Telehandler manufacturers are adding technology to their machines in the form of telematics and alternative power sources, as well as features for load and attachment management. Many of them are designed to help managers be more productive and and cut costs.

Lowering operating costs for telehandlers requires examining the overall investment, using telematics, choosing the right unit for the application, and of course, proper maintenance.

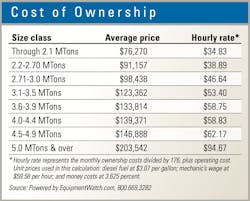

“Managers continue to be focused on return on investment (ROI) as defined not only by acquisition costs, but the total cost of the product over its lifetime,” says John Boehme, senior product manager for JLG. “Rental company owners and owner/operators are paying more attention to the versatility of each piece of equipment, the productivity gains the telehandler can provide, and the costs after the sale.”

ROI is also enhanced by telematics use, which has been growing in the telehandler category as manufacturers take cues from their earthmoving cousins.

“With the importance of ROI growing, telematics is also on a rapid growth path,” Boehme says. “The ClearSky fleet management telematics solution from JLG provides equipment owners and operators access to critical engine and equipment operational data so they can make better decisions on their investment. Data points—including location, engine hours, usage, fuel and battery levels, and maintenance schedules—are conveniently available in real-time and accessible from desktop or mobile devices. The system also monitors fault codes and other critical alerts.”

In addition, telematics can aid maintenance planning, heading off downtime and unbudgeted maintenance costs.

“Telematics are an important way for owners and operators to keep track of machine maintenance and operating costs,” says Rebecca Yates, product manager, material handling, for JCB. “The JCB LiveLink telematics system, which is standard on all JCB machines and includes a 5-year subscription, can send notifications when routine maintenance is due or if there is a fault that should be addressed. The advanced warning system helps owners and operators plan scheduled maintenance during downtime and maximize the uptime and productivity of their machine.”

Matthew Elvin, CEO of Xtreme Manufacturing and Snorkel, points to proper equipment selection as a cost-cutting foundation.

Telehandler applications affect operating costs

“To efficiently manage operating costs when using telehandlers, the critical factor is selecting the best suited telehandler for the job,” Elvin says. “The first part of this selection process is to identify whether the telehandler needed is for ‘pick-and-carry’ or ‘pick-and-place’ applications.

“Typically, telehandlers for pick-and-carry applications are designed to drive long distances with materials, but don’t require a lot of outreach,” Elvin says. “Telehandlers designed for this purpose do not have outriggers and are limited to two to three boom sections. For pick-and-place applications, the most suitable telehandlers typically have outriggers and three to five boom sections for greater outreach. The outriggers allow for increased stability when additional height and reach is required when placing a load.”

Elvin says that in terms of cost for pick-and-carry applications, the cost for outriggers in the initial purchase price can be eliminated. “Non-outrigger units have a lower overall weight, which delivers better tractive effort when paired with an equivalent drivetrain, and this results in more efficient maneuvering through job sites and greater gradeability,” he says.

“Managers should also ensure that the correct telehandler is being used for the job to avoid overloading the equipment, which can lead to eventual structural failures,” Elvin says. “A multitude of attachments are also available for telehandlers that can help to not only improve safety and productivity on the job site, but also reduce potential damage to the equipment resulting in repair costs.”

Mike Peterson, product application specialist for Caterpillar, also focuses on attachments.

“With the reduced workforce in some areas, taking advantage of options that increase efficiency is imperative,” Peterson says. “One way to accomplish that with telehandlers is to utilize the hydraulic fork positioner carriages. With this carriage attachment, operators adjust the forks from within the cab as they approach the various pick items. It eliminates the need to adjust the forks manually, which can be time consuming depending on how well the floating fork bar has been maintained.”

And finally, managers should not neglect simple and routine maintenance.

“Managers can keep operating costs down on their telehandlers by ensuring their operators and service technicians follow OEM-recommended service intervals and making sure their equipment is getting daily pre-operation checks,” says Mitch Fedie, marketing manager for Pettibone. “Simple procedures like checking engine oil, transmission fluid, air filters, and keeping the machine greased help ensure the longevity of the machine and avoid more serious and costly repairs.”

At Conexpo 2020, Snorkel introduced an electric compact rough-terrain telehandler, the lithium-ion battery-powered SR5719E.

“Powered by 80V 300Ah lithium-ion batteries, the SR5719E can perform continuously between charges for up to 6 hours depending on job site conditions,” Elvin says. “The onboard charger provides a full charge overnight, while off-board chargers options are available for fast-charging capabilities, up to 2.5 hours for a complete charge.”

Snorkel claims the SR5719E delivers a reduction of up to 60 percent in operating costs over the diesel equivalent, and also reduces noise. “We back all of our lithium-ion electric lifts with a two-year parts and labor, and five-year structural warranty, plus a 2,000-charging cycles or two-year lithium battery warranty, and batteries can be returned to the company at the end of their life for recycling,” Elvin says.

Xtreme and Skyjack have also debuted cab systems that enable a switch from an enclosed design to an open one.

In addition, Skyjack has introduced a drive-select dial option for its SJ519TH, called Flexdrive. It allows the operator to reduce drive speed while keeping all function speeds the same. By allowing low travel speed at high engine RPM, the operator is able to creep forward and reverse while maintaining all function and hydraulic performance.

Another recent tech option is JLG’s SmartLoad, available on the JLG 1644, 1732, and eventually coming to the entire JLG telehandler portfolio. SmartLoad is a bundle of three integrated technologies meant to work together to “increase operator confidence and optimize productivity.” The system includes automatic attachment recognition, a load management information system, and a longitudinal stability indicator.

“The automatic attachment recognition allows a telehandler to identify an attachment and display the appropriate load chart to the operator,” Boehme says. “The load management information system (LMIS) graphically depicts the location of the load within the load chart and assists the operator in navigating the boundaries of the chart. Finally, the longitudinal stability indicator works in conjunction with the LMIS to limit operation when a load becomes non-compliant.”

Gehl has a new Rear Camera and Radar System that includes a dash-mounted, 5-inch video display with video camera and radar sensor mounted near the rear lights. The Radar System provides both a visual and audio alert indicating proximity to objects behind the vehicle.

The radar detects 150-degrees horizontal from the sensor and up to 15 feet behind the machine with a 10-foot-wide zone. This system is an option and is not required for machine operation. Both the RS and DL series Gehl telescopic handlers are designed to provide operator sight lines through the frame to the rear, so the optional Reverse Camera and Radar System is a supplement to aid operators; operators remain responsible for checking the travel path for obstructions/ hazards before moving the telescopic handler.

The telehandler market, like others is feeling the effects of the Covid-19 pandemic.

“The initial outlook for the year was slightly down, comparable to the 2017 or 2018 market levels,” Josh Taylor, Genie product manager, Terex AWP. “This was mostly due to 2019 being a very strong buying year where there was a strong construction market, and there would be fewer incremental machines—machines not purchased as replacement for aged fleet—purchased in 2020. However, the Covid-19 pandemic has been a major disruption in the market and will contribute to a significantly suppressed market in 2020.”

Cat’s Peterson sums up the effects on the market. “With each state in the U.S. enforcing differentiated stay-at-home quarantine and isolation orders and policies, the severity of the impact on the rental markets has been mixed,” he says. “Construction projects in most states have been deemed essential work, however there are pockets of the industry that have either reduced workforce levels on the job site or determined to finish current activities without initiating [additional] work. As a result, utilization of the fleet has been impacted.”