Equipment managers rated their primary distributors slightly lower in their ability to partner on fleet services and support in 2021, according to an exclusive report from Construction Equipment. About 43 percent said their dealer’s ability to partner was either “excellent” or “very good,” down from 49 percent in 2020 and 51 percent in 2019.

The data were gathered as part of the 2022 Annual Report & Forecast. The full report will be published in January in partnership with Case Construction Equipment.

Dealer Excellence Awards recognize dealers that are doing the best job of partnering with equipment fleets.

Fleet managers are increasingly looking to their dealers to help them manage the machine data produced by the machines that they operate. The value of machine data to equipment operations has become more evident to equipment professionals, and managing the volume of machine data has put pressure on their ability to discern what data to monitor and how to respond to alerts.

Equipment manufacturers have bolstered their dealer support systems by providing machine monitoring and alerts to their dealers. Many dealers, in turn, have built systems through which they can communicate with their customers using the alerts and data to help manage service and product support.

The increasing demand for support services from equipment managers may be fueling this drop in satisfaction. The pandemic-driven demand for quicker and more customer-driven services such as online ordering, rapid delivery, and curbside pickup may also be raising expectations among fleets.

Demand is also increasing for dealers to offer service plans that perform the maintenance management function for fleets, including scheduling and performing preventive maintenance and onsite service calls.

Construction equipment technology

Accompanying the growth among fleet managers to use machine data for asset management is more sophisticated features on the equipment they manage, such as machine control, load-monitoring systems, and other technology that improves efficiency. Dealers must explain to fleet managers how technologies on the machines they sell improve their customers’ equipment operations.

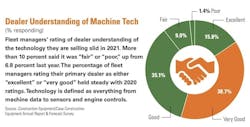

When asked to rate their primary distributor’s understanding of the technology they are selling on their equipment, more than half of respondents, 55 percent, rated their primary dealer as “excellent” or “very good.” This percentage was in line with last year, when 53 percent provided a rating of “excellent” or “very good.” On the other hand, one in 10 respondents rated their primary dealer as “fair” or “poor” in their knowledge of technology, the lowest level since we started asking the question in 2018.

In fairness to dealers, the amount of technology being placed on equipment has grown tremendously in recent years, specifically during and since Conexpo 2020. There is simply more and different technology available on machines that demands not only understanding, but also the ability to explain to customers and train the operators using it.

Among equipment managers who see the value of machine data to their management strategies and who recognize the value that machine technologies bring to the efficiency of their fleets, the primary dealer has become an increasingly important part of the asset-management process.