November 2016 will most certainly go down in the books as one of the most memorable months in recent decades. If the Chicago Cubs winning the World Series in dramatic Game 7 fashion wasn’t enough to shock you, then the events that unfolded during the late evening on Nov. 8 likely were.

Regardless of which side of the aisle you stand on, election night was a jaw-dropping moment. Donald Trump’s own campaign advisors, along with some of his supporters and pundits, admitted to being astonished as the story unfolded on election night.

What does a Trump-led America (coupled with a GOP-controlled Congress) mean for the nonresidential construction market? As with any election, it’s a mixed bag of the good, the bad, and the unknown.

CONSTRUCTION SECTOR REPORTS

The good: Trump proposes spending upward of $1 trillion to rebuild the nation’s roads, bridges, tunnels, water systems, and airports as part of a massive infrastructure bill. Although not primarily buildings work, this level of investment would most certainly create real estate development opportunities and needs—whether directly or indirectly—for the nonresidential community. Infrastructure investment is one of the few pressing issues that garners almost universal support among political leaders in Washington.

The bad: In his 100-day action plan, Trump outlines several measures that could hit nonresidential firms in the pocketbook in the near term. On the list is Obamacare, which Trump hopes to repeal and replace with traditional HSA and health insurance initiatives. This move could cause healthcare operators to take a “let’s wait and see” approach to real estate investments, much like they did during the implementation of Obamacare. Having healthcare owners hit the pause button for the second time in six years could severely impact nonresidential firms. At $87 billion in annual construction spending, healthcare is the largest sector in the nonresidential market.

The unknown: Given the GOP’s contentious relationship with Trump during the election cycle, we could be in for four more years of gridlock in Washington. It’s too early to predict how his ideas will be received by the House and Senate.

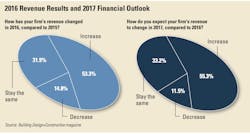

A recent survey of architects, engineers, and contractors by Building Design+Construction paints a picture of cautious optimism for nonresidential design and construction firms. Half of the respondents (50.3 percent) predict that 2017 will be an “excellent” or “very good” business year for their firm. More than half (55.3 percent) expect their firm’s revenue to increase next year; just 11.5 percent are forecasting a drop.

On the flip side, nearly a third (31.7 percent) cited “business impacts from the Presidential election” as a top-three concern—only behind “general economic conditions” and “competition from other firms.”

As we head into 2017, all we can do is hope the President-elect delivers on much more good than bad.

--Dave Barista is editorial director of Building Design+Construction