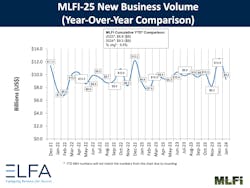

Overall new business among 25 leasing and finance companies was up 6% in January, compared to January 2023, according to the Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25). New business volume was $9.3 billion. Volume was down 26% from $12.5 billion in December.

“The optimism I expressed in last month’s MLFI continues as 2024 gets off to a strong start with solid new business volume and increased industry confidence," said Leigh Lytle, ELFA president and CEO, in a statement. "It’s especially encouraging to kick off in positive territory since equipment investment—the lifeblood of the equipment finance industry—is forecast to pick up in the second half of the year. Credit quality bears monitoring since delinquencies and charge-offs, in particular, remain elevated year over year.”

Read also: Leasing Confidence Index Ticks Up in February

Bobby Campbell, SVP, managing director, operations and strategic development, Fagstar Financial & Leasing, said in a statement:

“Our equipment finance industry has kicked off 2024 with a stronger launch than a year before on the heels of an extremely active fourth quarter. Many finance companies remain cautious within certain segments of the trucking industry, though credit concerns and delinquency are beginning to level off with hopes of a near-term positive inflection. With several bank finance players facing ongoing liquidity challenges, strong independents and captives should continue to take advantage of capturing additional market share in the months ahead.”

The MLFI-25 survey also indicated that recievables over 30 days were 2.3% unchanged from December and up from 1.9% in the same period in 2023. Charge-offs were 0.5%, up from 0.4% the previous month and up from 0.3% in the year-earlier period.

Credit approvals totaled 76%, up from 75% in December. Total headcount for equipment finance companies was up 1.4% year-over-year.

About the Author

Harlee Hewitt

Harlee is a former associate editor for Construction Equipment.