Fleet Managers Feel Fine Heading into 2020

For those who follow business news, 2019 could be dizzying. The stock market probably revealed the most about the reactionary nature of how government and media respond to various issues such as tariffs and Twitter. Even as bellwether construction companies such as Caterpillar and John Deere fought off the uncertainties of global trade conflict, their customers seem to have hummed along.

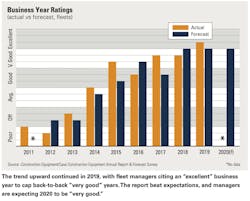

Managers of the nation’s fleets of construction equipment put a firm stamp of approval on 2019. The business index was “excellent,” the first time in many years that respondents have scored the business year so high. Frankly, it comes as a bit of a surprise, especially following three of the past four years when business was labeled “very good.” For 2019, business exceeded expectations, and it marks a strong five-year run for fleets.

Expectations for 2020 do not flag. Respondents expect it to be “very good.” This runs counter to the ongoing global trade fights, the fact that it is an election year—an increasingly divisive one—and data indicating a mixed bag on construction spending.

The Associated General Contractors of America, in a press release analyzing October data, suggested slower growth in private nonresidential and multifamily construction spending, and continued public investment.

Indeed, contract volume trends among fleet managers reveal the tension between spending on different types of construction. Last year, respondents reported a net of 29.2 percent (the percentage of respondents reporting an increase in contract volume minus those reporting a decrease), down slightly from 2018’s net of 35.9 percent. Both years fell short of expectations, yet the nets have consistently hung around 30 percent for the past six years—with the exception of the last election year, 2016. The outlook for 2020 is, however, more optimistic than 2019 with a net of 47.4 percent.

Respondents also expect bid prices to increase this year, although the extent has dropped a bit from previous years. For 2020, the net (those expecting increases minus those forecasting decreases) is 55.6 percent, down from 86 percent in 2018 and 73 percent last year. About two-thirds expect bid prices to rise this year, and about one-quarter expect them to stay the same. Material pricing is also expected to increase this year, with fleet managers reporting a net of 63.7 percent and 14.4 percent expecting material prices to stay the same.

Of course, fleet asset managers take into account all these business trends when planning equipment acquisitions, whether it be the price of asphalt, the effects of tariffs, or the amount of work in the pipeline.

What is the 2020 outlook for construction equipment fleets?

Fleet managers must ensure that the equipment needed to accomplish the work will be available. Acquisition strategies and replacement planning play key roles, and equipment rates contribute a major portion of bid pricing.

For the fifth consecutive year, fleet expansions have been strong among respondents, with nets hovering around 30 percent. Last year, 38.4 percent said their fleet had grown compared to 2018, and 5.4 percent said it had contracted, leaving a net of 33 percent. This was lower than the forecast net of 38 percent. For this year, fleets are lowering expectations slightly, with 38 percent forecasting growth minus 7 percent expecting shrinkage for a net of 30.5 percent.

The replacement rate dipped below 9 percent in 2019, following a rate of 9.7 percent the year before (see chart at top). The 2019 rate of 8.8 percent was off from the expected rate of 13.8, the largest miss since 2016. For 2020, fleet managers expect to replace 10 percent of fleets, a number that indicates healthy replacement plans.

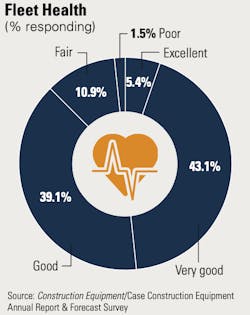

Fleet health depends on a regular turnover of old iron. Not only does replacement rate indicate that capital expenditure plans are in place, but it also indicates fleets are planning for ongoing business. In 2019, nearly half of respondents (48.5 percent) described their fleet’s health as “excellent” or “very good.” This was slightly higher than 2018 at 44.5 percent. On the unhealthy side of the scale, 12.4 percent of respondents said their fleet was either in “fair” or “poor” health in 2019.

Emissions-reducing technology and more sophisticated on-board computer technology have driven up new-equipment prices in recent years. Fleet managers have had to adjust. About 13 percent of respondents simply bumped their new-equipment budgets, and 14.4 percent said they will buy used equipment instead of new. One in five said price increases have had no effect on their plans, and 9 percent did not know how costs affected plans.

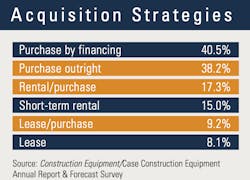

What is evident, though, is the percentage of fleet managers that use outright purchase as an acquisition strategy has declined. In 2019, 38.2 percent of respondents said they purchased equipment outright, down from 42 percent in 2018 and the historical high or 55 percent in 2016. Of course, extremely low interest rates make financing and leasing more attractive, but fewer used financed purchasing as an option last year: 40.5 percent compared to 45 percent in 2018. Rental/purchase agreements, at 17.3 percent, and short-term rental, at 15 percent, were the next popular acquisition strategies for fleet asset managers in 2019.

Short-term rental (measured in total rental machine hours) increased for about one-quarter of respondents in 2019, compared to 2018, and decreased for 14 percent. For the majority, however, use of short-term rental remained constant last year.

Changes in workforce also stayed consistent with previous years. Overall, 40 percent of respondents said they had increased the number of employees, with about half reporting the same staffing as in 2018. On the service and maintenance side, two-thirds reported no changes in the number of workers, and 27.1 percent hired more.