More Than Airborne Cameras, UAVs Are Tools In the Sky

In lieu of the flying cars science fiction once promised, increasing numbers of drones are plying the skies above, and their impact on the construction industry is substantial and continuing to evolve.

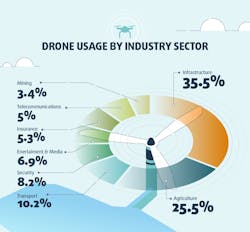

According to a survey commissioned by drone operation management software maker Skyward (part of Verizon) and executed by Blue Research, one in 10 companies with revenue of $50 million and more use drones, and the highest adoption (35 percent) is in construction and engineering.

Ninety-two percent of companies that use drones (also known as UAVs or UAS, for Unmanned Aerial Vehicles or Unmanned Aerial Systems) realized a positive ROI on their drone investment in one year or less.

The results also showed that drones are integral to business operations: Half reported their company’s bottom line would suffer if their company did not use drones.

And, investment is expected to grow. Among survey responders, drone use was pegged at 10 percent; it’s expected to increase to 20 percent in the future.

“In the last two years since the FAA passed Part 107, we’ve seen drone use accelerate across small businesses and multinational firms, and watched our customers build drone programs into sophisticated operations that increase efficiency, worker safety, and access to data,” says Mariah Scott, president of Skyward.

It is fascinating to see how quickly these organizations are obtaining a positive ROI. Although still a fairly nascent market, these data suggest the market is well poised to grow—and with good reason for doing so,” says Paul Abel, Ph.D., managing partner, Blue Research.

Major drone capabilities include capturing before and after visuals, project and production monitoring, and mapping to produce survey-accurate models for machine control and other uses. Think about drones as tools to capture the data machines are built to use and act upon.

Following is advice on how to convince management a program is worth implementing, a look at a few of the tech company and OEM offerings for fleets considering a drone program, and some other basics to consider.

Selling aerials up the chain

Skyward has advice on how to convince management and other levels of the company that a drone program is right for the enterprise. In its “Adding Drones to the Enterprise” report, it stresses the importance of building trust with all stakeholders at the beginning.

“While the boots-on-the-ground professional or manager is most interested in new-use cases, increasing efficiency, hiring pilots, and processing data, the company’s risk managers may not care about any of those things until it can be proven that drones won’t increase the company’s liability potential. Compliance and legal teams may be most concerned that flight crews will never violate airspace regulations or infringe on privacy,” Skyward writes.

In gaining buy-in for a pilot program, Step 1 is to start by knowing what you need to provide, and working backward. In other words, does your audience want numbers, details, a PowerPoint, or spreadsheets?

Skyward recommends starting with the following three metrics: Cost Transformation, demonstrate that what you want to do with drones is already being done, but by other means that are more costly, less safe, or less efficient; Data Use, show executives how the company will be able to use the data or imagery for purposes beyond what was contracted (for example, for revenue assurance, analyzing safety hazards, or proper installations from previous work); Show the Value of Efficiency, in that often the greatest value drones will provide will be by saving time and cutting costs.

Step 2 is creating a committee of stakeholders. Don’t be your company’s lone drone evangelist. Skyward says it has seen the difference between drone programs launched by a committee versus those by a lone enthusiast.

Step 3 is to focus on what the technology can produce, not on drones as such. “Like pencils, calculators, and personal computers, drones are only as valuable as what they can achieve,” Skyward says. “Before investing in aircraft, sensors, pilots, and analysis software, your executive team will want a clear idea of the advantages that drones can provide.”

Further, the report recommends not to try to tackle multiple-use cases all at once. Instead, start small. Propose a pilot program for a simple, low-risk use case and lead with the value you expect to achieve: saving money, saving time, achieving access to entirely new data, or a combination of these. “Let’s save our company money” is a much easier sell than “I’d like to find room in the budget to invest in drones and related assets.”

