneuverability for tight parking lot applications.

“When considering a paver, look at wear items such as the slat drive chains, slat bars, and conveyor floor liners to make sure they are designed to give years of reliable service life without replacement, and that they are backed by a strong warranty,” Polk says.

“And consider what drive system is required for the market. Rubber-track drive systems help maintain traction when pushing fully loaded asphalt trucks up steep grades,” Polk continues. “Some rubber-track drive systems in the past have required frequent replacement, adding to the total cost of ownership. Make sure the rubber track has an automatic tensioning system to prevent the track from disengaging, and is warranted for at least three years or 3,000 hours.”

Vögele’s Holland hones in on specific technologies.

“[Buyers] should look for: a material feeder system design to ensure material consistency; precise-propel controllability, especially on track pavers, to allow the operator to maintain proper straight line that improves smoothness and joint quality; and a screed Hold-and-Freeze feature that automatically engages with the propel lever to prevent screed settling and hump due to stops and starts. This is a standard feature on Vögele pavers and an optional feature on other brands,” Holland says.

In addition, Holland touts integrated, automatic grade-and-slope control systems like his company’s Niveltronic Plus system, and onboard diagnostic and backup controls that will allow operators to maximize uptime and efficiency.

Telematics features and machine control options continue to see growth, enticing buyers to look more at technology.

“It’s not really a recent addition, but the integration of the 3D paving and the application of 3D paving continues to grow,” Cat’s Anderson says. “In the past, it has been mostly utilized in the ideal world of airport jobs and new construction, but recently there have been some jobs where it has been used to make substantial corrections to the road base and with excellent results.”

Technology leads to increased uptime, says Volvo’s Laing. “That all starts with the dealer—their local support and technical expertise can make a huge difference from one brand to another. Telematics systems are also a critical tool for uptime. Traditional telematics systems such as Volvo CareTrack can let contractors see where their machine is, fuel consumption, and get basic fault codes to help diagnose issues before they result in downtime. One major differentiator with Volvo is ActiveCare Direct, a 24/7/365 machine monitoring and reporting service managed directly by Volvo,” Laing says.

ActiveCare Direct is currently available on earthmoving equipment, but Laing tells Construction Equipment it will be available on select pavers by the second quarter of 2019. “This service allows dealers to shorten the reaction time if there is a problem with the machine,” he says.

Roadtec’s Neisen says his company’s Guardian Telematics is the only telematics system that allows live, two-way wireless communication.

“With Guardian, those on the job site and those at the office or other locations share the same data at the same time,” Neisen says. “Modifications are made in real time to prevent machine issues and maintain productivity, reduce in-person service calls and downtime, and lower overtime and labor costs. You can change grade and slope control settings while on the job.”

Expect even more automation as pavers progress.

“Seemingly small mistakes by the operator can have an enormous impact on mat quality,” Laing says. “That’s why so many of the new features on pavers and compactors developed over the past decade are designed to assist the operators and help automate paver functions. Speed limiters, grade and slope control, auto vibration, and material-flow sensors on the screed are all perfect examples of technologies that help automate tasks that could cause mat quality problems, and really help to make paver functions easier for the operator.

“Thermal imaging is something that I believe we’ll start to see more of in the coming years,” Laing says. “Volvo already offers this type of system in Europe, and we have plans to bring it to North America. The program, called Pave Assist, provides the ability for the operator to see real-time information on a touchscreen display, such temperature variations in the asphalt. This information allows operators to make adjustments on the fly in order to avoid potential quality issues.”

Polk agrees thermal imaging is on the come. “More states like Colorado, Indiana, and Minnesota are adding in thermal imaging specifications to contracts and incentivizing contractors to lay asphalt with more uniform temperatures behind the screed,” he says. “If a contractor exceeds the specified maximum temperature deviation, then bonuses are not paid. Adding equipment to the fleet that remixes material prior to it being paved can help contractors lay more uniform mats, beat thermal imaging standards, and receive bonuses.”