A year unlike any other. Unprecedented. Historic.

2020 has more platitudes going for it than any other year in the lifetime of the editors overseeing Water & Wastes Digest, and the same can likely be said for practically all the WWD audience members.

Crossen is managing editor of Water & Wastes Digest.

In 2020, the water industry started strong and remained determined, diligent, and unrelenting in the face of the challenges presented throughout the year. From the ongoing and continuing global coronavirus pandemic to a tumultuous election—the results of which could present considerable change for the industry—the larger conversations of society have begun to permeate across the water and wastewater industry as a whole.

Issues of water access, water affordability, and water equity have become increasingly important as industry companies and associations doubled down on diversity and inclusion initiatives. Social media groups became even more united in sharing their work experiences as essential workers during the pandemic, despite often being left off the sharable photos and memes thanking essential workers. And perhaps most notably for the market was the acceleration of digital and smart water technologies and the impact it will have on future digital technologies.

WWD annually surveys its audience on the status of the industry and expectations for the coming year. Comparing the results of the 2020 survey to previous years, it appears that 2020—an election year—mirrors many of the responses and feelings of respondents in 2018—also an election year.

Read the complete industry report in 2021 Annual Report & Forecast.

Although nearly half of respondents to this year’s survey said 2020 was a “good” year (49 percent) and 16.3 percent said it was “very good,” nearly a quarter of the respondents said it was “mediocre” (24.8 percent). This is the largest portion to indicate “mediocre” since 2018 when 21 percent indicated it to be as such. Respondents are not deterred by this, however, as more than half said next year will be “good” (54.9 percent) and more than a quarter said it would be “very good” (25.5 percent). This follows a similar trend in 2018 when 70 percent of respondents that year thought 2019 would be “good,” “very good,” or “excellent.”

This outlook on the industry stresses just how resilient water and wastewater utilities are. Many of the steps a utility would take to become more resilient to extreme weather events—which have become an increasingly dominant reason for technology purchases—also made them resilient to the pandemic. Also, water and wastewater services were considered essential during the outbreak and proceeding months, so critical projects and construction continued, albeit after an initial stall.

“We had a healthy amount of activity occurring before the pandemic,” said Chad Mize, SVP of sales and marketing for Mueller Water Products. “There was this little lull. And then as we’ve seen, as people have been able to get back to work and have figured out how to work from home, and city councils get back together and they get to approve projects, that things certainly continue to roll.”

Other notable findings from the 2020 survey include revenue projections and the expectations of new construction compared to utility upgrades in the coming years. Firstly, revenue expectations for 2021 appear promising. Although respondents largely indicated their revenue remained the same from 2019 to 2020 (43.2 percent) and expect their revenue to remain the same in 2021 (47.4 percent), the percent of respondents who expected 2021 revenue to increase (42.2 percent) leaves only 10.4 percent expecting a decrease in revenue for 2021.

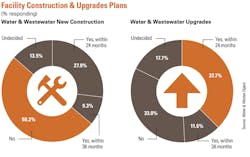

As for new construction, for the third year in a row, the majority of respondents indicated no new construction would be conducted in the next 36 months. Instead, the focus continues to be on upgrades to existing systems and equipment. Results from 2020 show 37.7 percent and 11.6 percent of respondents indicated they will be upgrading in 24 months and 36 months, respectively. New construction is not off the table, however. Results also show 27 percent of respondents indicated new construction in 24 months and 9.3 percent are looking at a 36-month timeline.

With the new Lead & Copper Rule Revision (LCRR) expected to make its mark in 2021, upgrades to existing system equipment make a lot of sense, as utilities will be expected to replace lead service lines. Also important to note is the requirement of the LCRR for utilities to inventory lead pipe, which opens pathways for solutions providers with the capabilities to conduct this inventory at scale.

This expectation is further reflected in the focus of budgets for 2021 as the two leading categories are Pipe/Distribution Systems and Sewers/Collection Systems with Monitoring falling into third behind them, which points out another key talking point for 2020: smart water.

Smart water’s rapid adoption

For the third year running, Monitoring has been listed in the top three budget items, which shows the increasing demand for smart water technologies. The talking points regarding smart water this year are the acceleration of smart technologies and their adoption by utilities due to the pandemic. The market has shifted from a push mindset to a pull as utilities recognize the need for the solutions.

“We thought before the pandemic that there was adoption acceleration occurring in the market at high single digits,” Mize said. “I think post-pandemic, we feel like there’s going to be a double-digit growth in that type of technology space and solutions across the country.”

Smart water technologies have allowed the industry to work remotely, monitor systems from their homes, and ultimately has helped them comply with social distancing guidelines.

With many utilities now in an age of data, Mize said the next step will be insights. Solutions providers are already ahead of the curve on providing platforms for data insights; the missing piece are data scientists who can make the most out of that data.

On a different topic entirely, the protests of the death of George Floyd in June resulted in marked responses from industry companies and associations as it relates to diversity and inclusion. Lynn Broaddhus, president of the Water Environment Federation said the response from WEF to this event—a statement of solidarity released within days—would likely not have occurred two or three years ago. This, she noted, indicates how far the association has come, but she also recognized how much more work is needed for the future.

“You would have never seen WEF do that two years ago, three years ago,” Broaddhus said. “It would be hard to imagine WEF doing that if we hadn’t been doing our homework on what this meant for us and what message we want to be sending to our members, especially those who are really affected most directly by what was going on.”

Diversity and inclusion dovetail with three other critical industry terms that have been added to many industry association roadmaps in the past couple of years: water affordability, water access, and water equity. The pandemic highlighted the magnitude of these issues as communities with the lowest income—which often also are communities of color—were disproportionately affected by the pandemic. Overlay data on access to clean and affordable water, and it showcases a strong correlation between the increased spread of the disease and water.

Lastly, the U.S. EPA released an update to the Financial Capabilities Assessment, which is a document aimed specifically at generating financial resources for communities of low and moderate income to be used for water and wastewater projects. This is the first time it has been updated since 1997, and it received far-reaching praise throughout the water sector as a means to address the issues noted above.