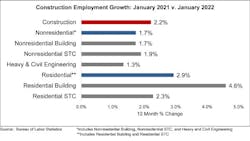

The construction industry lost 5,000 jobs on net in January, according to an Associated Builders and Contractors (ABC) analysis of data released by the U.S. Bureau of Labor Statistics.

Overall, the industry has recovered slightly more than 1 million (91 percent) of the jobs lost during earlier stages of the pandemic.

Nonresidential construction employment declined by 9,000 positions on net, with all of those losses and more emerging from the heavy and civil engineering subsector, which lost 9,500 jobs. Nonresidential building and nonresidential specialty trade contractors registered minimal job growth, adding 400 and 100 jobs, respectively.

The construction unemployment rate increased to 7.1 percent in January. Unemployment across all industries rose slightly from 3.9 percent in December to 4.0 percent last month.

“There are at least a dozen explanations for today’s employment report, which indicates that nonresidential construction employment declined in January even as many other segments added many jobs,” said ABC chief economist Anirban Basu. “First, it is conceivable that many construction workers left for other industries, including those who work in union settings, since pay increases are limited by pre-existing labor contracts. Second, it is possible that the omicron variant, which was peaking during the survey’s reference week, kept some workers off of payrolls. That explanation seems debatable, given rapid job growth economywide.

“Third, since much of the construction job loss was in infrastructure-oriented segments, it may be that some purchasers of public construction services have shifted into planning and engineering mode to figure out how incoming infrastructure dollars can and should be spent,” said Basu. “Finally, it may also be the case that rapid cost increases during the pandemic have led more project owners, both public and private, to postpone projects.

“Whatever the explanation, the overall employment report has some important implications for contractors,” said Basu. “Based on ABC’s Construction Confidence Index, contractors collectively expect that sales, employment and margins will grow over the next several months. Today’s strong jobs report for the broader economy bodes well for more aggressive interest rate hikes, which will result in a higher cost of capital that is likely to dampen the demand for construction services.”

Source: ABC