Finance Index Inches Up: ELFF

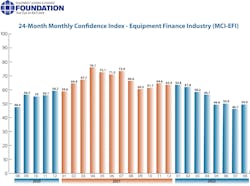

The August 2022 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) rose to 50, up from 46.1 in July, according to the Equipment Leasing & Finance Foundation. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by executives in the equipment finance sector.

When asked to assess their business conditions over the next four months, 14.8 percent of executives responding said that they believe business conditions will improve, an increase from 3.7 percent in July. One-third said business conditions will worsen, unchanged from July.

“The resilience of the equipment leasing and finance industry continues to demonstrate itself during 2022,” said Dave Fate, CEO, Stonebriar Commercial Finance, in a prepared statement. “Over the decades the industry has overcome and prospered through recessions, a financial crisis, and a global health pandemic. We are all now faced with the challenges of supply chain disruption, inflation, labor shortages, and the ‘noise’ that accompanies the upcoming midterm elections in a few months. Regardless of these challenges, the industry always performs well.”

Some 7.7 percent of respondents said demand for leases and loans to fund capital expenditures will increase over the next four months, a decrease from 11.1 percent in July. Another 15.4 percent responded that demand will decline, down from 33.3 percent in July.

None of the respondents evaluate the current U.S. economy as “excellent,” a decrease from 11.1 percent the previous month. Some 85.2 percent evaluate is as “fair,” up from 77.8 percent in July, and 14.8 percent label it “poor,” an increase from 11.1 percent.

About one in 10 (11.1 percent) said that they believe that U.S. economic conditions will get “better” over the next six months, an increase from 7.4 percent in July. A little more than one-third (37 percent) responded that economic conditions will worsen, a decrease from nearly half (51.9 percent) the previous month.

Source: ELFF