Graders, Scrapers, Track Loaders Stretch Component Life

Results of Construction Equipment's 2007 Component Lifecycle Research suggest that the decline in population of self-propelled scrapers and crawler loaders may be nearing its end, and that it would be very difficult for another type of machine to apply fine grade as inexpensively as motor graders. With 20 percent of these machines' populations persisting in primary production for 25,000, 18,000 and 20,000 hours (respectively), those who run them seem to be minimizing their ownership and operating (O&O) costs.

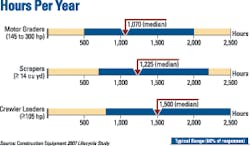

If competition from articulated dump trucks and excavators had left a significant number of underutilized scrapers or crawler loaders in North America, median hours of use per year would not be 1,225 and 1,500 —among the highest of earthmovers.

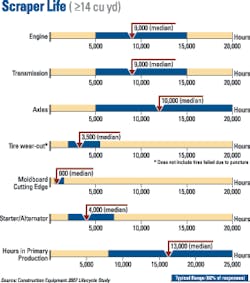

Die HardHalf of all scrapers persist in primary-production roles for 13,000 hours. It's the longest tenure among machine types Construction Equipment has researched (including excavators, wheel loaders, crawler dozers, articulated dump trucks, and backhoe-loaders). A significant portion — 20 percent — of all scrapers are still in primary production at 25,000 hours. Using median component lives, total scraper O&O cost remains within a 45-cent range from 10 to 13 years of age. Repairs in the 14th year cause O&O to jump 80 cents per hour, making it (at about 17,500 hours) the most economical time to replace the average machine.

Construction Equipment regularly surveys contractors to find out how long they expect major components in various machines to last. Of course, operating conditions have a major influence on the life of components and machines. But manufacturers generally observe the 20th percentile — across all applications — as the reliable life of most components. Some engineers call it B20 life. It's the point at which 20 percent of all components have failed, and the earliest limit of what Construction Equipment calls "typical life."

Median is the same as the 50th percentile, or B50 life. It's the point at which half of components have failed, and equipment manufacturers recommend that this be the outer limit of most users' life expectations. In fact, they encourage equipment users to manage components to their B20 life because the risk of component failure usually escalates so steeply after that. For example, a previous Construction Equipment lifecycle study looked at backhoe-loaders and articulated dump trucks. Results indicated that 20 percent of engines in 30-ton articulated dump trucks fail by 9,000 hours and another 30 percent of them are down within the next 1,000 hours. A Construction Equipment lifecycle study on excavators, wheel loaders and dozers found that half of engines in 20,000-pound and larger excavators last about 10,000 hours, and another 30 percent fail in the following 2,000 hours.

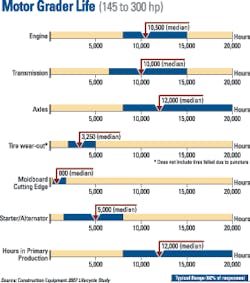

Defying DepreciationUsing motor graders' very consistent median component lives in an ownership and operating (O&O) cost equation for many different years during a common machine's life yielded uncommon results. Stable ownership costs, plus climbing repair costs kept the total O&O fairly constant through the 13th year. Because grader residual values tend to flatten out after 13 years,and because hours of use per year tend to stabilize at about the same point in the machines' lives, total O&O cost drops slightly each year after year 14 (about 13,600 hours).

One of the great distinctions with this year's lifecycle study is the production endurance of graders, scrapers and crawler loaders. Among other machine types Construction Equipment has researched — excavators, wheel loaders, crawler dozers, ADTs, and backhoe-loaders — 80 percent of units have been moved out of primary production by 12,000 to 18,000 hours. To be fair, crawler loaders reach their B80 production life at 18,000 hours. But 20 percent of motor graders are still in primary production at 20,000 hours, and 20 percent of motor scrapers are still producing at 25,000 hours.

Graders' B50 production life is 12,000 hours, and half of scrapers stay in primary production for 13,000 hours — the longest among machines Construction Equipment has researched.

Relatively low risk of pushing major component lives may be facilitating long scraper, motor-grader, and crawler-loader life. As noted above, it's risky to run an ADT engine beyond 9,000 hours without maintenance — rolling in new crankshaft bearings and replacing fuel injectors, for example.