The entire report can be downloaded at the company’s website, www.skyward.io

Tech company and OEM offerings

Construction technology companies and equipment OEMs have thrown resources behind drones and related services. Here’s a sampling.

Trimble collaborates with Propeller Aero to distribute its UAS analytics platform.

Propeller, based in Sydney and Denver, is engaged in the advanced collection, visualization, and analysis of data from UAS. Propeller’s automated ground control targets, cloud-based visualization, and rapid analysis platform is also integrated with Trimble’s Connected Site solutions to bring an end-to-end cloud-based UAS solution to civil engineering and construction contractors.

Propeller’s web-based interface together with Trimble’s Connected Site solutions allows users access to tools to measure surface geometry, track trends and changes across time, and perform visual inspections.

Both technical and nontechnical professionals can use the platform to gather insights remotely and collaborate, giving them the potential to make improvements in safety, efficiency, and the reduction of environmental impact across a construction work site.

“Propeller combines ease of use with powerful analysis tools that allow users to view 2D and 3D deliverables and extract valuable information,” says Scott Crozier, director of marketing for Trimble Civil Engineering and Construction. “Like Trimble, Propeller understands the value of quality and accurate data for integration with civil engineering and construction workflows.”

Leica’s new UAV technology (utilizing the “Aibot”) has been developed in partnership with drone manufacturer DJI, and it allows users to process and analyze millions of data points gathered from above and visualize the data to provide actionable information.

Then, that UAV data can be combined with existing survey technologies, such as TPS, GPS, and laser scanning. By meshing with existing survey technologies, such as total stations, GNSS, and laser scanning, users are meant to receive a more complete set of information that is easier to interpret and apply to a project.

The Leica Aibot can identify gaps early because of its level of accuracy, the company says. High-definition imagery and 3D mapping allow for the viewing of site mapping or progress documentation.

Throughout a project lifecycle of planning, designing, and construction, Aibot is designed to provide access to critical information to perform volume calculations and monitor site progress. From creating digital terrain models, to stripping, bulk earthworks, and trenching, to final fine grading, paving and compaction, the solution supports easier actuals comparisons providing a more transparent view of site progression monitoring and volume calculations to keep projects on schedule.

Topcon offers the Intel Falcon 8+ Drone “Topcon Edition,” built for high-resolution imaging in tight spaces and other challenging environments. It features high-definition imaging, thermal, and RGB stills, fully automated flight routes 2D and 3D, and triple redundancy for safety.

In addition to tech providers, consider what equipment manufacturers and their dealers have to offer.

Dealer drones

Last year, John Deere and its dealers began to offer the Kespry Aerial Intelligence System and the Kespry Drone 2s, which was said to be the first automated drone system with on-board LiDAR sensors that automatically detects and avoids obstacles such as trees, cranes, and buildings.

The alliance enables John Deere customers to use Kespry’s fully integrated industrial drone platform to capture topographic data in minutes with survey-grade accuracy.

“This technology helps our dealers offer a seamless workflow to site development and road building contractors from project planning through grading dirt,” says Andrew Kahler, product marketing manager, John Deere WorkSight. “The data gathered from the Kespry system will help our customers and equipment operators make decisions that reduce costs and improve productivity as they optimize the job site and spend less time on jobs.”

Kespry delivers a fully automated drone system that takes off, flies a designated flight path, and lands, all without operator intervention. The Kespry Drone 2s allows customers to create a mission with the touch of a finger, then capture, analyze, and share survey-grade data and insights.

The post-processed data are accessible from anywhere in the world via a web interface, allowing customers to access real-time 3D renderings, volumetric analysis, and data export features with the click of a button. The drone-collected data can then be exported from the Kespry cloud to a number of common modeling packages including AGTEK Earthwork 4D, another endorsed John Deere solution to perform 3D model overlays, cut/fill maps, bidding, and takeoff procedures.

“These advanced aerial intelligence systems are already changing the face of work in industrial markets as surveyors and contractors are able to retool their skill sets for this increasingly connected world,” says George Mathew, chairman and CEO of Kespry.

