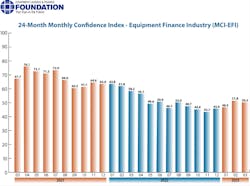

Confidence in the equipment leasing and finance industry dropp3d in March to 50.3, down from 51.8 in February, as measured by the Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI).

The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the equipment finance sector, published by the Equipment Leasing & Finance Foundation.

“As the pandemic becomes farther in the rear view mirror, industries affected such as livery, fitness, entertainment, and hospitality are now showing strong demand for equipment,” said Nancy Pistorio, Foundation chair and president, Madison Capital LLC, in a statement.

When asked to assess their business conditions over the next four months, 10.7 percent of respondents said that they believe business conditions will improve, a decrease from 16.1 percent in February. One in three (32.1 percent) said that business conditions will worsen, an increase from 22.6 percent in February.

One in 10 (10.7 percent) said demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from 9.7 percent in February. Some 21.4 percent said demand will decline, up from 19.4 percent in February.

Only 3.7 percent of respondents evaluate the current U.S. economy as “excellent,” up from none the previous month. Nine of 10 (88.9 percent) grade it as “fair,” and 7.4 percent evaluate it as “poor.”

Four in 10 (42.9 percent) said that they believe economic conditions in the U.S. will worsen over the next six months—an increase from 41.9 percent—and 3.6 percent said conditions will get “better.”

Source: Equipment Leasing & Finance Foundation

About the Author

Rod Sutton

Sutton has served as the editorial lead of Construction Equipment magazine and ConstructionEquipment.com since 2001.

Our mission is to help managers of heavy equipment and trucks to improve their performance in acquiring and managing their fleets. One way we do that is with our Executive Institute, where experts share information and ideas that will enable equipment managers to accurately manage equipment costs so that they can deliver the optimum financial benefits to their organizations.

We also have a laser focus on product development, performance, and technology; as well as equipment acquisition, disposal, and maintenance. Our exclusive Field Tests take earthmoving equipment and truck into the field for professional evaluations.

Check out our free newsletters to see the latest content.

You can find Sutton on LinkedIn.