Leasing Confidence Up: ELFF

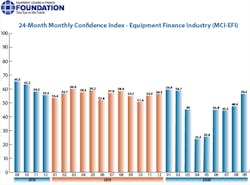

An index measuring confidence in the equipment-finance market increased in September to 56.5, up from 48.4 in August. The Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) is compiled by the Equipment Leasing & Finance Foundation.

The Foundation also released highlights of its COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry. Nine of 10 respondents have offered payment deferrals, including extensions, modifications, or restructuring. Some 73 percent of companies expect that the default rate will be greater in 2020 than in 2019, down from 76 percent last month.

When asked about the outlook for the future, Dave Fate, president/CEO, Stonebriar Commercial Finance, said, “The equipment finance industry has always been resilient. The debt and equity markets are strong with lots of liquidity, and election noise will be over soon.”

Optimism was reflected in the MCI-EFI data that showed 36 percent of respondents expecting their business conditions to improve over the next four months, up from 24 percent in August. On the other hand, 18 percent expect business conditions will worsen.

Some 29 percent of the survey respondents expect that demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 14 percent in August. About 7 percent expect demand to decline.

About 18 percent of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up slightly from 17 percent in August.

None of the respondents evaluate the current U.S. economy as “excellent,” unchanged from the previous month; 46 percent evaluate it as “fair,” and 54 percent evaluate it as “poor,” up from 52 percent last month.

Half of survey respondents expect that U.S. economic conditions will get “better” over the next six months, an increase from 31 percent in August. About 11 percent believe economic conditions in the U.S. will worsen over the next six months.

“I am more positive than I was three months ago regarding the duration of the recession and the future in general,” said Christopher Enbom, CEO/chairman, AP Equipment Financing. “The economic stimulus was very well timed and now people are quickly adjusting to living with Covid. In certain industries spending has increased dramatically.”

Source: ELFF