General Equipment & Supplies, Construction Equipment’s 2019 Dealer Excellence Award winner, has positioned itself to partner with its customers by investing in back-end infrastructure and customer-facing personnel.

GES and other dealers are working to support equipment fleets and develop the partnerships that allow fleet managers to take full advantage of the technology and data now available on the machines they acquire. Equipment manufacturers are also focusing on dealer support, investing in construction telematics and support personnel that will provide insight and expertise for their dealers on the front line.

Machine data offers fleet managers insights into machine location, performance, and reliability, and dealers can help end-users manage maintenance and make productivity decisions within a fleet.

How this relationship develops will depend on dealer expertise, performance, and pricing as much as it will depend on equipment managers’ need for the services that will come.

How can construction equipment dealers partner with fleets?

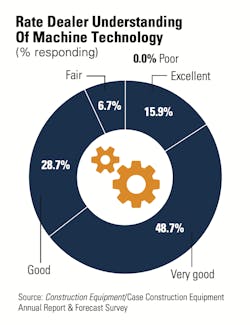

We asked respondents to rate their primary equipment dealers on two areas of technology: understanding and ability to partner. Noticeable improvement was recorded over last year. Among respondents, 15.9 percent rated their primary dealer “excellent” in its ability to understand the technology they are selling on their equipment. About two-thirds rated their dealer either “excellent” or “very good,” which is up from 56 percent.

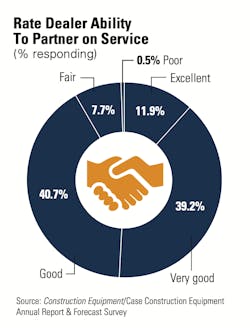

The results on the data side, partially measured by how fleets rate their primary dealer on its ability to partner on service and support, were also higher than in 2018. Although the question does not specify the use of data, dealers certainly have the opportunity to use it to better provide after-sale support and service; fleet managers can benefit from more accurate maintenance planning and even predictive diagnostics.

Slightly more than half of respondents said their primary dealer’s ability to partner on service and support was “excellent” or “very good.” This is up 5 basis points over the previous year. Similarly, the percentage of respondents who rated their dealer as “fair” or “poor” also dropped, from 12 percent in 2018 to 8 percent in 2019.