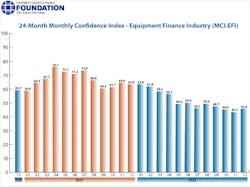

The December 2022 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) rose to 45.9, up from November’s number of 43.7. The index, created by the Equipment Leasing & Finance Foundation, is a qualitative assessment of both the prevailing business conditions and expectations for the future.

When asked about the outlook for the future, MCI-EFI survey respondent Adam Warner, President, Key Equipment Finance, said, “‘Cautious optimism’ is the theme as we move into 2023,” said respondent Adam Warner, president of Key Equipment Finance, in a statement. “The Federal Reserve is signaling that rate increases are slowing down; yet, this move doesn’t outweigh the softening demand for equipment financing due to rates being so high as a result.

“Businesses will need to continue moving forward regardless, and that means implementing new technology to increase productivity, efficiency, and profitability.”

Four of 10 respondents (40.7 percent) said that they believe business conditions will worsen over the next four months, down from 53.6 percent in November. The percentage expecting business to improve rose from zero to 3.7 percent.

Demand for the leases and loans needed to fund capital expenditures will increase over the next four months, said 7.4 percent of respondents, down from 10.7 percent in November. One in five (22.2 percent) said that they believe demand will decline, up from 21.4 percent in November.

The U.S. economy is “excellent,” according to 3.7 percent of respondents, unchanged from the previous month. Seven of 10 (70.4 percent) of respondents evaluate the economy as “fair”; 25.9 percent evaluate it as “poor.”

None of the survey respondents said that they believe that U.S. economic conditions will get “better” over the next six months, unchanged from November. About half (51.9 percent) said that they believe economic conditions in the U.S. will worsen over the next six months, a decrease from 71.4 percent the previous month.

Source: Equipment Leasing & Finance Foundation