Since the collaboration began, Kespry has added a suite of capabilities that include grade planning and analysis, site and surface comparison including cut/fill visualization and design plan development, and compliance.

The earthworks capabilities include on-demand drone data capture and analysis so mass haul plans can be developed before projects begin, with an entire site mapped and analyzed in hours. Tools also enable haul road planning to support more efficient site planning. There’s also on-demand cut/fill analysis enabling close management of the project and specific bid requests.

Finally, design plan comparisons through project plan overlay onto Kespry data, aiming to reduce the complexity and cost of rework. Safety also can be improved through close monitoring of change and analysis of grades around the site.

Commercial drone data company Skycatch, and China-based DJI, manufacturer of civilian drones and aerial imaging technology, announced their partnership to manufacture and deliver a fleet of high-precision drones for Komatsu Smart Construction. This is the first time DJI has manufactured a custom drone for a partner.

Each customizable Matrice 100 drone will be manufactured by DJI and outfitted with specialized Skycatch technology that will include the Guidance GPS module.

The Explore1 drones come with the Edge1 base station that does image processing without the need for an active Internet connection. The Skycatch drones’ algorithms can recognize basic materials on a construction site, as well as people and other vehicles, and users can supply their own data to train new algorithms.

The value of the contract was not revealed but the commercially available Matrice 100 is available for about $3,200. Add on the $1,000 per unit Guidance GPS and the Skycatch $1,800 per month subscription, and the 1,000 drone order, which DJI says is the largest commercial drone order in history, comes to just under $1 million. Komatsu Smart Construction plans to use the Skycatch Explore1 drones to autonomously fly over job sites to create highly accurate 3D site maps and models.

The map data will be used for Komatsu Smart Construction’s new data service that enables robotic earthmoving equipment to correctly dig, doze, and grade autonomously according to digital construction plans.

Caterpillar partnered with a company called Redbird in 2016. Redbird was a pioneer in the acquisition and analysis of aerial data collected by drones. Later that year, Redbird was acquired by Airware, which then drew a strategic investment from Caterpillar Ventures.

The investment allows Airware to accelerate programs that enable dealers to offer solutions and services within the construction, mining, and quarrying industries, and highlights Caterpillar’s commitment to the Industrial Internet of Things (IIoT).

Today, teams are using the Airware Redbird solution to monitor day-to-day progress of their sites to improve productivity, worker safety, and operational efficiency.

“Commercial drone technology is becoming a necessity for construction, mining, and quarrying organizations looking to increase overall productivity while cutting costs,” says Jonathan Downey, founder & CEO of Airware. Caterpillar dealers offer their customers drone services and analytics, including a core set of photogrammetry, mapping, and volumetrics tools, and a suite of advanced analysis and reporting modules.

Know the rules

Like virtually everything else, drones are subject to regulations. Before beginning a program, review FAA Part 107 rules.

To operate the controls of a small UAS under Part 107, users need a remote pilot airman certificate with a small UAS rating, or be under the direct supervision of a person who holds such a certificate. Users must be at least 16 years old to qualify for a remote pilot certificate, and they can obtain it in one of two ways. They may pass an initial aeronautical knowledge test at an FAA-approved knowledge testing center. If they already have a Part 61 pilot certificate, other than a student pilot certificate, they must have completed a flight review in the previous 24 months and must take a small UAS online training course provided by the FAA.

If the user has a non-student pilot Part 61 certificate, he or she will immediately receive a temporary remote pilot certificate when applying for a permanent certificate. Other applicants will obtain a temporary remote pilot certificate upon successful completion of a security background check. If your company uses drones to view, map, or monitor construction projects, obtaining approval to operate commercial drones in controlled airspace is becoming easier and safer.

The FAA has announced it is expanding tests of an automated system that will ultimately provide near real-time processing of airspace authorization requests for unmanned aircraft operators nationwide.