In comparison, there is much less risk in pushing the engines and transmissions in graders, scrapers and crawler loaders to their B50 life. Twenty percent of scraper engines and transmissions fail within the first 5,000 hours, for example, and it takes another 5,000 hours for the next 30 percent of those power-train components to fail. The rate of failure accelerates, but not steeply enough to prevent most of those machines from working two more years without requiring repair.

Component-life benchmarks like this can be as useful for justifying investments in improved maintenance as they are for managing repairs. For example, if you want to stretch component life beyond B20 life, you can reduce risk of failure by changing oil and filters and conducting other maintenance rigorously according to the manufacturer's recommendations. In many organizations, that can require a careful training program for service people, or even outsourcing some maintenance. Using premium materials, such as fluids and filters, may also reduce wear.

Component-life expectations are an elusive part of the solution to one of the most important questions equipment professionals must answer if they're going to field cost-effective equipment: What's the economic life of each machine?

Ownership and operating costs start high because of the steep drop in the machine's value (depreciation) the first years the machine is in use. When O&O is at its nadir, depreciation has started to level off, and repair costs have not yet begun to rise steeply. This is the end of the machine's economic life — while its residual value remains decent and before major repair expenses are necessary.

Most of the factors necessary to estimate future O&O costs are reasonably easy to estimate. Purchase price is known, residual value can be estimated, taxes and insurance are relatively fixed, and maintenance costs are generally fixed per hour of machine operation. Repair costs are elusive, though.

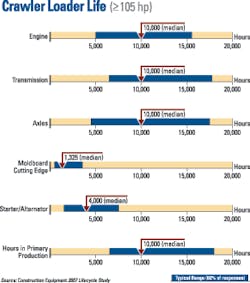

Persistent ProducerWith median production life of 10,000 hours, crawler loaders' usage more closely resembles that of wheel loaders, excavators, and other more populous earthmovers. The far reaches of the typical range remains an important distinction, however. Only wheel loaders and articulated dumps equal 20 percent of crawler loaders' ability to reach 18,000 hours in primary production. The track-loader sweet spot — the point in their life where O&O cost is at a minimum — appears to be in their 12th and 13th years, around 11,500 hours.

We plugged B50 lives of the main component groups from this study into an O&O-cost spreadsheet with some estimates of repair costs for each component. Then we added estimated residual values for a Caterpillar crawler loader in the Midwestern United States from the residual-value tool Dr. Mike Vorster has written about in the Equipment Executive column, along with declining average annual hours (about what you would expect as a machine ages and requires more service) for a number of years in the life of the average crawler loader. Total O&O cost dropped through 10 years, leveled off in years 12 and 13, and began to climb in year 14. The sweet spot — where O&O cost is at a minimum for crawler loaders that average around 1,000 hours per year and achieve engine and transmission life of about 10,000 hours — appears to be in their 12th and 13th years, at 11,400 to 11,700 hours.

Conducting the sweet-spot exercise using motor graders' B50 component lives yielded a twisted result. More-consistent ownership costs, plus climbing repair costs kept the total O&O climbing slightly through the 13th year, at about 12,900 hours. (Of course, total O&O cost rose only 30 cents from year 10 to year 13.)

Because Cat motor-grader residual values tend to flatten out after 13 years, and because hours of motor-grader usage per year also tend to stabilize at about the same point, total O&O cost drops slightly each year after year 14 (about 13,600 hours).

The scraper sweet spot, when calculated using B50 lives for scraper components, looks more like that of crawler loaders because scraper depreciation doesn't level off like that of motor graders, and annual scraper usage tends to drop steeply between 10 and 15 years. Total scraper O&O cost declines ever so slightly each year into the 13th year, logging about 16,600 hours. (From the 10th year to the 13th, hourly costs fall less than 45 cents.) Expensive maintenance events in the 14th year cause O&O to jump 80 cents per hour.

Using industry-benchmark component lives to estimate the economic life of machines is an interesting exercise. But it is just an exercise. As much as operating conditions affect component life and repair cost, it's important to do the math with life and cost values derived from your own fleet's experience.

Depending on how your numbers compare to industry benchmarks, the results might inspire you to improve maintenance and reduce costs with extended machine life. Or they might help you resist the urge to tamper with a maintenance program that's out-performing the industry.