Fleets are Ready to Roll in 2018

It appears 2016 might have been a blip along the road to recovery. After posting a “very good” business year in 2015, equipment managers expected 2016 to be a similar year. Instead, business fell back to “good” and managers did not expect much better in 2017.

Construction Sector Reports

But that is not what happened. Last year marked the highest business year ranking in almost 10 years, another “very good” year with expectations for even more positive results in 2018.

The uncertainty of the 2016 election season appeared to have dampened expectations for 2017, but construction responded with solid numbers as the economy began to show sustained signs of health.

As business moved into the “very good” range, contract volume kept up. The numbers in 2017 substantially beat expectations cast at the end of 2016. The net for contract volume (the percentage reporting increases minus the percentage reporting decreases) was 35.2 percent last year, far higher than the 25.9 percent net predicted.

Expectations for next year are even higher. Some 60.2 percent of respondents expect contract volume to increase in 2018, and when the 7.3 percent expecting decreases is subtracted, the net for 2018 contract volume is 52.9 percent. About one-third of respondents expect revenue to be the same this year as it was in 2017.

Nearly nine in 10 respondents expect bid prices to respond positively to demand. In 2016, almost 60 percent expected 2017 bid prices to increase. Factoring out those expected decreases, the net was 55.5 percent. The net for 2018 expectations is nearly 90 percent. About 87 percent of respondents expect bid prices to increase this year with less than 1 percent expecting a decline. The net for 2018 is 86.7 percent.

Equipment fleet trends

Of course, the equipment rate plays a large part in bid pricing, and fleet managers’ efforts on fielding the most productive, cost-efficient machines directly affect the bottom line. Higher acquisition costs pertaining to emissions technology has put even more pressure on bid pricing (see related story).

The net for fleet expansions has been creeping upward since returning to the 30-percent range in 2015. In 2017, 40.4 percent of respondents said they would be expanding, and 4.8 percent decreasing, for a net of 35.6 percent. This was 4.5 percentage points higher than expectations for the year. For 2018, 41.3 percent expect to increase fleet size, and 4.2 decrease, for a net of 37.1 percent.

Machine replacement rates have hovered around 9 percent for the fourth consecutive year. In 2017, managers reported replacing equipment at a rate of 9.7 percent, about one-half percentage point shy of expectations. This is still the highest rate in 10 years, and managers expect to be able to replace machines at a 10.7-percent pace this year.

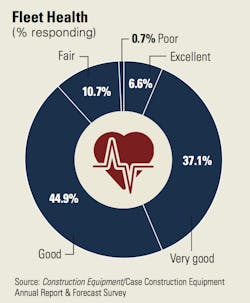

Both rates—expansion and replacement—indicate a fleet’s ability to stay healthy. As equipment ages, its operating costs escalate. Newer iron keeps costs down, keeps utilization up, and should aid productivity. A slight dip in the percentage of respondents reporting “excellent” or “very good” fleet health may indicate that the unexpected bump in business caught many fleets off guard. In 2016, 47.4 percent reported fleets in this condition. In 2017, that percentage was 43.7. The percentage of fleets in the unhealthy spectrum, “fair” or “poor,” remained statistically the same. In 2016, that group was 11.6 percent; in 2017, 11.4 percent.

As business picked up in 2017, more respondents turned to financing to fund equipment acquisitions. The percentage who said they purchase by financing increased to 40.6 percent last year from 34.0 percent in 2016. More than half of respondents, 52.8 percent, purchase outright, a number that hasn’t changed much in five years. The percentage of respondents who employ the rental/purchase strategy, on the other hand, returned to historical levels after a three-year upward trend, moving back to 16.5 percent from 23.9 percent in 2016.

Another key cost that fleet managers must consider when computing equipment rates is labor, specifically labor tied to repair and maintenance of the fleet. The technician shortage is tightening as business activity picks up. Hiring was up substantially in 2017, with 44.4 percent of respondents reporting an increase in overall equipment-related workforce. This is the highest percentage if several years. On the service and maintenance side, the percentage was up only slightly from 2016, with about one-quarter reporting growth in this area.