Construction spending gains on manufacturing, housing strength

Total construction spending in May increased by 0.9 percent from April and 2.4 percent year-over-year as gains in manufacturing construction and single-family homebuilding offset a downturn in major infrastructure segments, according to the Associated General Contractors of America of new federal data.

Construction spending, not adjusted for inflation, totaled $1.9 trillion at a seasonally adjusted annual rate in May. Monthly and year-over-year changes varied among major segments.

Public construction spending was mixed, as the largest infrastructure categories declined for the month and education spending was flat.

- Highway and street construction declined 0.4 percent from April

- Public spending on transportation facilities, such as airports, transit, and passenger rail, slid 0.8 percent.

- There were monthly increases of 1.1 percent in spending on sewage and waste disposal and 2.6 percent on water supply, but

- A drop of 3.8 percent in conservation and development, such as river and harbor projects.

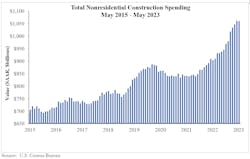

National nonresidential construction spending decreased 0.2 percent in May, according to Associated Builders and Contractors. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.06 trillion.

Spending declined on a monthly basis in nine of the 16 nonresidential subcategories. Private nonresidential spending fell 0.3 percent, and public nonresidential construction spending increased 0.1 percent in May.

Read also: Infrastructure backlog bumps up: ABC

“Nonresidential construction spending declined in May, ending a streak of 11 consecutive monthly increases,” said Anirban Basu, ABC chief economist, in a statement. “While spending is up more than 17 percent over that span, manufacturing-related construction has accounted for the majority of that increase. Excluding the manufacturing segment, nonresidential construction spending is barely outpacing inflation, up just 6 percent over the past year.

“Contractors remain relatively upbeat, according to ABC’s Construction Confidence Index, and ongoing strength in manufacturing and publicly financed segments justifies that confidence,” said Basu. “Unfortunately, conditions may prove challenging in other segments over the next few quarters. Interest rates remain elevated and are likely to rise at least once more over the second half of 2023, exacerbating already tight credit conditions and ultimately limiting construction activity.”

Said Ken Simonson, chief economist for AGC, in a statement:

“The data for May show there has been no letup in the feverish pace of manufacturing construction but a very mixed picture for other project types. There have been strong year-over-year increases in most categories, but it remains to be seen if the market is now cooling.”

The pickup in private residential spending was led by a 1.7 percent increase in single-family homebuilding—the first gain since April 2022, according to AGC. Multifamily construction dipped by less than 0.1 percent, its first decline since July 2022.